SAPPI LTD Reports 54.5% Increase in Total Revenue of USD 190.0 Million for Q1 FY2023.

March 28, 2023

Earnings Overview

For the first quarter of the financial year ending December 31, 2022 (FY2023), SAPPI LTD ($BER:SPIA) reported total revenue of USD 190.0 million, signifying a 54.5% increase compared to the same period the previous year. However, net income decreased by 2.2% year over year, amounting to USD 1660.0 million.

Market Price

This significant growth in revenues can be attributed to increased sales of products in the paper and pulp sector and higher pricing for pulp products. The news of these strong financial results was unfortunately overshadowed by the company’s stock price, which opened at €2.8 and closed at the same price, down a steep 9.6% from the prior closing price of 3.1. Investors were likely concerned by increased competition and potential currency effects as a result of the strengthening US Dollar. Despite this, analysts remain positive on SAPPI LTD‘s future prospects as they believe the company is well-positioned to leverage its strong portfolio of paper and pulp products for continued growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sappi Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 7.26k | 603 | 8.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sappi Ltd. More…

| Operations | Investing | Financing |

| 896 | -356 | -281 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sappi Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.23k | 3.69k | 4.47 |

Key Ratios Snapshot

Some of the financial key ratios for Sappi Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.8% | 39.0% | 11.9% |

