Strategic Education Sees Increased Enrollments, New Partnerships, But Little Growth

May 19, 2023

Trending News ☀️

Strategic Education ($NASDAQ:STRA) Inc. has recently seen increased enrollments, new partnerships and a higher-than-expected stock price, but overall, the company has seen little growth. This is in spite of the fact that the company has invested heavily in technology, research, and development. Strategic Education offers a wide range of post-secondary programs, including both traditional and online classes. It also operates several online degree programs in business, healthcare, IT, and other disciplines.

However, despite these investments and higher enrollments, Strategic Education has yet to see significant growth. This may be due in part to the fact that, despite the increased demand for education, there is still a lack of qualified educators and instructors in the industry. This has resulted in a shortage of qualified individuals to fill the demand for classes.

In addition, Strategic Education has also faced challenges from competitors in the industry who have better resources and more established programs. This has limited the company’s ability to expand its own offerings and reach new markets. In order to address these challenges and bring about long-term growth, Strategic Education has made investments in technology and research and development. The company is now looking toward establishing partnerships with other educational institutions in order to increase its presence and reach new markets. However, with continued investments in technology and research and development, and with new partnerships with other educational institutions, the company may be able to bring about long-term growth.

Share Price

On Thursday, STRATEGIC EDUCATION stock opened at $78.1 and closed at $78.3, down by 0.1% from prior closing price of 78.4. Despite not seeing any substantial growth in the company’s stock value, STRATEGIC EDUCATION has made some progress on other fronts over the past year. Enrollment numbers have seen an increase due to the company’s strategic partnerships with other educational institutions, offering more opportunities and resources to students.

Additionally, STRATEGIC EDUCATION has established new partnerships with organizations in both the public and private sectors, broadening their reach and strengthening their offerings. While these accomplishments are noteworthy, they have yet to translate into significant stock market growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Strategic Education. More…

| Total Revenues | Net Income | Net Margin |

| 1.06k | 37.61 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Strategic Education. More…

| Operations | Investing | Financing |

| 104.7 | -45.88 | -140.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Strategic Education. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.17k | 555.34 | 67.03 |

Key Ratios Snapshot

Some of the financial key ratios for Strategic Education are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.5% | -24.7% | 5.9% |

