TERADYNE Reports 25.2% Lower Revenue and 17.3% Lower Net Income for Fourth Quarter of 2022.

February 7, 2023

Earnings report

TERADYNE ($NASDAQ:TER) is a leading American electronics engineering and manufacturing company that specializes in automation solutions for a wide range of industries. It is a publicly traded company and its stock is listed on the New York Stock Exchange. The company reported a total revenue of USD 172.3 million, a 25.2% decrease compared to the same period the year prior. This primarily resulted from lower sales in the company’s Industrial Automation and Test Systems businesses. Net income for the quarter was USD 731.8 million, a 17.3% decrease compared to last year. This was due to lower sales and higher expenses related to research and development activities.

Additionally, the company recorded higher taxes as a result of a decrease in earnings before taxes. This was primarily due to lower net income and lower cash inflows from customers. Overall, TERADYNE’s financial results for the fourth quarter of fiscal year 2022 showed a significant decrease in both revenue and net income compared to the prior year. Despite the difficult environment, the company remains committed to delivering innovative products and solutions to its customers, while continuing to manage its costs and cash flow effectively.

Price History

Despite the lower financials, TERADYNE stock opened at $99.7 and closed at $103.7, up by 0.2% from prior closing price of 103.4. This was due to higher-than-expected earnings and cost-cutting measures that had been put in place during the quarter. The company attributed their lower revenues to a decrease in demand for their products, caused by the current economic crisis, as well as a decrease in manufacturing output due to supply chain disruptions.

In addition, costs associated with moving their operations online to meet the demands of the pandemic, such as higher IT and software expenses, further contributed to the lower revenue. The company’s net income also decreased by 17.3%, due to the aforementioned factors as well as higher research and development costs associated with new product development and an increase in operating expenses. This shows that despite the current economic crisis, the company is still able to maintain their position in the market and remain competitive. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Teradyne. More…

| Total Revenues | Net Income | Net Margin |

| 3.16k | 715.5 | 23.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Teradyne. More…

| Operations | Investing | Financing |

| 577.92 | 43.75 | -892.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Teradyne. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.5k | 1.05k | 14.47 |

Key Ratios Snapshot

Some of the financial key ratios for Teradyne are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.2% | 16.3% | 26.9% |

