RENEW ENERGY GLOBAL Reports Record Revenue and Net Income for Fourth Quarter of FY2023

June 9, 2023

☀️Earnings Overview

RENEW ENERGY GLOBAL ($NASDAQ:RNW) reported total revenue of INR 23319.0 million and net income of INR 74.0 million for their fourth quarter of FY2023, ending March 31 2023. This demonstrated a year-over-year increase of 56.0% and 102.1% respectively compared to the same quarter of the previous year.

Market Price

Stock prices opened at $5.3 and closed at $5.5, which represented a 5.5% increase from its last closing price of $5.2. This increase in market value was largely driven by the company’s strong performance in the fourth quarter. These impressive results were largely driven by the company’s ongoing commitment to investing in clean energy sources, such as solar and wind power. The company’s commitment to clean energy continues to be reflected in its stock price performance.

Shares of RENEW ENERGY GLOBAL rose steadily throughout the fourth quarter, with investors responding positively to the company’s assurances of future growth. As investors become increasingly aware of the environmental benefits of renewable energy, companies like RENEW ENERGY GLOBAL are poised to benefit from this shift in investor sentiment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RNW. More…

| Total Revenues | Net Income | Net Margin |

| 78.22k | -5.03k | -7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RNW. More…

| Operations | Investing | Financing |

| 62.57k | -71.98k | 19.11k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RNW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 748.11k | 628.37k | 275.64 |

Key Ratios Snapshot

Some of the financial key ratios for RNW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.3% | 17.7% | 62.0% |

