REGAL REXNORD Reports Outstanding Year-Over-Year Increase of 2214.6% in Total Revenue for FY2022

February 5, 2023

Earnings report

REGAL REXNORD ($NYSE:RRX), a leading global manufacturer and distributor of industrial products, recently reported its outstanding year-over-year increase of 2214.6% in total revenue for FY2022. This impressive growth was achieved in the fourth quarter alone, which ended on December 31 2022, with a total revenue of USD 101.5 million. Furthermore, the company also recorded a 2.3% increase in net income compared to the same period of the previous year, reaching USD 1244.7 million. The company’s financial results for FY2022 were reported on February 2 2023, which showed that REGAL REXNORD had achieved its highest ever total revenue and net income. The impressive growth was driven by a number of initiatives, such as the expansion of its product portfolio, increased customer engagement and focus on cost optimization.

Additionally, the company also benefited from strong demand in key markets such as Europe and the United States. With its impressive financial results, REGAL REXNORD has cemented its position as one of the leading global suppliers of industrial products. Its strong performance has not only been attributed to its innovative products, but also the company’s commitment to delivering the highest quality services to its customers. This is further bolstered by its commitment to investing in new technologies and expanding its operations into new markets. Undoubtedly, this is a very exciting time for the company and its shareholders.

Market Price

This announcement sent their stock soaring, with it opening at $151.1 and closing at $156.1, a rise of 9.4% from its prior closing price of 142.7. The company credited its success to a combination of strategic investments, customer-focused solutions, and innovative technology. This increase in total revenue is attributed to several factors, including new product launches, increased international sales, and improved customer service.

Additionally, the company has made significant investments in research and development, which has resulted in the launch of a number of cutting-edge products that have been well-received by customers. This increase is largely due to the company’s focus on cost reduction and operational efficiency. The impressive results reported by REGAL REXNORD have been met with enthusiasm by investors, who have responded by sending their stock prices up 9.4% since the announcement. As such, the company is well-positioned to continue its success in the future and build on its impressive growth from FY2022. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Regal Rexnord. More…

| Total Revenues | Net Income | Net Margin |

| 5.22k | 488.9 | 9.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Regal Rexnord. More…

| Operations | Investing | Financing |

| 436.2 | -113.3 | -274.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Regal Rexnord. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.27k | 3.85k | 92.89 |

Key Ratios Snapshot

Some of the financial key ratios for Regal Rexnord are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | 29.8% | 13.4% |