| FCF Margin | ROE | ROA |

| 5.9% | 2.4% | 1.8% |

Analysis

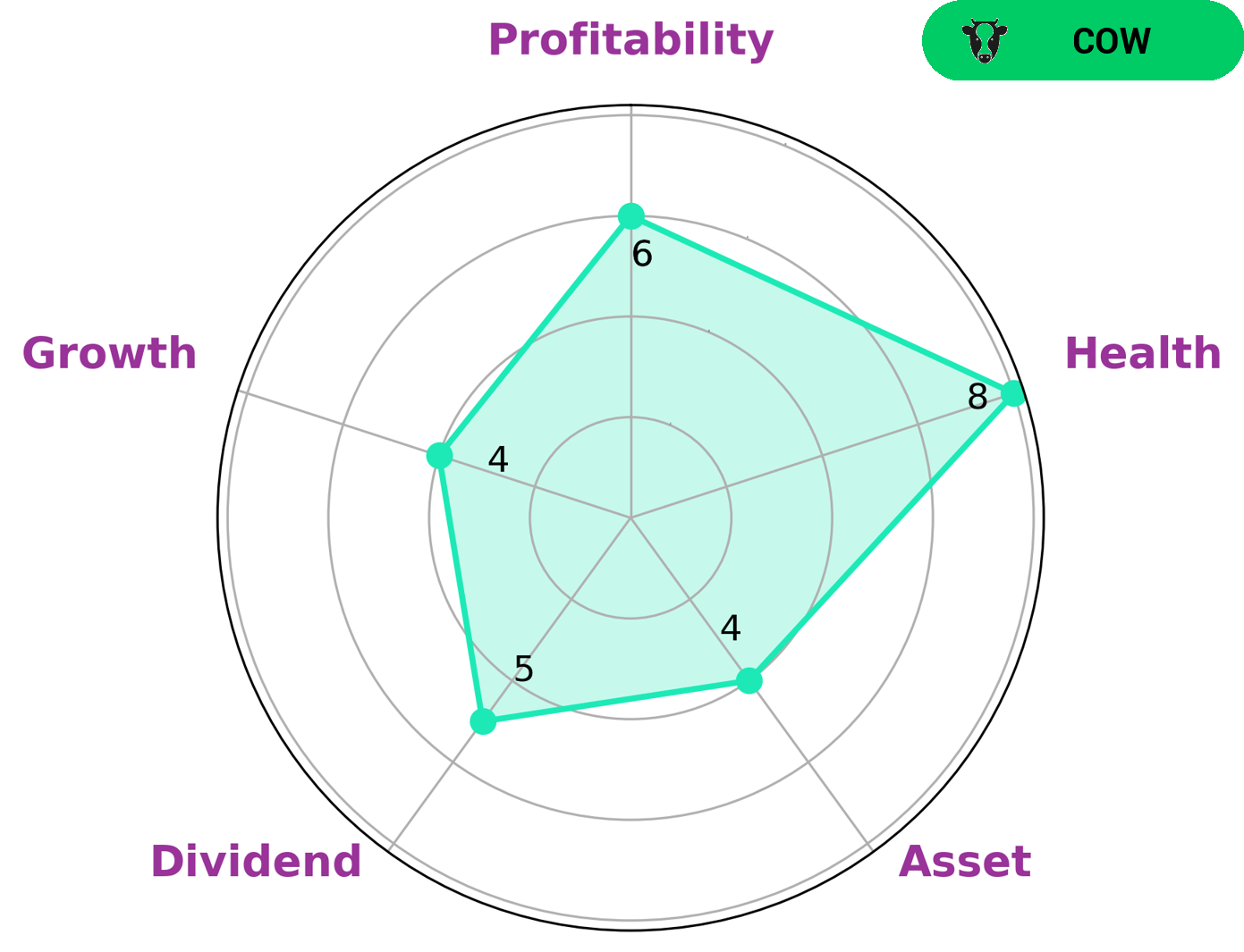

GoodWhale conducted an analysis of STRATEGIC EDUCATION‘s wellbeing and found that they are classified as a ‘cow’ according to the Star Chart. This type of company is typically characterized by a track record of paying out consistent and sustainable dividends, making them an attractive option for long-term investors. The analysis determined that STRATEGIC EDUCATION is strong in terms of asset and medium in terms of dividend, growth, and profitability. Additionally, its health score of 8/10 based on cashflows and debt indicates that the company is capable to safely ride out any crisis without the risk of bankruptcy. Therefore, STRATEGIC EDUCATION is an attractive option for long-term investors looking for stability and consistent returns. More…

Peers

The company operates a network of schools, colleges and universities across the two countries. Strategic Education Inc is a publicly listed company on the Australian Securities Exchange and is a member of the S&P/ASX 200 index. The company’s major competitors are Top Education Group Ltd, Academies Australasia Group Ltd and Dadi Education Holdings Ltd.

– Top Education Group Ltd ($SEHK:01752)

The company has a market capitalization of 150.85 million as of 2022 and a return on equity of -1.05%. The company is engaged in the provision of educational services. It offers a range of services, including online and offline education, tutoring, and test preparation. The company has a wide network of schools and colleges across the world. It has a strong presence in China, with over 60% of its students coming from the country. The company is listed on the New York Stock Exchange.

– Academies Australasia Group Ltd ($ASX:AKG)

Academies Australasia Group Ltd is a provider of vocational and higher education. The company has a market capitalization of 49.77 million as of 2022 and a return on equity of -3.54%. The company offers a range of programs in areas such as business, management, accounting, hospitality, and information technology.

– Dadi Education Holdings Ltd ($SEHK:08417)

Dadi Education Holdings Ltd is a publicly traded company with a market capitalization of $29.76 million as of March 2022. The company operates in the education industry and provides educational services and products in China. Dadi Education Holdings Ltd has a negative return on equity of 7.15%. This is due to the company’s high debt levels and operating losses.

Summary

Strategic Education, Inc. is a provider of postsecondary education and training services offering degree and non-degree programs both online and through its network of physical campuses. Recent company initiatives have led to an increase in enrollments as well as new partnerships with other educational institutions, however the stock has failed to show significant growth in the past few years. Investors looking to make a move into the sector will want to take a closer look at the company’s financials, competitive landscape, and strategic plans for growth to determine whether an investment is right for them.

Recent Posts