WEC ENERGY Reports 12.7% Revenue Increase and 16.2% Net Income Increase for FY2022 Q4

February 12, 2023

Earnings report

WEC Energy, a major diversified energy company based in Milwaukee, Wisconsin, recently released its earnings results for the fourth quarter of fiscal year 2022 (FY2022 Q4). For the period ending December 31 2022, WEC ENERGY ($NYSE:WEC) reported total revenue of USD 253.0 million – a 12.7% increase from the same period in the previous year – and net income of USD 2558.4 million, a 16.2% year-over-year increase. WEC Energy is engaged in the generation, transmission, distribution and sale of electricity and natural gas to customers in Wisconsin, Illinois, Michigan and Minnesota. The company also provides energy-related products and services, including steam, chilled water, and cogeneration services to customers in the same region.

Additionally, WEC Energy owns and operates several power plants across the United States. The reported revenue increase was primarily driven by higher sales volumes in the electricity and natural gas segments, partially offset by lower sales due to mild weather. Additionally, WEC Energy’s net income benefited from higher sales volume and improved operating costs. Looking ahead, WEC Energy expects to continue to benefit from increasing customer demand as well as rising natural gas prices. Additionally, the company is continuing to invest in renewable energy projects and plans to continue to reduce its carbon emissions. Overall, the strong fourth quarter performance by WEC Energy indicates that the company is in a good position to continue to generate strong returns for its shareholders in the coming quarters.

Stock Price

This news was well-received by investors, as the stock opened at $95.3 and closed at $94.9. The impressive revenue and net income growth reflect WEC ENERGY’s success in providing reliable energy services to its customers. WEC ENERGY’s strong fourth quarter results can be attributed to its focus on cost management and operational efficiency. The company has invested heavily in new technologies and processes to ensure customer service remains at the highest level.

Additionally, WEC ENERGY has been able to identify areas of cost savings, while also developing innovative strategies to manage pricing volatility in the energy markets. The company’s strong performance in Q4 has led to an optimistic outlook for its future. WEC ENERGY is poised to continue its success in delivering reliable energy services to its customers, while also continuing to make investments in new technologies and processes. As the energy landscape continues to evolve, WEC ENERGY is well-positioned to capitalize on the changing market conditions and remain a leader in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wec Energy. More…

| Total Revenues | Net Income | Net Margin |

| 9.6k | 1.41k | 14.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wec Energy. More…

| Operations | Investing | Financing |

| 2.06k | -2.64k | 676.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wec Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 41.87k | 30.26k | 36.1 |

Key Ratios Snapshot

Some of the financial key ratios for Wec Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.5% | 7.9% | 23.4% |