| FCF Margin | ROE | ROA |

| -26.6% | 28.2% | 4.1% |

Analysis

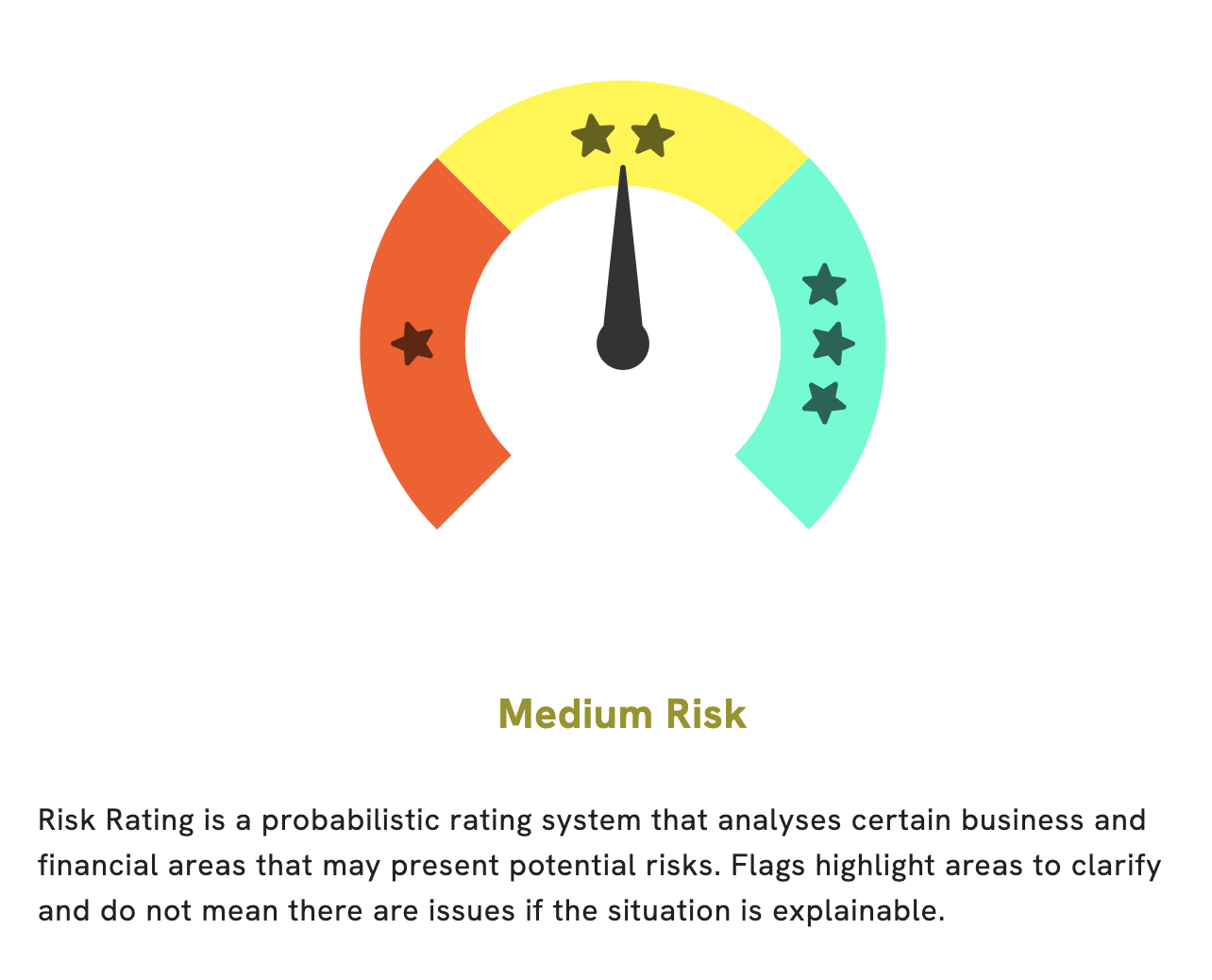

At GoodWhale, we recently conducted an analysis of RENEW ENERGY GLOBAL’s wellbeing. Based on our Risk Rating, RENEW ENERGY GLOBAL is considered a medium risk investment in terms of financial and business aspects. We advise those interested in this investment to become a registered user in order to explore and assess the potential risks that might be present in the business and financial areas. With more knowledge about the company, investors can make an informed decision about investing in RENEW ENERGY GLOBAL. More…

Peers

As the world increasingly looks for cleaner energy sources, many companies are vying for a piece of the renewable energy pie. ReNew Energy Global PLC is one such company, and it competes against others such as Karma Energy Ltd, Westbridge Renewable Energy Corp, and Shinfox Energy Co Ltd. All of these companies are looking to provide renewable energy solutions that are both effective and affordable.

– Karma Energy Ltd ($BSE:533451)

Karma Energy Ltd is an Indian renewable energy company with a market cap of 366.77M as of 2022. The company has a Return on Equity of 9.92%. Karma Energy Ltd is involved in the development, construction, and operation of renewable energy projects in India. The company has a portfolio of solar, wind, and biomass projects.

– Westbridge Renewable Energy Corp ($TSXV:WEB)

Westbridge Renewable Energy Corp is a Canadian renewable energy company. The company has a market capitalization of 38.54 million as of 2022 and a return on equity of -46.38%. The company operates in the wind, solar, and hydroelectric power generation sectors. The company was founded in 2006 and is headquartered in Calgary, Alberta, Canada.

– Shinfox Energy Co Ltd ($TWSE:6806)

Shinfox Energy Co Ltd is a Japanese company that specializes in the development and operation of renewable energy power plants. The company has a market cap of 13.4 billion as of 2022 and a return on equity of 2.33%. Shinfox Energy Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

Summary

Investing in Renew Energy Global is looking very promising. For their fourth quarter of FY2023, they reported a total revenue of INR 23319.0 million and a net income of INR 74.0 million, showing a year-over-year growth of 56.0% and 102.1%, respectively. This is an impressive performance, indicating that the company has been able to weather the impacts of the global pandemic well and maintain steady growth.

The stock price moved up the same day, which suggests that investors are feeling confident about the company’s prospects. Renew Energy Global looks like a promising investment opportunity.

Recent Posts