| FCF Margin | ROE | ROA |

| 13.1% | 23.5% | 15.2% |

Analysis

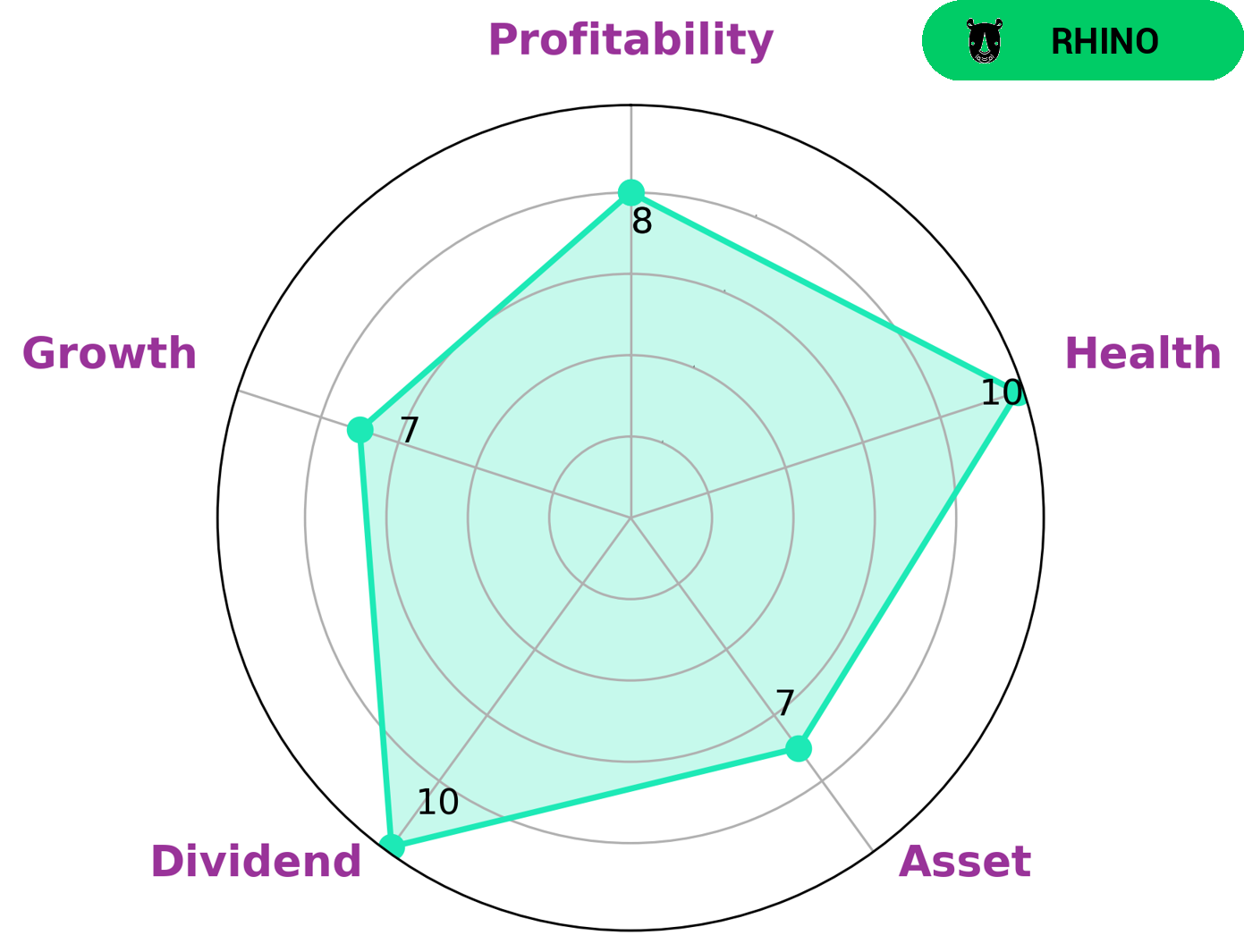

The Star Chart also demonstrates that TERADYNE has a health score of 10/10, indicating that it is capable of paying off debt and funding future operations. These qualities make TERADYNE an attractive investment for a variety of investors. Those interested in dividend payments, for example, will be pleased to note that TERADYNE has strong asset, dividend, growth, and profitability numbers. Investors with a more aggressive outlook may prefer the company’s higher risk/reward potential, as it is likely to produce above-average returns if market conditions continue to favor the company. TERADYNE is also likely to appeal to value investors, as it trades at a discount to its peers and offers a solid return on equity. Growth investors may be drawn to TERADYNE for its ability to increase earnings and revenue at a steady rate. Finally, those looking to invest in a company with strong fundamentals may find TERADYNE a suitable option given its strong cash flows and solid balance sheet. Overall, TERADYNE’s financials suggest that it is a solid investment opportunity for those seeking long-term growth or income. The company’s low debt and strong cash flow provide an element of security, while its moderate growth and attractive valuation make it attractive to a range of investors. More…

Peers

The competition between Teradyne Inc and its competitors is fierce. Lam Research Corp, Taiwan Semiconductor Manufacturing Co Ltd, and Apple Inc are all major players in the market. Teradyne Inc has been able to stay ahead of the competition by innovating and developing new products.

– Lam Research Corp ($NASDAQ:LRCX)

Lam Research Corporation is an American company that manufactures semiconductor processing equipment used in the fabrication of integrated circuits. The company was founded in 1980 and is headquartered in Fremont, California. Lam Research has a market capitalization of $51.81 billion as of March 2021 and a return on equity of 54.63%. The company’s products are used in a variety of applications, including memory chips, microprocessors, and graphics processors.

– Taiwan Semiconductor Manufacturing Co Ltd ($TWSE:2330)

With a market cap of 9.75T as of 2022, Taiwan Semiconductor Manufacturing Co Ltd is one of the largest companies in the world. The company’s return on equity is 22.34%, meaning that it generates a significant amount of profit for shareholders. Taiwan Semiconductor Manufacturing Co Ltd is a leading provider of semiconductor manufacturing services and one of the largest manufacturers of semiconductors in the world. The company’s products are used in a wide range of electronic devices, including computers, mobile phones, and consumer electronics.

– Apple Inc ($NASDAQ:AAPL)

Apple Inc. is an American multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. The company’s products and services include iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, a portfolio of consumer and professional software applications, iCloud, and iTunes. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple was incorporated as Apple Computer, Inc., in 1977. The word “Computer” was removed from the company’s name in 2007, as its traditional focus on personal computers shifted towards consumer electronics.

Summary

Investors looking to analyze TERADYNE‘s performance should take into account the company’s fourth quarter financial results for the fiscal year 2022. The company reported total revenue of USD 172.3 million, a 25.2% decrease year-over-year. Net income for the quarter was also down, at USD 731.8 million, a 17.3% decrease from the same period last year. This could be indicative of a downward trend in TERADYNE’s performance over the past year, and investors should take caution when considering allocating funds to the company. It is important for investors to assess the company’s financials in the context of its broader market. Analysts should consider the current global economic climate, as well as potential macroeconomic trends which may affect TERADYNE’s performance in the future.

Additionally, investors should assess the company’s competitive position within its industry, and whether it has a solid growth strategy in place to ensure future success. Overall, while TERADYNE may have seen a decrease in its financial performance in the fourth quarter of its fiscal year 2022, investors should not necessarily be discouraged from investing in the company. By taking into account the above factors, investors can make an informed decision regarding whether or not the company is a good fit for their portfolio.

Recent Posts