Plug Power Intrinsic Value Calculation – Can Plug Power (NASDAQ:PLUG) Reach Profitability?

March 31, 2023

Trending News ☀️

Will Plug Power ($NASDAQ:PLUG) Inc. (NASDAQ: PLUG) reach breakeven? This is the question investors and analysts are asking about the alternative energy company, Plug Power Inc. (NASDAQ: PLUG). The company has developed a comprehensive suite of products, services and solutions, ranging from fuel cells to hydrogen storage and fueling systems, to turn key energy solutions. PLUG’s stock has had a rocky ride in recent years, but the company is bullish on its prospects for the future.

This year, the company has made significant investments in research and development to enhance its technology and expand its product lines. It has also been actively marketing its solutions to potential customers and partners. Whether these efforts will be enough to reach profitability is yet to be seen, but investors will be watching closely as they consider whether to invest in PLUG’s stock.

Market Price

Monday was a tough day for Plug Power Inc. (NASDAQ:PLUG), with the stock opening at $11.5 and closing at $10.7, down by 4.5% from the prior closing price of 11.2. The company is a leading provider of hydrogen and fuel cell solutions, offering an array of products for commercial and industrial uses, including fueling, vehicle and material handling products. The answer to the question depends on Plug Power’s ability to continue to develop and deliver innovative solutions that meet customer needs. This is particularly important in the current market, where customers are increasingly seeking out sustainable solutions that provide cost savings with minimal environmental impact. If Plug Power can successfully meet these demands and capitalize on the growth opportunities presented by its competitors, it stands a chance of reaching profitability.

Analysts are also optimistic about the company’s potential to reach profitability, noting that Plug Power has recently increased its investments in research and development and commercialization efforts. This could lead to more efficient products that could be attractive to more customers, leading to higher sales and greater profitability. Ultimately, Plug Power’s success in reaching profitability depends on its ability to capitalize on the current market opportunities and continue to innovate new products. If the company can do this, its stock may rebound from Monday’s slump. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Plug Power. More…

| Total Revenues | Net Income | Net Margin |

| 701.44 | -724.01 | -97.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Plug Power. More…

| Operations | Investing | Financing |

| -828.62 | -679.37 | -77.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Plug Power. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.76k | 1.7k | 6.88 |

Key Ratios Snapshot

Some of the financial key ratios for Plug Power are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.0% | – | -97.5% |

