STEVANATO GROUP Reports Increased Revenue and Net Income in the Fourth Quarter of FY2022

March 5, 2023

Earnings report

On March 2, 2023, STEVANATO GROUP ($NYSE:STVN) reported their earnings results for the fourth quarter of FY2022 (ending December 31, 2022). The results showed a total revenue of EUR 48.3 million, an 8.3% increase from the same quarter the previous year. Furthermore, net income for the quarter was EUR 292.1 million, a 25.6% year-over-year increase.

These strong financial results demonstrate STEVANATO GROUP’s successful financial management over the past year and demonstrate the company’s ability to generate significant returns over the long-term. STEVANATO GROUP’s investors and shareholders can rest assured that their investments are in safe hands and are likely to generate healthy returns in the future.

Stock Price

The company’s stock opened at $23.0 and closed at $23.7, marking a 6.2% increase from the last closing price of $22.3. This marks a positive outlook for the company as they have achieved substantial success in the current market. The reported revenue increase is mainly attributed to STEVANATO GROUP‘s effective marketing strategies and investments in research and development.

Additionally, the increased net income can be credited to the company’s cost-effective manufacturing process and efficient inventory management. The continuous growth of STEVANATO GROUP highlights the company’s commitment to providing quality services and products to meet their customers’ needs. Furthermore, this positive news could mean further investments into the company, offering potential long-term return for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stevanato Group. More…

| Total Revenues | Net Income | Net Margin |

| 983.7 | 143 | 14.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stevanato Group. More…

| Operations | Investing | Financing |

| 103.3 | -243 | -44.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stevanato Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.63k | 665.12 | 3.64 |

Key Ratios Snapshot

Some of the financial key ratios for Stevanato Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.4% | 45.7% | 22.1% |

