TE CONNECTIVITY Reports Decreased Revenue But Increased Net Income For First Quarter of FY2023

January 30, 2023

Earnings report

TE CONNECTIVITY ($NYSE:TEL) is a global technology and manufacturing leader that designs and manufactures connectivity and sensor solutions for a variety of industries, including automotive, industrial, data communications, and consumer products. On December 31 2022, TE CONNECTIVITY reported its earnings results for the first quarter of FY2023, ending January 25 2023. Total revenue for the quarter was USD 397.0 million, a decrease of 29.9% compared to the same period in the previous year. This decrease in revenue was mainly attributed to lower sales in the automotive and industrial markets, along with unfavorable exchange rate fluctuations.

However, despite the decrease in revenue, net income increased 0.6% to USD 3841.0 million. This increase was mainly due to cost reduction initiatives taken during the quarter and a decrease in expenses in areas such as research and development and selling, general, and administrative expenses. The company also saw an increase in operating margins due to higher gross margins resulting from reduced overhead costs and product mix. Overall, TE CONNECTIVITY reported a strong first quarter despite lower revenue due to their cost reduction initiatives and improved product mix. The company is optimistic about the future and is confident that it will be able to continue to expand its reach and improve its margins as the year progresses. TE CONNECTIVITY remains committed to delivering value to its customers, shareholders, and employees through its innovative products and services.

Market Price

On Wednesday, TE CONNECTIVITY reported decreased revenue but increased net income for the first quarter of FY2023. TE CONNECTIVITY stock opened at $121.0 and closed at $123.6, down by 0.9% from previous closing price of 124.6. Despite the decrease in revenue, TE CONNECTIVITY reported an increase in net income due to cost savings initiatives, including reduction in spending and improved operational efficiency. The company also noted that the increase in net income was partially offset by lower revenue and higher tax expenses.

Overall, TE CONNECTIVITY’s first quarter results indicate that the company is beginning to see some positive results from its cost savings initiatives. While the decrease in revenue may be concerning, the increase in net income is a positive sign. Going forward, TE CONNECTIVITY will need to continue its cost savings initiatives in order to remain competitive in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Te Connectivity. More…

| Total Revenues | Net Income | Net Margin |

| 16.3k | 2.26k | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Te Connectivity. More…

| Operations | Investing | Financing |

| 2.52k | -944 | -1.75k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Te Connectivity. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 21.35k | 9.88k | 33.96 |

Key Ratios Snapshot

Some of the financial key ratios for Te Connectivity are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | 9.3% | 16.0% |

