SIGNET JEWELERS Reports 59.5% Decrease in Revenue for Q3 FY2023, But Net Income Up 2.9% Year-on-Year

December 29, 2022

Earnings report

On December 6 2022, SIGNET JEWELERS ($NYSE:SIG) reported earnings results for the third quarter (Q3) of the fiscal year 2023, ending October 31 2022. SIGNET JEWELERS is a publicly-traded jewelry retailer, offering a variety of products such as diamonds, gold, silver, and other precious stones to customers around the world. For the third quarter, the company achieved total revenue of USD 37.5 million, down 59.5% year-on-year. Despite the sharp decline in revenue compared to the same quarter last year, SIGNET JEWELERS reported net income of USD 1582.7 million, up 2.9% year-on-year.

This increase in net income was mainly attributed to cost-cutting measures implemented by management, such as reducing store operations and inventory costs. SIGNET JEWELERS’ financial performance during the third quarter of FY2023 reflects the trend of many retailers in the current market, where a decrease in demand has caused many companies to adjust their strategies to remain profitable. Going forward, SIGNET JEWELERS has expressed their commitment to providing customers with quality products and services, and will continue to look for ways to reduce costs and improve efficiency in order to remain competitive in the market.

Price History

On Tuesday, SIGNET JEWELERS reported a 59.5% decrease in revenue for the third quarter of the fiscal year 2023. Despite the decrease in revenue, the company’s net income was up 2.9% year-on-year. Following the announcement, SIGNET JEWELERS stock opened at $64.0 and closed at $69.5, soaring by 20.2% from its prior closing price of 57.8. This news came as a surprise to many investors, who had expected the company to report a much lower figure of revenue for the quarter due to the ongoing pandemic. Despite the decrease in revenue, SIGNET JEWELERS was still able to increase its net income year-on-year, indicating that the company was able to keep its costs under control. The jump in SIGNET JEWELERS stock prices following the news was largely attributed to the company’s ability to turn a profit despite the decrease in revenue.

The impressive performance was seen as a sign that the company is well-positioned to weather the economic downturn and emerge stronger in the long run. Looking ahead, SIGNET JEWELERS is expected to continue to focus on cost-cutting measures and expanding its product lines in order to maintain its profitability. At the same time, the company is also looking for new opportunities to capitalize on the shift in consumer preferences that has occurred as a result of the pandemic. With these efforts, SIGNET JEWELERS is hoping to not only maintain its current level of profitability, but also to grow even further in the upcoming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Signet Jewelers. More…

| Total Revenues | Net Income | Net Margin |

| 7.99k | 379.2 | 8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Signet Jewelers. More…

| Operations | Investing | Financing |

| 617.9 | -1.09k | -696 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Signet Jewelers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.35k | 4.33k | 43.82 |

Key Ratios Snapshot

Some of the financial key ratios for Signet Jewelers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 50.1% | 6.2% |