| FCF Margin | ROE | ROA |

| 10.5% | 14.1% | 8.3% |

Analysis

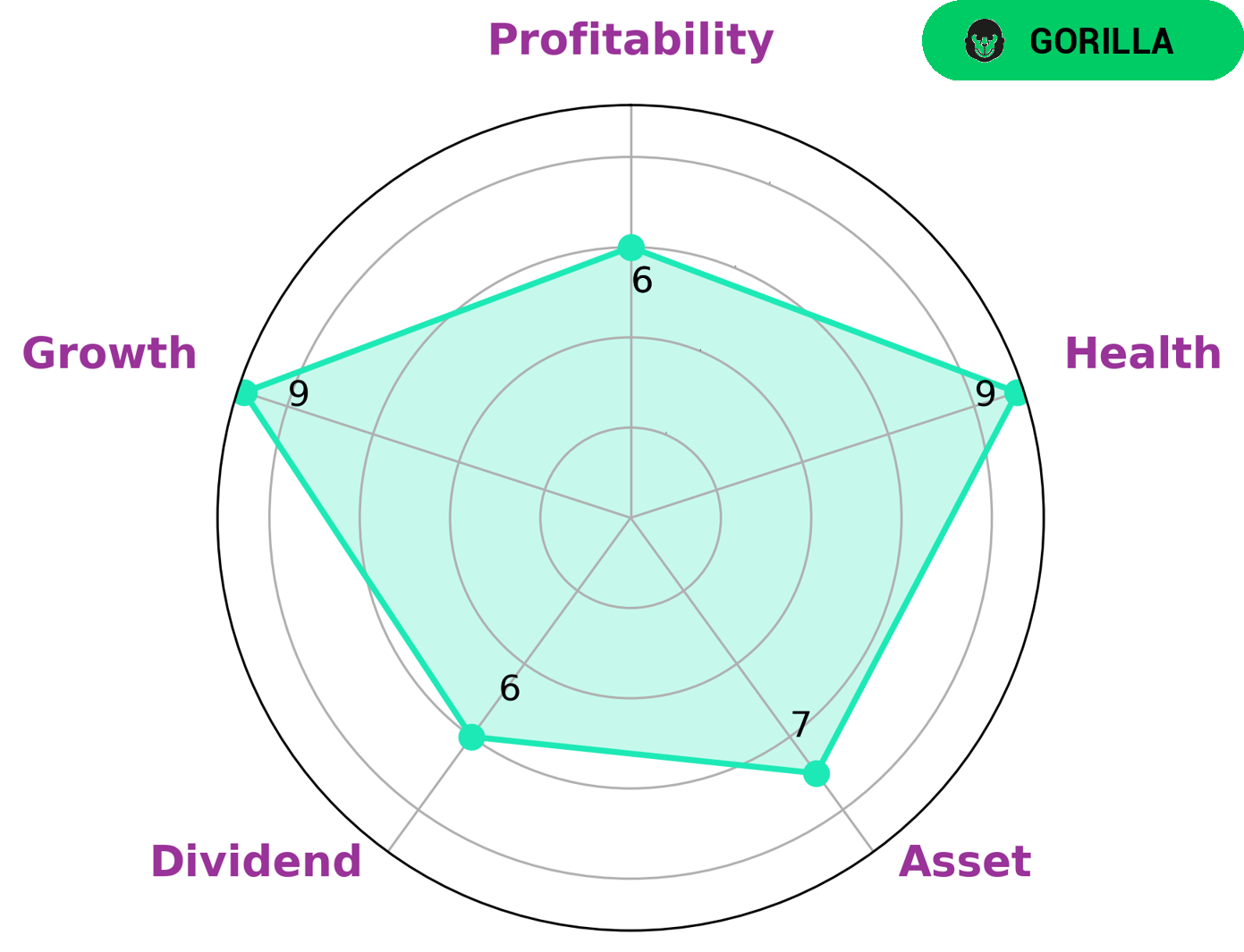

GoodWhale has conducted an analysis of STEVANATO GROUP‘s financials. Upon examination of the Star Chart, it is evident that STEVANATO GROUP has strong assets, strong growth, and medium dividend and profitability. These performance metrics place the company in a ‘gorilla’ type classification, meaning that the company has achieved a stable and high revenue or earnings growth due to a strong competitive advantage. Given the company’s impressive performance, there are certain types of investors who may find this company particularly irresistible. These would include value investors, who aim to identify and invest in undervalued stocks, in addition to long-term investors looking to benefit from the gradual rise of STEVANATO GROUP’s stock prices over time. Moreover, the company maintains a high health score of 9/10, indicating that its cashflows and debt are healthy enough to enable it to ride out any market crises without the risk of bankruptcy. More…

Peers

The company has a long history of success and has a strong market presence in Europe, North America, and Asia. Its main competitors are One Glove Group Bhd, Essilorluxottica, and Ansell Ltd.

– One Glove Group Bhd ($KLSE:5079)

One Glove Group Bhd is a Malaysian company that manufactures and sells gloves. The company has a market capitalization of 133.48 million as of 2022 and a return on equity of -17.63%. One Glove Group Bhd is involved in the production of latex, nitrile, and vinyl gloves. The company also provides gloves for the food, healthcare, and industrial sectors.

– Essilorluxottica ($OTCPK:ESLOY)

With a market capitalization of 78.25 billion as of 2022 and a return on equity of 4.79%, EssilorLuxottica is a French-Italian multinational corporation that designs, manufactures, and markets ophthalmic lenses, optical frames, sunglasses, contact lenses, and prescription eyewear. The company also provides eye care services. EssilorLuxottica is headquartered in Paris, France.

– Ansell Ltd ($ASX:ANN)

Ansell Ltd is a publicly traded company with a market capitalization of 3.53 billion as of 2022. The company has a return on equity of 9.21%. Ansell is a global leader in providing protective solutions. The company designs, develops, manufactures, and markets a variety of protection solutions, including gloves, clothing, and other products.

Summary

This impressive performance was met with an immediate positive response from investors as the stock price rose on the same day. Based on these figures and the confident outlook for the company’s growth, analysts are suggesting that STEVANATO GROUP currently presents an attractive proposition for investors.

Recent Posts