| FCF Margin | ROE | ROA |

| 10.7% | 14.8% | 7.7% |

VI Analysis

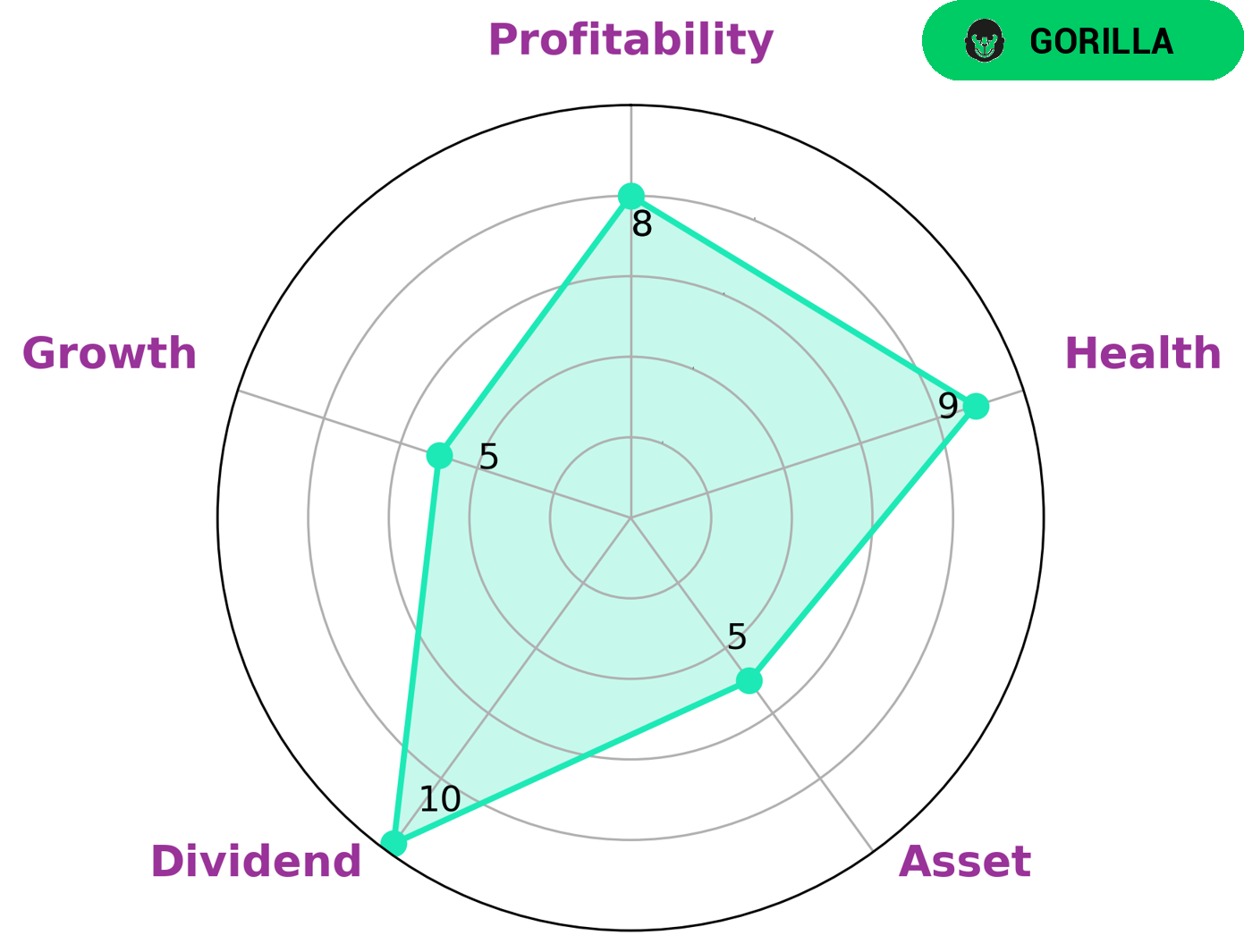

The VI Star Chart shows that it is a “gorilla”, a company that has achieved high and stable revenue or earning growth due to its strong competitive advantage. Investors with a long-term focus, who are looking for stability in their investments, may look to TE CONNECTIVITY as an attractive option. The company is strong in dividends and profitability, and medium in asset growth. It also has a high health score of 9/10 when it comes to cash flows and debt, indicating that it is capable of sustaining its operations in times of crisis. TE CONNECTIVITY stands out as an attractive company for investors with a long-term focus, due to its strong performance in dividends and profitability, as well as its ability to remain stable even in challenging situations. It has the potential to be a successful long-term investment, and is an option that investors should consider. More…

VI Peers

The company’s products are used in a variety of industries, including automotive, aerospace, telecommunications, industrial, and consumer electronics. TE Connectivity‘s main competitors are Amphenol Corp, Littelfuse Inc, Rexel SA, and other smaller companies. The company has a strong market position and offers a wide range of products.

However, its competitors are also well-established and offer similar products.

– Amphenol Corp ($NYSE:APH)

Amphenol Corp is a worldwide electronics manufacturer. They have a market cap of 43.95B as of 2022 and a Return on Equity of 23.34%. The company designs, manufactures, and markets electrical, electronic, and fiber optic connectors, interconnect systems, and coaxial and high-speed specialty cable.

– Littelfuse Inc ($NASDAQ:LFUS)

Littelfuse is a global manufacturer of circuit protection devices. Its products are used in a variety of industries, including automotive, consumer electronics, industrial, and telecommunications. The company has a market cap of 5.37B and a ROE of 13.41%.

– Rexel SA ($OTCPK:RXEEY)

As of 2022, Rexel SA has a market cap of 5.33B and a Return on Equity of 14.71%. The company is a leading distributor of electrical supplies and equipment. It operates in over 30 countries and serves a wide range of customers, from large corporates to small businesses. Rexel is committed to providing quality products and services, and to being a responsible corporate citizen.

Summary

Investors should take note of TE Connectivity’s first quarter of FY2023 results, which demonstrate a decrease in total revenue but an increase in net income. This is a positive sign that the company is managing its resources and operations efficiently. TE Connectivity’s strong financial standing and position as a global leader in connectivity and sensing solutions make it a promising investment opportunity. The company’s products are highly sought after in various industries, such as automotive, aerospace, industrial, and medical. Moreover, TE Connectivity’s research and development initiatives have enabled it to stay ahead of the competition and create innovative products and services.

In addition, the company has a solid balance sheet, with access to sufficient liquidity that can help it withstand economic downturns. Taking these factors into consideration, investors should consider investing in TE Connectivity for the long-term to benefit from the company’s growth prospects.

Recent Posts