| FCF Margin | ROE | ROA |

| -2.8% | 12.3% | 3.4% |

Analysis

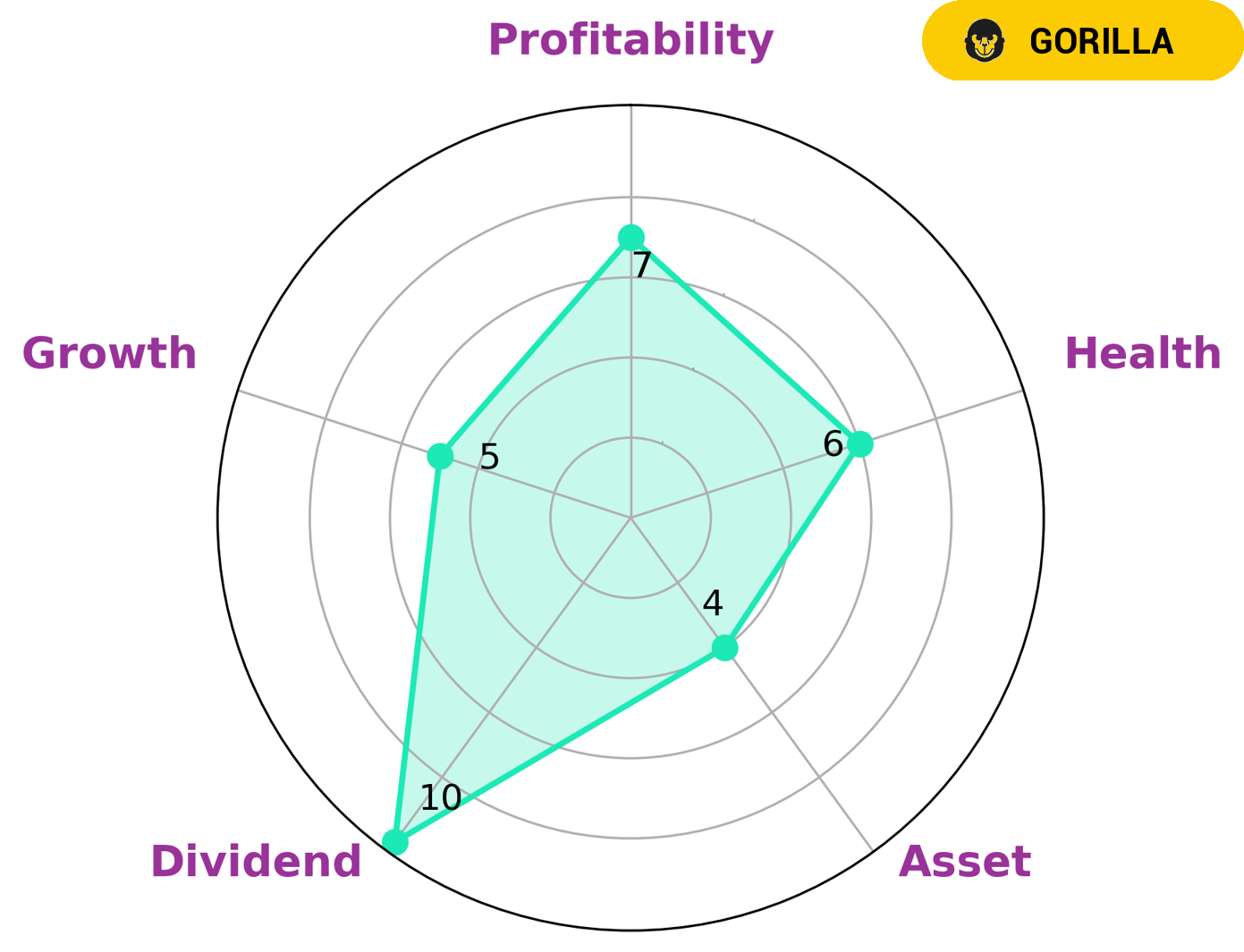

GoodWhale’s analysis of WEC ENERGY‘s wellbeing indicates that the company has an intermediate health score of 6/10 in terms of its cashflows and debt, suggesting that it is in a position to ride out any potential crisis without the risk of bankruptcy. WEC ENERGY is classified as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for a safe and stable investment may be interested in WEC ENERGY. The company is strong in dividend payments and profitability, and is medium in asset growth. As such, it is an ideal option for those who want a steady return on their investments. Additionally, WEC ENERGY may be attractive to those who are looking for steady long-term growth, as the company is likely to remain strong in the face of market volatility. Overall, GoodWhale’s analysis of WEC ENERGY’s wellbeing paints a picture of a reliable and stable business with a strong competitive advantage. This makes it an attractive option for investors looking for a low risk investment with the potential for long-term growth. More…

Peers

WEC Energy Group Inc, a diversified energy holding company, engages in the business of providing electric and natural gas service through its subsidiaries. Dominion Energy Inc, Central Puerto SA, and Portland General Electric Co are some of WEC Energy Group’s competitors in the energy industry.

– Dominion Energy Inc ($NYSE:D)

Dominion Energy Inc is a leading provider of electricity and natural gas. The company serves more than 6 million customers in the United States. Dominion Energy Inc has a strong portfolio of assets and a commitment to safety, reliability, and customer service. The company’s market cap is 54.69B as of 2022 and its ROE is 7.47%. Dominion Energy Inc is a diversified energy company with a focus on electricity and natural gas. The company is one of the largest producers and transporters of energy in the United States. Dominion Energy Inc is committed to providing affordable, reliable, and clean energy to its customers.

– Central Puerto SA ($NYSE:CEPU)

Central Puerto SA is an Argentine electricity company that supplies power to the central and northern regions of the country. It has a market cap of 1.25B as of 2022 and a Return on Equity of 7.42%. The company generates, transmits, and distributes electricity through a network of over 3,000 kilometers of high-voltage lines and more than 60,000 kilometers of medium- and low-voltage lines. It also has a thermal power plant with a capacity of 1,200 MW.

– Portland General Electric Co ($NYSE:POR)

Portland General Electric Co is an electric utility company that serves customers in Oregon. As of 2022, the company had a market capitalization of $3.9 billion and a return on equity of 9.64%. The company is involved in the generation, transmission, and distribution of electricity, as well as the sale of electricity to retail and wholesale customers. Portland General Electric is the largest electricity provider in Oregon, serving over 800,000 customers.

Summary

Investors looking to add WEC Energy to their portfolio may find the company’s fourth quarter earnings report encouraging. The company reported total revenue of USD 253.0 million, a 12.7% year-over-year increase, and net income of USD 2558.4 million, a 16.2% increase from the same period in the previous year. The company’s strong performance suggests that it is on track to achieve its long-term objectives, including cost containment and operational efficiency.

Investors may also appreciate the company’s focus on sustainability, as it continues to invest in renewable energy sources and other green initiatives. With its solid financial performance and commitment to sustainability, WEC Energy is well-positioned for continued success in the years to come.

Recent Posts