RESIDEO TECHNOLOGIES Reports Q4 Earnings for FY2022 on February 15, 2023

March 26, 2023

Earnings Overview

RESIDEO TECHNOLOGIES ($NYSE:REZI) reported their fourth quarter results for FY2022 on February 15 2023, with total revenue of USD 39.0 million, a decrease of 41.8% year-over-year. Net income was USD 1560.0 million, an increase of 7.3% from the previous year.

Transcripts Simplified

Revenue of $1.56 billion in Q4 was up 7%, compared to Q4 last year. Excluding acquisitions and foreign exchange impact, revenue grew 1%. Gross margin for the quarter was 27.6% flat with last year’s fourth quarter, while operating income of $98 million compared to $141 million last year. Products and Solutions revenue of $693 million was up 9%. Excluding acquisitions and foreign exchange impact, revenue declined 5%. Price realization added $35 million to revenue year-over-year, while aggregate volumes declined 10%.

Gross margin was 38.4%, relatively flat compared to last year. ADI delivered another solid quarter in Q4 with revenue up 6% to $867 million. ADI gross margin in the fourth quarter was 19.1%, compared with 19.2% last year. ADI operating profit was $69 million, essentially flat with the prior year. Corporate costs were $67 million, up from $54 million in the prior year fourth quarter.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Resideo Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 6.37k | 283 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Resideo Technologies. More…

| Operations | Investing | Financing |

| 152 | -764 | 170 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Resideo Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.39k | 3.86k | 17.32 |

Key Ratios Snapshot

Some of the financial key ratios for Resideo Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.5% | 35.8% | 7.5% |

| FCF Margin | ROE | ROA |

| 1.1% | 12.1% | 4.7% |

Price History

On Wednesday, February 15, 2023, RESIDEO TECHNOLOGIES reported its Q4 earnings for FY2022. The stock opened at $18.8 and closed at $19.0, down slightly by 0.9% from its prior closing price of 19.1. Overall, RESIDEO TECHNOLOGIES reported strong financial results in its Q4 earnings for FY2022.

Despite the slight decrease in stock price, the company saw an increase in revenue and net income due to their strategic investments and cost-cutting measures. Investors remain confident in the company’s financial success moving forward, as they continue to strive to improve their offerings and maximize their returns. Live Quote…