| FCF Margin | ROE | ROA |

| 6.8% | 7.0% | 4.3% |

Analysis

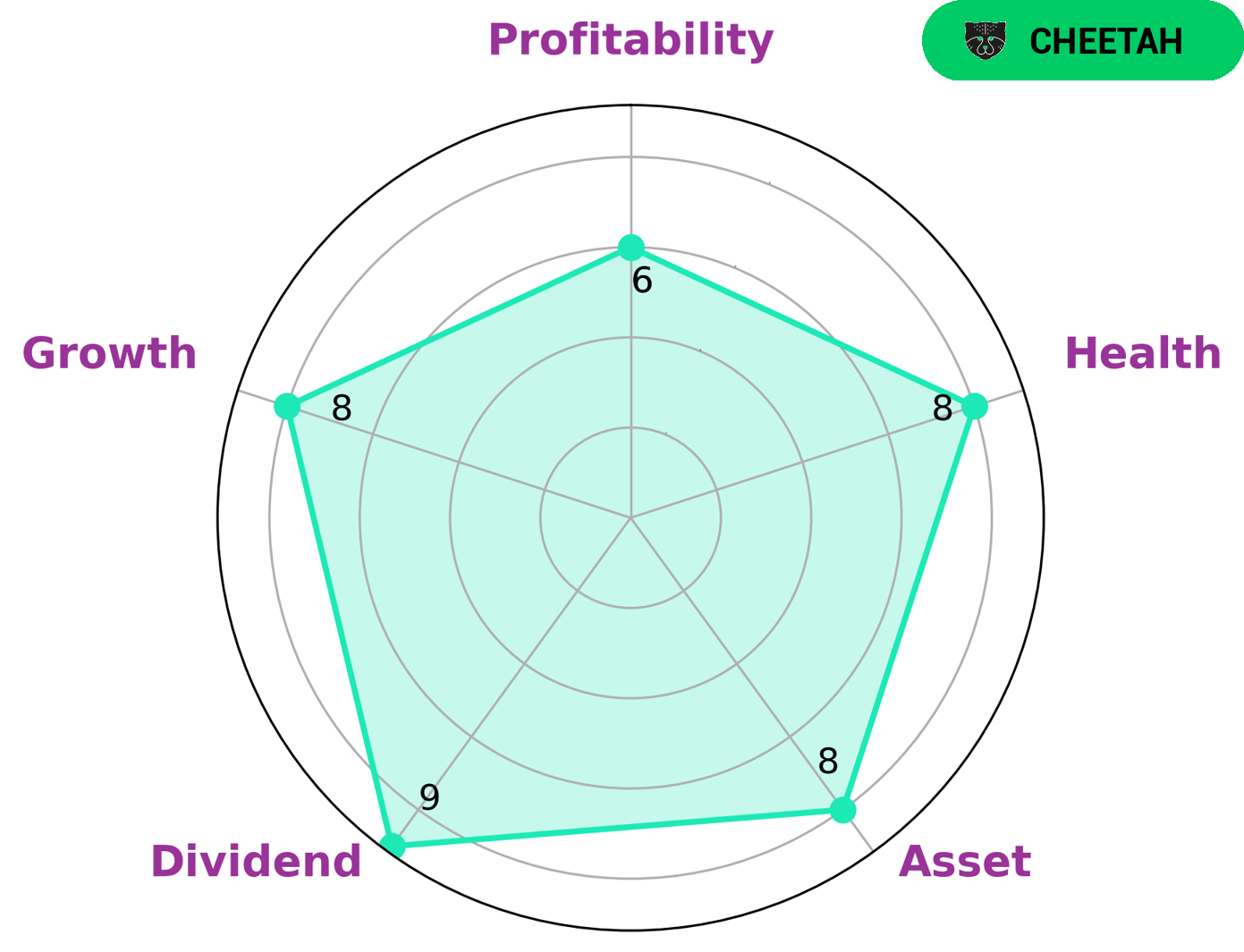

REGAL REXNORD is a strong company based on GoodWhale’s analysis of its fundamentals. According to GoodWhale’s Star Chart, REGAL REXNORD has a high score in assets, dividends, and growth and a medium score in profitability. The company also has an impressive health score of 8 out of 10 when it comes to cashflows and debt, meaning that it can easily survive any crisis without the risk of bankruptcy. Overall, REGAL REXNORD is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Such companies may interest investors looking for high growth potential, as well as those who are willing to take on higher risk in exchange for the potential of higher returns. Furthermore, investors may be attracted to the company’s strong asset and dividend performance, as well as its impressive health score. All these factors make REGAL REXNORD an attractive investment opportunity for those seeking high-growth companies with strong fundamentals. More…

Peers

The company’s products are used in a variety of industries, including aerospace, defense, transportation, and industrial. Rexnord is a publicly traded company, and its shares are listed on the New York Stock Exchange. The company has a market capitalization of approximately $3 billion. Rexnord’s competitors include Estun Automation Co Ltd, Parker Hannifin Corp, and R Stahl AG.

– Estun Automation Co Ltd ($SZSE:002747)

Estun Automation Co Ltd is a company that manufactures and sells automation equipment. The company has a market cap of 17.8B as of 2022 and a return on equity of 6.3%. The company’s products are used in a variety of industries, including automotive, aerospace, and electronics. Estun Automation Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

– Parker Hannifin Corp ($NYSE:PH)

Parker Hannifin Corp is a manufacturer of motion and control technologies. Its products include hydraulic, pneumatic, and electromechanical systems and components. The company has a market cap of $33.39 billion and a return on equity of 13.12%.

– R Stahl AG ($LTS:0Q9C)

Founded in 1883, thyssenkrupp AG is a German multinational conglomerate with businesses in a wide range of sectors, including automotive, elevators, industrial services, materials, and shipbuilding. The company has a market capitalization of €70.2 billion as of 2022 and a return on equity of -1.36%. thyssenkrupp AG is headquartered in Essen, Germany.

Summary

Regal Rexnord is a company that recently reported impressive financial results for the fourth quarter of FY2022. Total revenue for the period increased by 2214.6%, reaching USD 101.5 million, while net income rose by 2.3% to USD 1244.7 million. The stock price moved up in response to the news, indicating that investors are bullish on the company’s future prospects. From an investing perspective, Regal Rexnord looks to be a good choice due to its strong financial performance and favorable outlook. The company has demonstrated its ability to generate consistent revenue growth and profitability, which should attract the attention of long-term investors.

Furthermore, the stock price remains relatively low, meaning there is potential for further gains in the future. Overall, Regal Rexnord appears to be a solid investment opportunity for those looking to diversify their portfolios and benefit from the company’s growth potential. With its strong fundamentals and positive outlook, the company is well-positioned to continue its success in the coming years.

Recent Posts