PACCAR Inc [NASDAQ: PCAR] Stock Trading Around $73.05 Per Share – Is More Growth on the Horizon?

March 4, 2023

Trending News ☀️

PACCAR ($NASDAQ:PCAR) Inc NASDAQ: PCAR saw a slight decline in its stock prices this week, closing at $73.05 per share on Wednesday. With the current stock price, investors may be wondering if more growth is in store for the company. This success has been attributed to their strong sales, performance, and overall financials exceeding analysts’ expectations. The company has also made important investments in research and development to ensure their products remain competitive and constantly evolving.

This strategy has helped PACCAR Inc to maintain their market position and appeal to customers around the world. Meanwhile, the overall global commercial vehicle market is expected to continue to grow over the next five years, which could indicate that there may be more growth in store for PACCAR Inc’s stock.

Price History

Recent news sentiment on PACCAR INC NASDAQ: PCAR stock has mostly been positive, driving the stock price to rally over the past few weeks. On Thursday, the stock opened at $72.9 per share and closed at $74.8, up by 2.4% from prior closing price of 73.0. Analysts are expecting that the stock will continue to climb upwards in the coming weeks due to the company’s strong financials, promising outlook and its position in the growing transportation industry. With continued strong performance and positive news, PACCAR Inc could be a great investment opportunity in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Paccar Inc. More…

| Total Revenues | Net Income | Net Margin |

| 28.82k | 3.01k | 10.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Paccar Inc. More…

| Operations | Investing | Financing |

| 3.03k | -2.03k | 304.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Paccar Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 33.28k | 20.11k | 24.72 |

Key Ratios Snapshot

Some of the financial key ratios for Paccar Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | 7.3% | 12.8% |

