WINNEBAGO INDUSTRIES Reports Decreased Revenue and Net Income for FY2023 Q1

December 28, 2022

Earnings report

WINNEBAGO INDUSTRIES ($NYSE:WGO) is a leading manufacturer of recreational vehicles in the United States. On December 16 2022, it reported earnings results for the first quarter of FY2023 as of November 30 2022. For the reported quarter, the company had achieved total revenue of USD 60.2 million, which was a decrease of 39.6% year over year. Reported net income was USD 952.2 million which was a decrease of 17.6% year over year when compared to the same period last year. The decrease in revenue was due to lower sales in the motor home market, which is the primary source of revenue for WINNEBAGO INDUSTRIES.

Additionally, the company noted that higher freight costs and commodity prices also contributed to the decrease in revenue for the quarter. In terms of net income, the company reported a 17.6% decrease year over year. This can be primarily attributed to higher operating costs, as well as lower sales due to the pandemic. Furthermore, the costs associated with restructuring activities during the quarter also impacted net income. Despite this, the company remains committed to delivering high quality products and services to its customers, and it is confident that its long-term growth prospects are still intact.

Share Price

The stock opened at $56.0 and closed at $55.3, down by 0.8% from the previous closing price of 55.8. This was mainly due to a decrease in sales of motorhomes and other recreational vehicles, partially offset by an increase in towable RV sales. Despite the decrease, the company is still committed to delivering quality products and services to its customers and is taking necessary steps to improve its financial performance in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Winnebago Industries. More…

| Total Revenues | Net Income | Net Margin |

| 4.75k | 351.24 | 7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Winnebago Industries. More…

| Operations | Investing | Financing |

| 374.02 | -91.37 | -222.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Winnebago Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.39k | 1.11k | 42.25 |

Key Ratios Snapshot

Some of the financial key ratios for Winnebago Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.7% | 52.8% | 10.6% |

