TENABLE HOLDINGS Reports 94.7% Revenue Decrease for 4Q FY2022, 23.9% Increase in Net Income Year-Over-Year.

February 21, 2023

Earnings report

TENABLE HOLDINGS ($NASDAQ:TENB), a global provider of cyber exposure, vulnerability management and compliance solutions, reported its financial results for the fourth quarter ended December 31, 2022 on February 7, 2023. The company reported total revenue of -21.5 million, a 94.7% decrease compared to the same quarter in the previous year. Despite the decrease in revenue, TENABLE HOLDINGS reported net income of 184.6 million, a 23.9% increase year-over-year. The company attributed this increase to strong operational execution and cost-saving measures they implemented during the quarter. This is a positive sign that the company is able to remain profitable during a difficult time.

This is a favorable sign that the company can continue to operate in the current environment without any financial strain. Looking ahead, TENABLE HOLDINGS is optimistic about their future prospects and believe that their security solutions are well-positioned to address the cyber security challenges that organizations face today. With the company’s financial position remaining strong and their solutions continuing to remain relevant, TENABLE HOLDINGS is well-positioned to realize future success.

Market Price

This can be attributed to the pandemic-related challenges faced by TENABLE HOLDINGS and its customers, especially in the second half of the year. Despite the decrease in revenue, the company reported a 23.9% increase in net income year-over-year. The stock opened on Tuesday at $42.5 and closed at $43.4, up by 1.6% from its previous closing price of $42.7. This suggests that the investors have responded positively to the results, despite the overall decline in the revenue of TENABLE HOLDINGS.

These increases indicate that the company is still generating positive cash flow, indicating that it is still financially sound despite the decline in revenue. Overall, despite the decrease in revenue and the challenges posed by the pandemic, TENABLE HOLDINGS reported some positive results for its 4Q FY2022. The increase in net income and cash flows as well as the reduction in total debt are encouraging signs for investors and demonstrate that the company is still in a strong financial position. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tenable Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 683.19 | -92.22 | -13.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tenable Holdings. More…

| Operations | Investing | Financing |

| 131.15 | -128.04 | 23.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tenable Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.44k | 1.17k | 2.4 |

Key Ratios Snapshot

Some of the financial key ratios for Tenable Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.4% | – | -9.7% |