Analysis

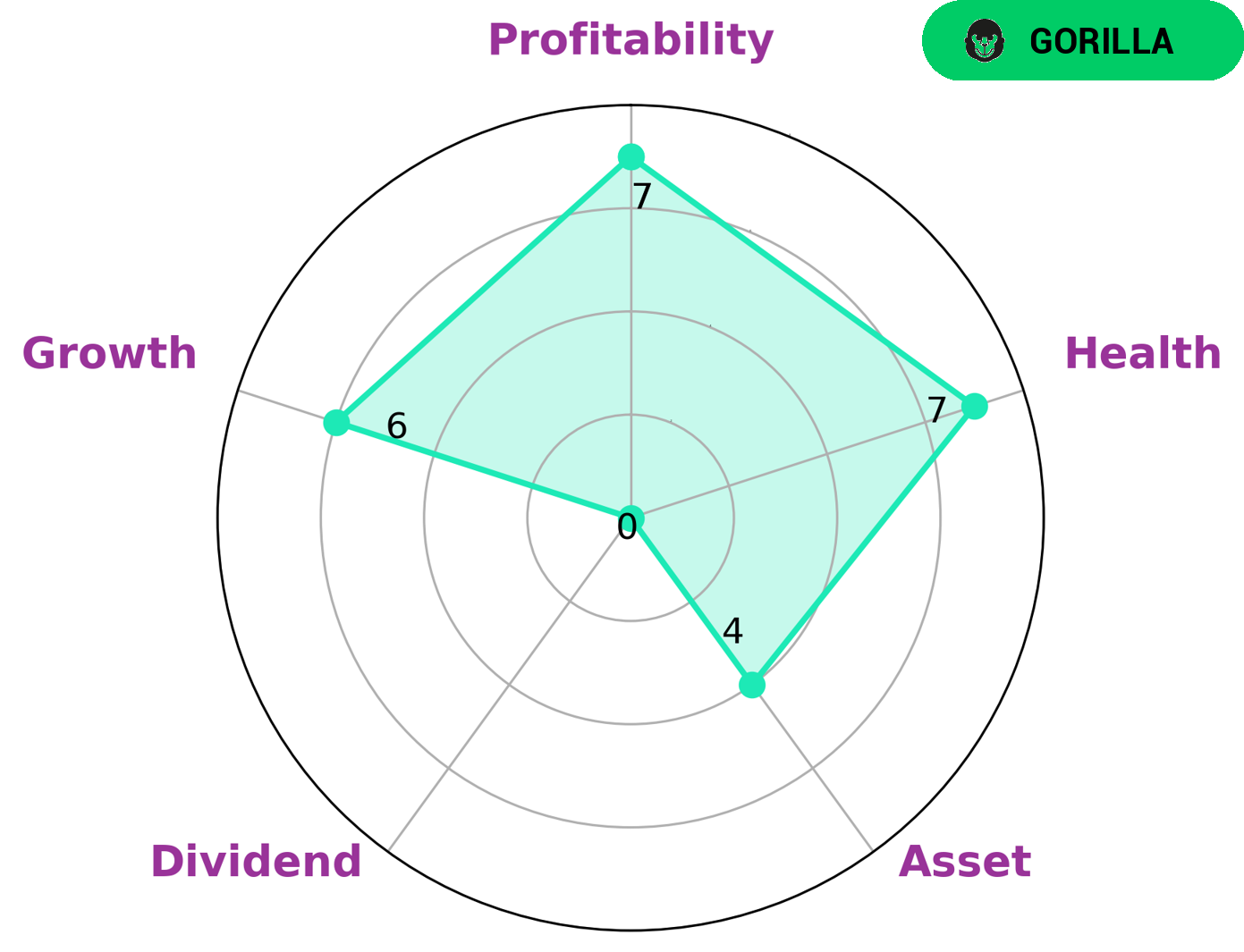

Investors who may be interested in such a company are those looking for consistent returns from a strong business. We assessed the health of RESIDEO TECHNOLOGIES and found that they had a score of 7/10 with regard to their cashflows and debt, indicating that they are capable of riding out any crisis without the risk of bankruptcy. Our evaluation also revealed that RESIDEO TECHNOLOGIES is strong in profitability, medium in asset, growth and weak in dividend. This shows that the company is able to achieve consistent growth with moderate investment, but may not provide attractive returns to dividend-focused investors. More…

Peers

George Risk Industries Inc, Oermester Vagyonvedelmi NyRt, and Aedge Group Ltd are all major competitors in the security industry. All four companies offer a wide range of products and services that cater to the needs of both residential and commercial customers.

– George Risk Industries Inc ($OTCPK:RSKIA)

Founded in 1954, George Risk Industries, Inc. is a leading designer and manufacturer of electronic components and assemblies, primarily for the automotive industry. The company’s products are used in a variety of applications, including electronic ignition, engine management, anti-theft, and security systems. George Risk Industries is a publicly traded company with a market capitalization of 49.31M as of 2022. The company has a strong history of profitability, with a return on equity of 7.05%. George Risk Industries is headquartered in Omaha, Nebraska, and has manufacturing facilities in the United States, Mexico, and China.

– Oermester Vagyonvedelmi NyRt ($LTS:0P31)

Oermester Vagyonvedelmi NyRt is a Hungarian company that provides security services. The company has a market cap of 2.55M as of 2022 and a Return on Equity of 15.67%. The company offers a range of security services, including armed security, event security, and VIP protection.

– Aedge Group Ltd ($SGX:XVG)

Aedge Group Ltd is a holding company that operates through its subsidiaries. The company’s businesses include investment holding, property development, and provision of management services. The company has a market cap of 28.09M as of 2022 and a return on equity of -6.22%. The company’s businesses are mainly based in Singapore and China.

Summary

RESIDEO TECHNOLOGIES reported strong fourth quarter earnings for FY2022, with total revenue of USD 39 million, a decrease of 41.8% year-on-year, while net income increased by 7.3% to USD 1560 million. The company appears to be in a good financial position, which should be attractive to potential investors. This is further evidenced by the company’s ability to increase net income despite a decline in revenue. With the addition of new products, the outlook for RESIDEO TECHNOLOGIES appears to be positive, making it an attractive investment opportunity.

Recent Posts