| FCF Margin | ROE | ROA |

| 5.9% | 24.6% | 13.1% |

VI Analysis

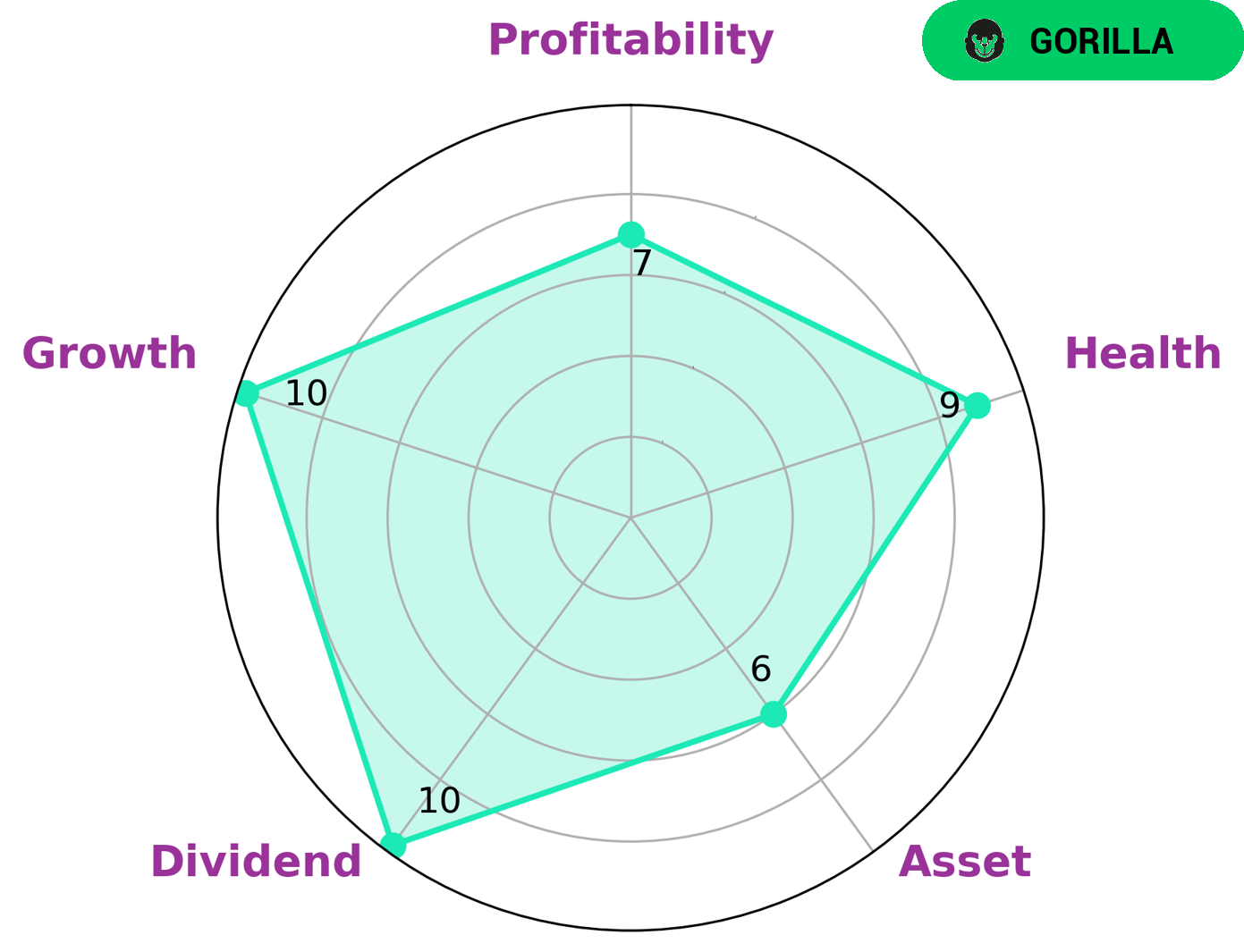

Investors looking for a strong long-term potential in their portfolio may find WINNEBAGO INDUSTRIES to be a great option. According to the VI Star Chart, the company has been classified as a ‘gorilla’ due to its strong competitive advantage and stable revenue and earnings growth. The company has a high health score of 9/10, which is an indication of its ability to ride out any crisis without the risk of bankruptcy. Additionally, it is strong in dividend, growth and profitability, and medium in asset. WINNEBAGO INDUSTRIES is a great investment opportunity for investors looking for stability and strength. The company has a strong competitive advantage and a healthy balance sheet, which makes it capable of handling any difficult times without taking too much of a financial hit. Furthermore, the company’s dividend, growth, and profitability make it an attractive investment opportunity. It is also medium in asset, which means that investors can expect steady returns from their investments. More…

VI Peers

The competition between Winnebago Industries Inc and its competitors is fierce. Each company is striving to be the best in the industry and to provide the best products and services to their customers. This competition is good for the consumer because it allows them to choose from a variety of products and companies that are all trying to be the best. It also keeps the prices of the products and services down because the companies are always trying to outdo each other.

– Polaris Inc ($NYSE:PII)

Polaris Inc is a global company with a market cap of 5.58B as of 2022. It designs, engineers, and manufactures powersports vehicles, including motorcycles, snowmobiles, and ATVs. The company also manufactures related parts and accessories. Polaris has a strong focus on innovation and is constantly introducing new products to the market. The company’s return on equity is 32.56%.

– Hino Motors Ltd ($TSE:7205)

Hino Motors Ltd is a Japanese manufacturer of commercial vehicles and diesel engines. The company is a leading producer of medium and heavy-duty trucks in Japan, and is a part of the Toyota Group. Hino Motors Ltd has a market cap of 343.84B as of 2022, and a Return on Equity of -4.8%. The company manufactures a wide range of commercial vehicles, including trucks, buses, and engines. Hino Motors Ltd also has a strong presence in the global market, with exports to over 100 countries.

– Vaksons Automobiles Ltd ($BSE:539402)

Vaksons Automobiles Ltd is an Indian company that manufactures and sells automobiles. As of 2022, the company had a market capitalization of 215.14 million and a return on equity of -0.15%. The company’s products include cars, trucks, and buses.

Summary

Investing in WINNEBAGO INDUSTRIES can be a potentially wise decision for investors who are looking for a reliable and long-term investment. The company reported total revenue of USD 60.2 million for FY2023 Q1, down 39.6% year over year, and net income of USD 952.2 million, down 17.6% year over year. Despite the decrease year-over-year in revenue and net income, WINNEBAGO INDUSTRIES is still a profitable company with a strong balance sheet. It is well positioned to take advantage of industry trends and capture market share.

Additionally, the company has a long history of operational excellence and sound financial management, which makes it an attractive option for investors. Furthermore, WINNEBAGO INDUSTRIES has a diversified product portfolio and a large customer base, ensuring a steady stream of income. All these factors make WINNEBAGO INDUSTRIES a viable investment option for investors seeking long-term growth in their portfolio.

Recent Posts