| FCF Margin | ROE | ROA |

| -184.3% | -10.3% | -7.4% |

Analysis – Plug Power Intrinsic Value Calculation

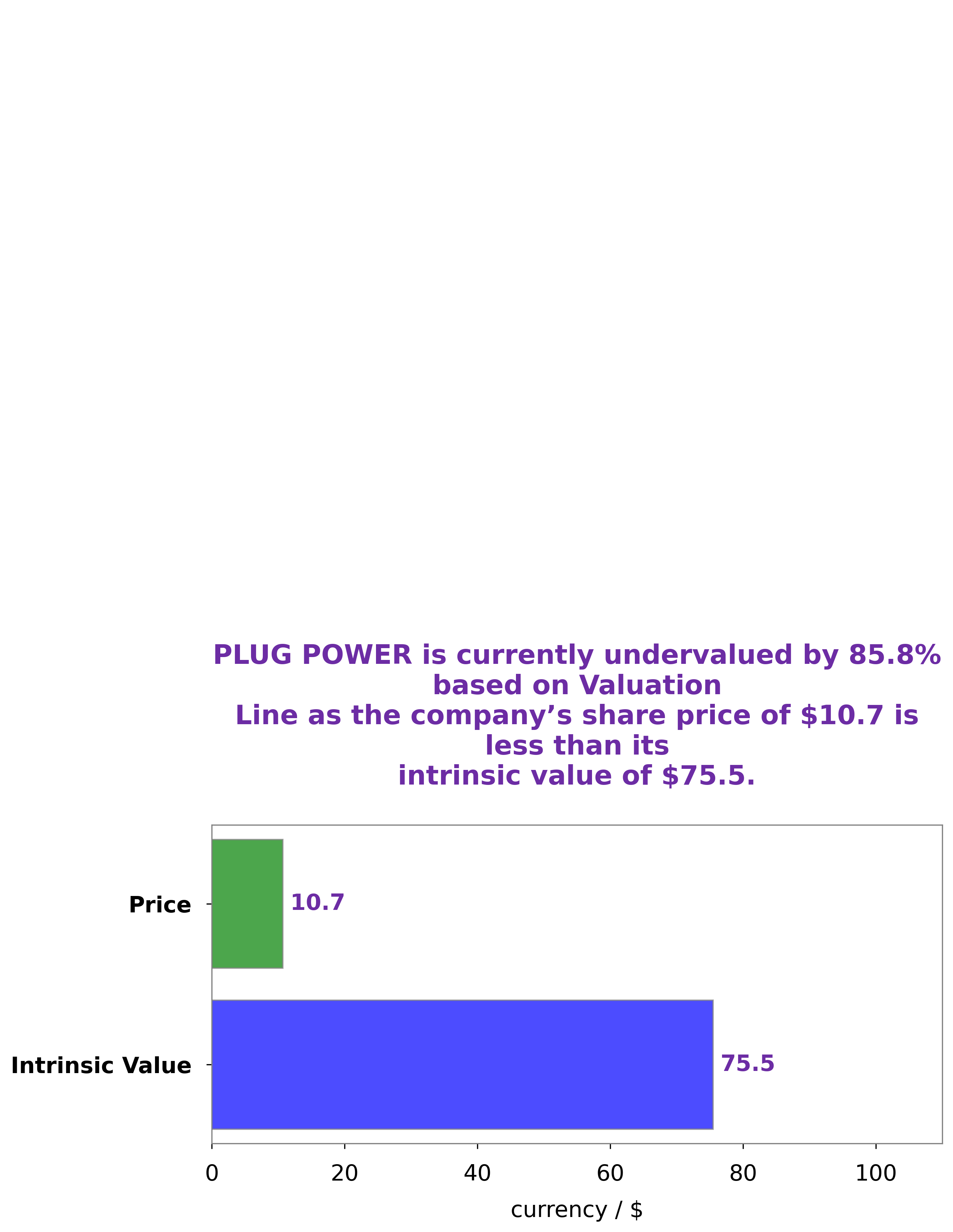

At GoodWhale, we recently did a deep dive into the wellbeing of PLUG POWER. After extensive analysis, we’ve come to the conclusion that PLUG POWER’s intrinsic value is around $75.5. This figure is based on our proprietary Valuation Line. Right now, PLUG POWER’s stock is trading at a much lower price – only $10.7. This means the stock is undervalued by a staggering 85.8%. We’re confident that investors should take this opportunity to buy PLUG POWER’s stock and benefit from the wide gap between its current price and its intrinsic value. More…

Peers

Plug Power Inc. is a leading provider of energy solutions that enable its customers to power their operations with clean, reliable energy. The company’s products and services include fuel cells, hydrogen refueling, and power management systems. Plug Power Inc. competes with Loop Energy Inc, AFC Energy PLC, and Greenchek Technology Inc in the provision of energy solutions.

– Loop Energy Inc ($TSX:LPEN)

As of 2022, Loop Energy Inc has a market cap of 60.66M. The company has a Return on Equity of -31.52%. Loop Energy Inc is a company that provides fuel cells and hydrogen fuel cell electric vehicles. The company’s products are used in a variety of applications, including automotive, transportation, stationary power, and portable power.

– AFC Energy PLC ($LSE:AFC)

AFC Energy PLC is a company that focuses on providing alternative energy solutions. The company has a market capitalization of 143.44 million as of 2022 and a return on equity of -24.64%. Despite the negative return on equity, the company’s market capitalization indicates that investors are still confident in the company’s ability to generate future returns. The company’s focus on alternative energy solutions makes it a unique player in the market and gives it a potential growth opportunity in the future.

– Greenchek Technology Inc ($OTCPK:GCHK)

Greenchek Technology Inc is a publicly traded company that engages in the design, manufacture, and sale of electronic test and measurement equipment. The company has a market cap of 35.51k as of 2022 and a return on equity of 2.93%. Greenchek Technology Inc’s products are used in a variety of industries, including telecommunications, aerospace, defense, and semiconductor. The company’s products are sold worldwide through a network of distributors and resellers.

Summary

Investing in Plug Power Inc. (NASDAQ: PLUG) has been a roller coaster ride, as the stock price has been highly volatile in recent years. There are several factors that make this stock a risky investment and one of the most important is the company’s financial status. While the company is making strides in developing its fuel cell technology, it remains to be seen when PLUG can break even and turn a profit. Recent news has been mixed, as the stock price has moved both up and down on news of partnerships and product launches.

Overall, Plug Power represents a high risk, high reward investment, as the company works towards profitability and success. Investors should conduct thorough research before investing in this stock.

Recent Posts