| FCF Margin | ROE | ROA |

| 5.6% | 15.4% | 4.9% |

VI Analysis

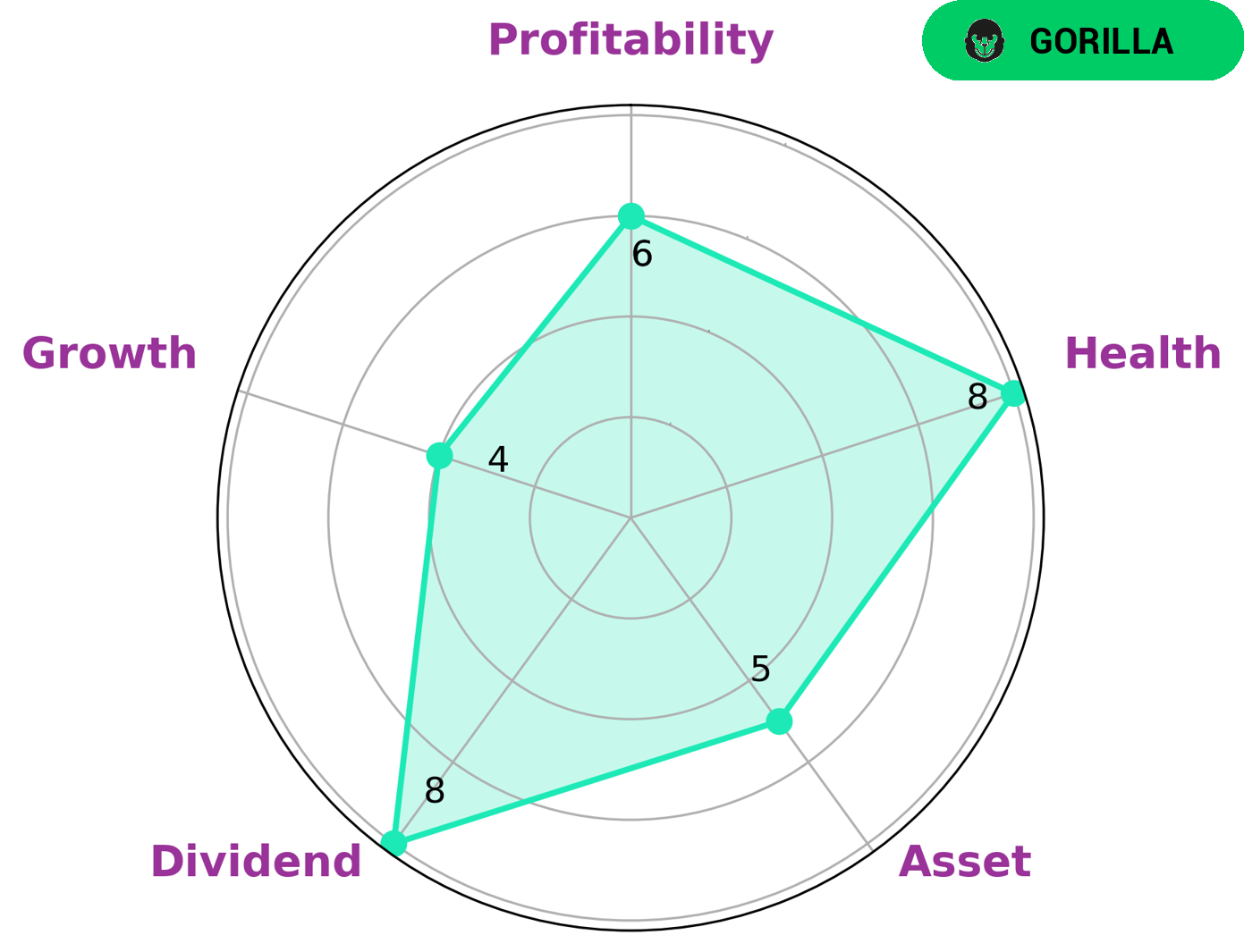

Investors looking for high-growth opportunities may be interested in Signet Jewelers, a company classified as a “gorilla” due to its strong competitive advantage and stable and high revenue or earnings growth. Its fundamentals are a reflection of its long-term potential, making it an attractive target for those seeking to invest in the industry. Signet Jewelers has an impressive health score of 8/10, indicating its capability to sustain future operations in times of crisis through its cashflows and debt. It is strong in dividend and medium in asset, growth and profitability. This means that it offers investors attractive returns in the form of dividends, while also providing potential capital appreciation. The company also has a presence in a variety of markets, having established itself as a leader in each of them. This provides investors with the assurance that their investments will be backed by a company with a strong track record and the capacity to capture further growth opportunities. It is also well-positioned to benefit from its diverse customer base, giving it the potential to increase its market share. Overall, Signet Jewelers is an attractive investment opportunity for those looking for a reliable and high-growth opportunity. Its fundamentals make it a safe bet for investors, as it is well-positioned to capture further growth opportunities. Its cashflows and debt make it capable of sustaining operations in times of crisis, while its presence in a variety of markets give it the potential to increase its market share. More…

VI Peers

The company is engaged in the retail sale of diamond jewelry, watches, and other related items. Signet Jewelers competes in the jewelry industry with other retailers such as Jakroo Inc, ABC Technologies Holdings Inc, and National Vision Holdings Inc.

– Jakroo Inc ($OTCPK:JKRO)

ATC Technologies Holdings Inc is a global provider of precision machining solutions. The company offers a range of services, including contract manufacturing, machining, and assembly. ATC serves a variety of industries, including aerospace, defense, medical, and semiconductor. The company has a market cap of 559.41M and a ROE of -9.23%.

– ABC Technologies Holdings Inc ($TSX:ABCT)

National Vision Holdings Inc is a holding company that operates through its subsidiaries as one of the largest optical retailers in the United States. The company offers a wide variety of vision care products and services including eyeglasses, contact lenses, eye exams, and prescription sunglasses. As of 2022, the company had a market capitalization of 2.66 billion dollars and a return on equity of 10.47%. National Vision Holdings Inc operates over 1,400 stores in 42 states across the United States.

Summary

Investing in SIGNET JEWELERS is a potentially lucrative opportunity for investors. Despite a 59.5% year-on-year drop in total revenue for Q3 of FY2023, the company’s reported net income was up 2.9%. This signaled to investors that the company is still on track for long-term growth, which could make it a worthwhile investment.

Additionally, the stock price moved up the same day that SIGNET JEWELERS reported its earnings results, further strengthening the argument for investing in the company. As such, it is a promising option for investors who are looking to diversify their portfolios with reliable stocks. The company has a proven track record of profitability and its stock is likely to continue performing well in the future. With a reasonable price-to-earnings ratio, SIGNET JEWELERS may be an ideal choice for investors who are looking for a safe bet with potential for growth.

Recent Posts