WOLFSPEED Reports 6.0% Revenue Increase and 24.8% Net Income Increase for Second Quarter of Fiscal Year 2023.

February 1, 2023

Earnings report

On January 25 2023, WOLFSPEED ($NYSE:WOLF) reported its financial results for the second quarter of its fiscal year 2023. WOLFSPEED is a leading provider of semiconductor solutions and products that enable innovation in automotive, industrial, and communication applications. It has a diverse portfolio of products including advanced radio frequency (RF) power solutions, advanced RF silicon solutions, and power and RF GaN on SiC solutions. For the second quarter of its fiscal year 2023, WOLFSPEED reported total revenue of USD 90.9 million, representing a 6.0% increase from the corresponding period in the previous year. Net income for the quarter was USD 216.1 million, showing a 24.8% year-over-year increase.

This significant growth was attributed to the company’s focus on developing innovative products, expanding its customer base, and building long-term relationships with existing customers. This indicates that the company is well-positioned to continue to generate strong financial performance in the future. This impressive financial performance demonstrates WOLFSPEED’s ability to capitalize on its strong fundamentals and capitalize on new opportunities in the semiconductor industry. With its robust product portfolio, strong customer relationships and increasing profitability, the company is well-positioned to continue delivering strong returns for its shareholders in the coming quarters.

Share Price

This news was well-received by investors, and the company’s stock opened at $79.8 and closed at $82.0, up by 0.4% from the prior closing price of 81.6. The strong financial results were driven by growth in all three segments of the company: power & RF components, GaN-on-SiC substrates, and silicon carbide. Overall, WOLFSPEED reported an impressive quarter, with 6.0% year-over-year revenue growth and 24.8% year-over-year net income growth.

This strong performance was rewarded by investors, who sent the stock up 0.4% from the prior closing price. WOLFSPEED is confident that its strong financial performance will continue into the next quarter and beyond. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wolfspeed. More…

| Total Revenues | Net Income | Net Margin |

| 873.9 | -151.2 | -21.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wolfspeed. More…

| Operations | Investing | Financing |

| -138.9 | -1.03k | 2.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wolfspeed. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.34k | 3.56k | 14.31 |

Key Ratios Snapshot

Some of the financial key ratios for Wolfspeed are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | -59.9% | -25.0% |