| FCF Margin | ROE | ROA |

| 5.7% | 17.8% | 6.9% |

Analysis

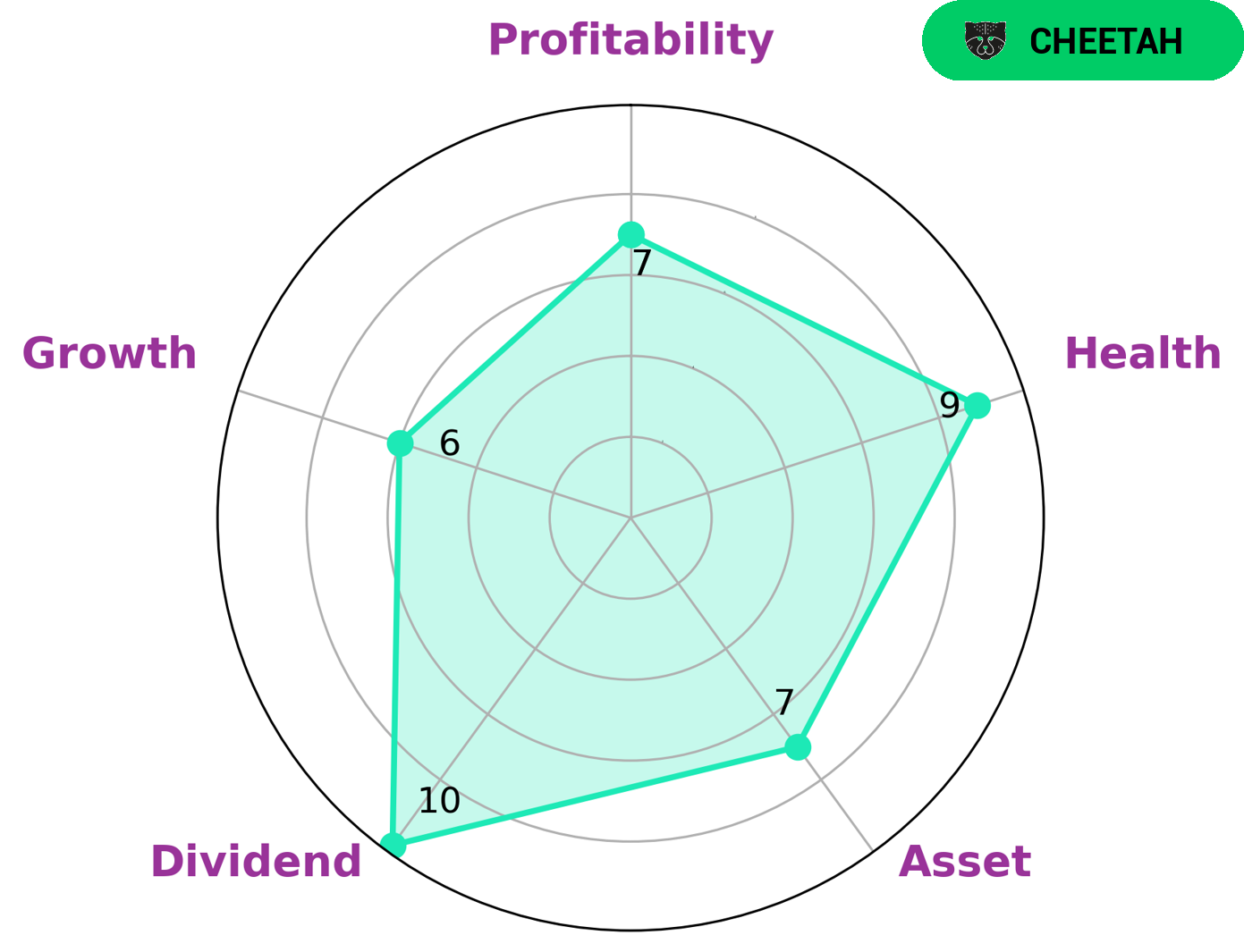

As GoodWhale, we have conducted an analysis of PACCAR INC‘s wellbeing. According to the Star Chart, PACCAR INC has been classified as a ‘cheetah’, meaning that it has achieved high revenue or earnings growth yet is considered less stable due to lower profitability. This makes it an attractive investment option for some types of investors who are willing to take on more risk with the potential for higher returns. GoodWhale’s analysis also shows that PACCAR INC has a high health score of 9/10 in relation to its cashflows and debt. It is therefore capable of enduring any crisis without the risk of bankruptcy. Additionally, PACCAR INC is strong in assets, dividend, and profitability, while being medium in growth. All of these characteristics make it an attractive option for investors who are interested in higher returns but prepared to take more risk. More…

Peers

PACCAR Inc is one of the world’s leading truck manufacturers. The company’s main competitors are Oshkosh Corp, Daimler Truck Holding AG, Caterpillar Inc. PACCAR Inc manufactures and sells a wide range of trucks and related parts and services. The company operates in three segments: Truck, Parts, and Financial Services. PACCAR Inc is headquartered in Bellevue, Washington, and has manufacturing facilities in the United States, Mexico, Australia, the Netherlands, and the United Kingdom.

– Oshkosh Corp ($NYSE:OSK)

Oshkosh Corporation is a leading manufacturer and marketer of access equipment, specialty vehicles and vehicle bodies for the primary markets of defense, concrete placement, refuse hauling, access equipment, and fire & emergency. Oshkosh Corporation manufactures, sells and services products under the brands of Oshkosh®, JLG®, Pierce®, McNeilus®, Jerr-Dan®, Frontline™, CON-E-CO®, London® and IMT®.

– Daimler Truck Holding AG ($OTCPK:DTRUY)

Daimler Truck Holding AG is a holding company that provides trucks and services for the transportation sector. The company has a market capitalization of 21.1 billion as of 2022 and a return on equity of 8.52%. Daimler Truck Holding AG operates in three segments: Daimler Trucks, Daimler Buses, and Daimler Financial Services. The company offers a range of trucks for different applications, including heavy-duty trucks, medium-duty trucks, and light-duty trucks. Daimler Truck Holding AG also provides financing, leasing, and insurance services for its customers.

– Caterpillar Inc ($NYSE:CAT)

Caterpillar Inc.’s market capitalization is 97.35 billion as of 2022. Its return on equity is 33.83%. The company manufactures construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. It also provides financing and leasing services through its subsidiaries.

Summary

PACCAR Inc (NASDAQ: PCAR) is a well-known American manufacturer of commercial vehicles and engines. Analysts believe that PACCAR is currently undervalued, considering their strong financial performance and future potential. This was mainly driven by higher sales of trucks and parts, as well as cost savings from restructuring activities. The company also signed a multi-year agreement to supply a global engine platform to an undisclosed original equipment manufacturer. The company plans to increase the percentage of its sales coming from aftermarket parts and services, which should lead to higher margins for the company. Overall, analysts believe that PACCAR is currently undervalued given their strong financial performance and future potential. The company’s initiatives to increase their parts distribution system and growing sales of trucks and parts are expected to continue to drive growth moving forward.

Additionally, news sentiment surrounding the stock is mostly positive which could lead to further gains in the near future.

Recent Posts