American Public Education Reports Record-Breaking Q1 with GAAP EPS of $0.38 and Revenue of $149.7M

May 10, 2023

Trending News 🌥️

American Public Education ($NASDAQ:APEI) (APE) is a for-profit provider of online higher education services, offering multiple degree programs through its American Public University System. Recently, the company reported record-breaking first quarter performance. According to an earnings release, APE reported a GAAP EPS of $0.38, surpassing analysts’ estimates by $0.83, and revenue of $149.7M, exceeding expectations by $0.4M. This successful quarter is indicative of the growth American Public Education has undergone over the past few years. The following year saw the company acquire exclusive access to Navy College Program Distance Learning Partnership, allowing APE to offer discounts and scholarships to Navy personnel and their families.

The strong financial performance from last quarter is linked to this growth in recent years. With an increased demand for online learning, APE has been able to capitalize on its expanding range of degree programs and educational services. This has resulted in record-breaking first quarter performance with a GAAP EPS of $0.38, surpassing analysts’ estimates by $0.83, and revenue of $149.7M, exceeding expectations by $0.4M.

Earnings

American Public Education (American Public Education) reported their first quarter financials for FY2022, with total revenue of $149.7 million and a GAAP earnings per share (EPS) of $0.38. This represented a 1.0% decrease in total revenue from the prior year, and a 169.7% decrease in net income from the prior year. This strong performance highlights the ongoing commitment of American Public Education to providing quality public education across the United States.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APEI. More…

| Total Revenues | Net Income | Net Margin |

| 606.33 | -115.04 | -0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APEI. More…

| Operations | Investing | Financing |

| 29.21 | -13.67 | -35.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APEI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 615.06 | 265.33 | 18.51 |

Key Ratios Snapshot

Some of the financial key ratios for APEI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.4% | -19.6% | 1.8% |

| FCF Margin | ROE | ROA |

| 2.1% | 2.0% | 1.1% |

Share Price

However, the stock opened at $5.4 on Tuesday and closed at $5.2, down 4.0% from the previous closing price of $5.4. This was despite the strong financial results reported, which have driven the stock to all-time highs in recent weeks. The company attributed the decline in stock to a broader market sell-off which affected the overall tech sector.

Despite this, investors remain optimistic about the company’s long-term outlook. With the recent investment in new technology, the company is well-positioned to continue driving strong financial results in the future. Live Quote…