| FCF Margin | ROE | ROA |

| 7.5% | 22.1% | 8.7% |

Analysis

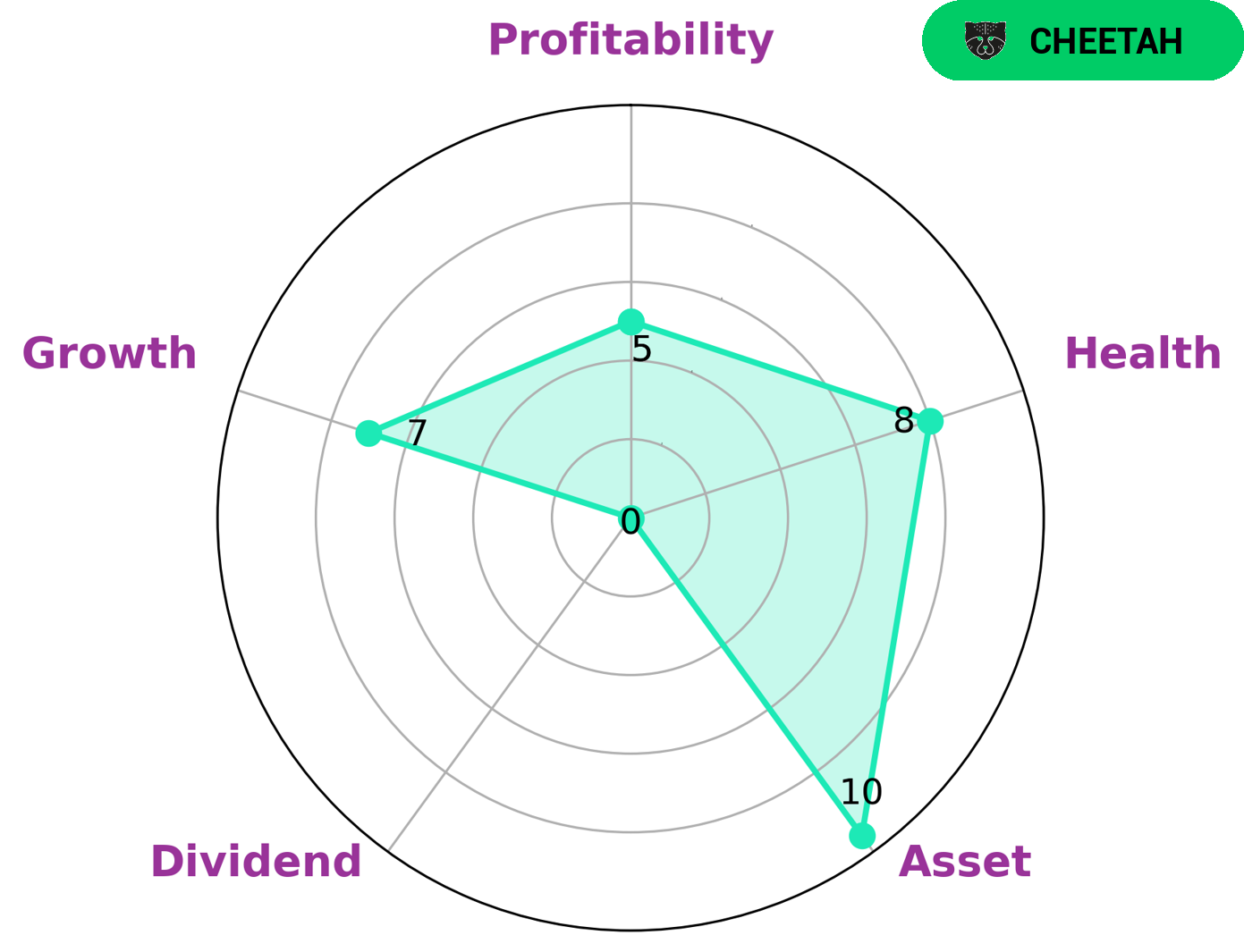

At GoodWhale, we have conducted an analysis of SAPPI LTD‘s fundamentals. Our Star Chart shows that SAPPI LTD has a high health score of 8/10 with regard to its cashflows and debt, meaning that it is capable to safely ride out any crisis without the risk of bankruptcy. Additionally, our analysis reveals that SAPPI LTD is strong in asset and growth, medium in profitability, and weak in dividend. Based on these metrics, we have classified SAPPI LTD as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Such companies may be attractive to investors who are looking for potential high returns but are aware of the potential risks associated with the company. These investors may include those who are more speculative and willing to take on higher levels of risk compared to those focused on preservation of capital and steady income. More…

Peers

Sappi Ltd is one of the world’s leading pulp and paper companies, producing premium quality products and solutions to customers throughout the world. As a global leader in the industry, Sappi faces competition in the form of PT Indah Kiat Pulp & Paper Tbk, Oji Holdings Corp, and Paper Corea Inc. All four of these companies have a strong presence in the international pulp and paper market and continually strive to provide innovative and high-quality products.

– PT Indah Kiat Pulp & Paper Tbk ($IDX:INKP)

PT Indah Kiat Pulp & Paper Tbk is a major Indonesian papermaking company that produces a variety of paper products including office paper, printing paper, industrial paper, tissue paper and cardboard. As of 2023, the company has a market capitalization of 40.49T and a Return on Equity of 14.71%. This puts PT Indah Kiat Pulp & Paper Tbk among the top companies in the Indonesian papermaking industry. The company’s current market capitalization is indicative of its strong financial performance and its commitment to providing quality paper products. Additionally, its return on equity is well above average in comparison to other companies in the industry, indicating that the company is an efficient operator and is able to generate a higher return on equity than most of its competitors.

– Oji Holdings Corp ($TSE:3861)

Oji Holdings Corp is a leading global paper and pulp manufacturer, with operations in the Asia-Pacific region, Europe, North America and the Middle East. The company’s market capitalization currently stands at 521.06 billion as of 2023. This is an impressive figure, highlighting the success and stability of the company. Additionally, its Return on Equity (ROE) of 6.39% reflects its profitability and attractive return on investments for shareholders.

– Paper Corea Inc ($KOSE:001020)

Corea Inc is a Korean-based company that specializes in providing technological services including software, IT solutions and cloud computing. As of 2023, the company has a market cap of 47.27B, which is one of the highest among tech companies. Additionally, Corea Inc has a strong return on equity of 26.21%, making it a leader in the industry. The success of Corea Inc is attributed to its robust portfolio of innovative services and solutions, as well as its strong commitment to customer service and satisfaction.

Summary

SAPPI LTD‘s financial performance in the first quarter of FY2023 ending December 31, 2022 was strong, with total revenue increasing by 54.5% compared to the same period the previous year. However, net income fell 2.2% year over year. Despite the strong revenue growth, investors may be concerned about the decline in net income resulting in stock prices declining for the same day. As a result, investors may want to carefully consider the short and long-term implications of investing in SAPPI LTD to determine whether or not it is a worthwhile investment.

Recent Posts