| FCF Margin | ROE | ROA |

| 16.4% | -15.6% | -2.9% |

Analysis

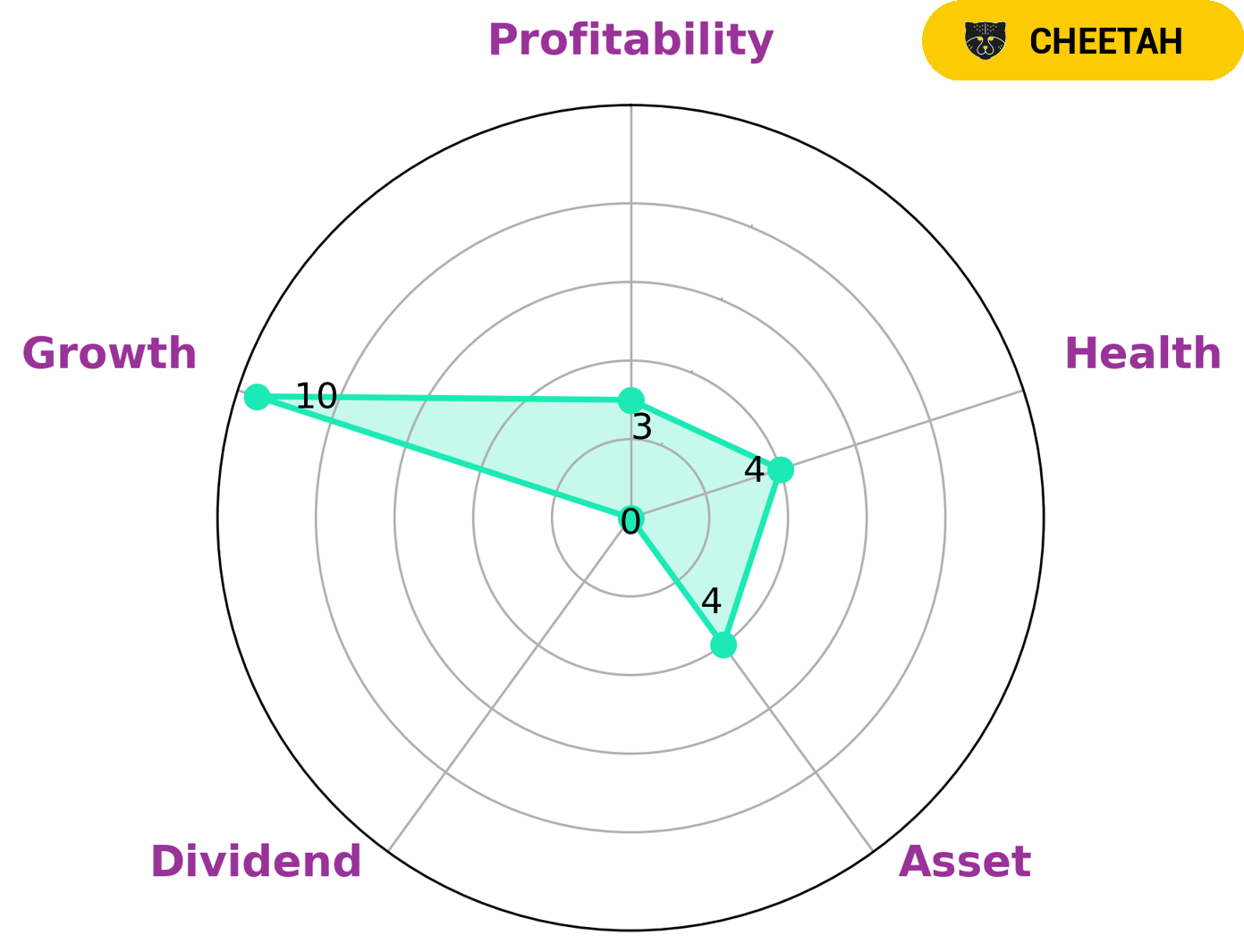

GoodWhale has conducted an analysis of TENABLE HOLDINGS‘s wellbeing and classified the company as a ‘cheetah’ according to their Star Chart. Companies of this type have achieved high revenue or earnings growth but are considered less stable due to lower profitability. This type of company might be attractive to investors looking for high growth potential, but they must carefully consider the risk of lower stability. The analysis of TENABLE HOLDINGS showed an intermediate health score of 4/10, indicating that the company may be able to safely ride out any crisis without the risk of bankruptcy. The company is strong in growth, medium in asset and weak in dividend, profitability. This suggests that investors looking for long-term returns should be aware of the potential instability associated with investing in such companies. Overall, investors looking for growth potential with higher risk should consider TENABLE HOLDINGS as an option. However, they should carefully assess the risk associated with investing in such companies before making a decision. By taking into consideration the stability of the company and its current financial stability, investors can make an informed decision about investing in TENABLE HOLDINGS. More…

Peers

Tenable was founded in 2002 by Jack Huffard, Ron Gula, and Marcus Ranum. Tenable went public in July 2018, and trades on the NASDAQ under the symbol TENB. Tenable delivers Tenable.io, the world’s first Cyber Exposure platform, as well as a suite of award-winning products including the Nessus vulnerability scanner. Tenable.io provides continuous visibility into an organization’s cyber exposure across their entire attack surface, from operating systems and hardware to virtualization and cloud environments and containers. By identifying and prioritizing vulnerabilities and configurations issues, Tenable.io helps organizations to fix critical issues before they can be exploited. In addition to Tenable.io, Tenable also offers a suite of products that includes the Nessus vulnerability scanner, which is used by more than 1.5 million users in over 150 countries. Nessus is available in a variety of editions, including a free edition, and is used by small businesses, Fortune 500 companies, government agencies, and many of the world’s leading service providers.

– Indra Sistemas SA ($OTCPK:ISMAY)

Indra Sistemas SA is a Spanish company that provides technology solutions for defense, security, and transportation. As of 2022, the company has a market capitalization of 1.7 billion euros and a return on equity of 18.37%. Indra Sistemas SA is a leading provider of technology solutions for the defense, security, and transportation markets. The company has a strong presence in Spain and Europe, and is expanding its operations in Asia and the Americas.

– Check Point Software Technologies Ltd ($NASDAQ:CHKP)

Check Point Software Technologies Ltd is a software company that provides internet security solutions. Its products include firewall products, anti-virus software, and intrusion detection systems. The company has a market cap of 16.5B as of 2022 and a Return on Equity of 18.44%. Check Point Software Technologies is headquartered in Tel Aviv, Israel.

– Cyber Security 1 AB ($LTS:0GCB)

Cyber Security 1 AB is a Swedish company that specializes in providing cyber security solutions. The company has a market capitalization of 16.14 million as of 2022 and a return on equity of -11.14%. Cyber Security 1 AB’s solutions include intrusion detection and prevention, vulnerability management, and security information and event management. The company serves a range of industries, including government, healthcare, finance, and retail.

Summary

TENABLE HOLDINGS reported disappointing results for the fourth quarter of FY2022, with total revenue decreasing by a significant 94.7% compared to the same quarter the previous year. Despite this, net income for the quarter grew 23.9% year over year. For investors, these results suggest that TENABLE HOLDINGS has been able to maintain profitability in the face of a severe revenue decline. This could indicate that the company’s cost-cutting measures have been effective and it is well-positioned to weather further economic downturns. Furthermore, the year-over-year increase in net income suggests that the company is well-managed and may be in line for profitable future quarters.

However, it is important for investors to keep in mind that the revenue decline indicates that the company may not be able to generate sufficient cash flow to sustain itself in the long term. Therefore, investors should monitor the company’s performance closely in order to ensure that it is taking the necessary steps to improve its financial position. This includes looking out for opportunities to increase revenue or reduce costs, as well as evaluating potential partnerships or acquisitions that could provide additional stability. Overall, TENABLE HOLDINGS seems to have made some progress in terms of maintaining profitability, but investors should continue to exercise caution before investing in the company.

Recent Posts