Analysis

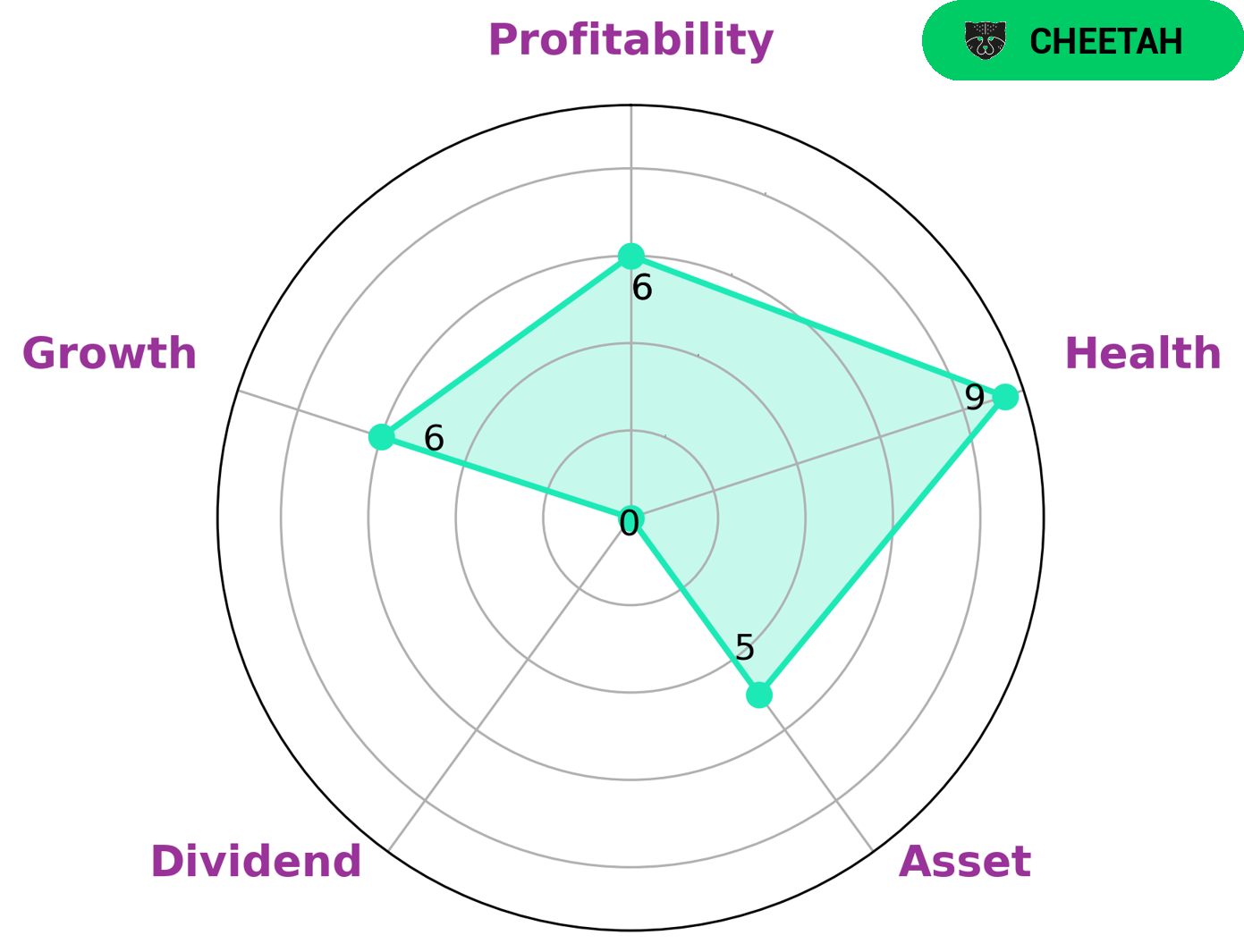

GoodWhale has conducted an in-depth analysis of AMERICAN PUBLIC EDUCATION’s financials. Our star chart shows that it is classified as ‘cheetah’ which implies that the company had high revenue or earnings growth but is considered less stable due to lower profitability. Therefore, this type of company may be attractive to investors who are looking for a high growth opportunity, but who are also comfortable with taking on higher levels of risk. Further, AMERICAN PUBLIC EDUCATION has a high health score of 9/10 with regard to its cashflows and debt, which suggests that it is capable of sustaining operations in times of crisis. Additionally, when looking at its strengths, weaknesse and medium scores, AMERICAN PUBLIC EDUCATION is strong in assets, medium in growth, profitability and weak in dividends. Therefore, this type of company may be attractive to investors who are looking for a high growth opportunity with a risk/reward trade-off. More…

Peers

As the for-profit education industry continues to grow in the United States, so does the competition among the companies that provide these services. American Public Education, Inc. (APEI) is one of the largest for-profit education providers in the country and competes with other companies such as Grand Canyon Education, Inc. (GCEI), Koolearn Technology Holding Ltd., and BExcellent Group Holdings Ltd.

– Grand Canyon Education Inc ($NASDAQ:LOPE)

As of 2022, GC Education Inc has a market cap of 2.74B and a ROE of 33.2%. The company provides higher education services, including online programs and on-campus programs in the United States. GC Education Inc is a publicly traded company on the Nasdaq stock exchange.

– Koolearn Technology Holding Ltd ($SEHK:01797)

Koolearn Technology Holding Ltd is a provider of online education services in China. The company offers a range of online courses covering various academic subjects, including mathematics, physics, chemistry, biology, and English. Koolearn Technology Holding Ltd also provides online test preparation services for students preparing for various exams, such as the Chinese College Entrance Examination, or “gaokao.” The company was founded in 2006 and is headquartered in Beijing, China.

– BExcellent Group Holdings Ltd ($SEHK:01775)

BExcellent Group Holdings Ltd is a Hong Kong-based company principally engaged in the provision of educational services. The Company operates its business through four segments. The Language Training segment offers language courses to individuals and corporate clients. The Test Preparation segment offers courses to prepare students for academic tests, such as the Graduate Record Examinations, the Test of English as a Foreign Language and the Scholastic Aptitude Test, among others. The International Education segment provides international education services. The Others segment is engaged in the provision of professional training courses and the operation of kindergartens.

Summary

Despite these strong results, the stock price dropped the same day as the earnings report was released. This could indicate that investors were expecting even better results or had other concerns. Analysts should continue to keep an eye on APE as this stock could be an attractive investment opportunity in the future.

Recent Posts