| FCF Margin | ROE | ROA |

| -71.6% | -7.0% | -2.6% |

VI Analysis

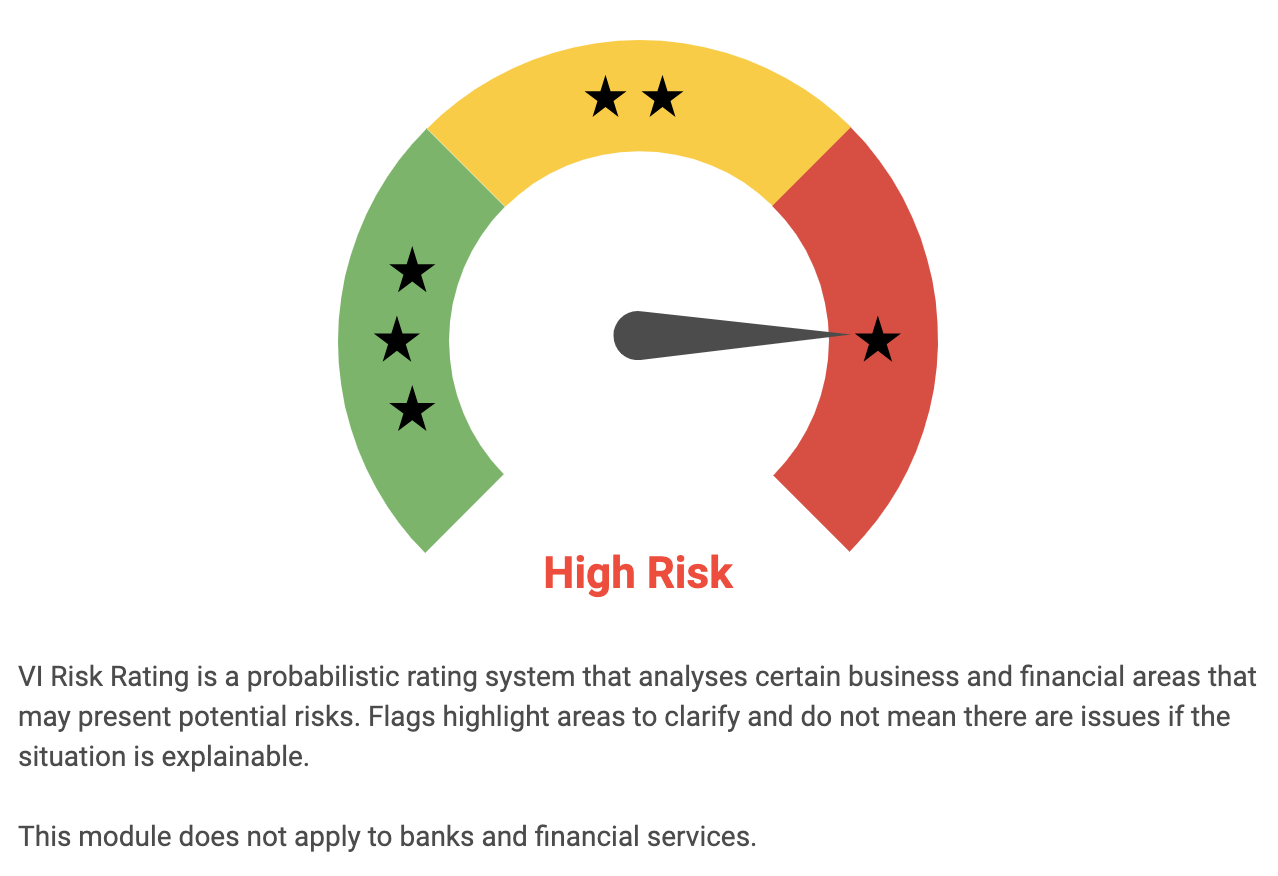

The VI app is a great tool for investors to quickly analyze the fundamentals of WOLFSPEED, a US-based semiconductor company. Based on the VI Risk Rating, WOLFSPEED is a high risk investment in terms of both financial and business aspects. The app provides users with a comprehensive overview of the company’s financial performance, allowing them to make more informed decisions on the long-term potential of the investment. It compares WOLFSPEED’s performance against industry benchmarks and peers to provide a comprehensive picture of the company’s financial health.

In addition, the app identifies three risk warnings related to WOLFSPEED’s income statement, balance sheet and cash flow statement. This includes red flags such as low profitability, weak liquidity and declining cash flows. By understanding these warnings, investors can assess their risk tolerance and decide if the company is suitable for their portfolio. The VI app is a great way to quickly assess the fundamentals of WOLFSPEED and evaluate its long-term potential. Investors can register on vi.app to get a detailed report and further explore the company’s financials and risk factors.

Peers

The company’s products are used in a variety of applications, including cell phones, wireless infrastructure, and military and aerospace. Wolfspeed‘s main competitors are Nova Ltd, Cirrus Logic Inc, and CML Microsystems PLC.

– Nova Ltd ($NASDAQ:NVMI)

Nova Ltd is a large company with a market cap of 2.09B. It has a strong ROE of 25.44%. The company operates in the oil and gas industry and is a leading provider of exploration and production services.

– Cirrus Logic Inc ($NASDAQ:CRUS)

Cirrus Logic, Inc. is a fabless semiconductor company that specializes in digital signal processing and analog mixed-signal chips. It has a market cap of $3.79B and a ROE of 21.86%. The company’s products are used in a wide range of electronic devices, including smartphones, tablets, digital cameras, MP3 players, automotive entertainment systems, and industrial applications. Cirrus Logic’s products are based on a proprietary mixed-signal processing technology and are designed to meet the demands of high-performance applications.

– CML Microsystems PLC ($LSE:CML)

CML Microsystems PLC is a market leader in the design, development and manufacture of high performance analog and mixed-signal semiconductors. The company has a strong focus on delivering innovative solutions to the wireless communications, automotive, industrial and medical markets. CML Microsystems has a long history of profitability and has a strong balance sheet with no debt. The company’s shares are listed on the London Stock Exchange.

Summary

Investors should take a close look at WOLFSPEED‘s financial results for the second quarter of its fiscal year 2023. On December 31 2022, total revenue was reported as USD -90.9 million, a 6.0% increase from the corresponding period in the previous year. Net income for the quarter was reported as USD 216.1 million, representing a 24.8% year-over-year increase. These results show that WOLFSPEED is continuing to experience growth in its operations and has become increasingly profitable.

The company appears to be well-positioned to capitalize on future opportunities and make investments that will drive further growth in the coming years. With this in mind, investors should consider WOLFSPEED as a potential investment opportunity.

Recent Posts