RED ROCK RESORTS Reports 38.3% Decrease in Total Revenue for FY2022 Q4

March 27, 2023

Earnings Overview

RED ROCK RESORTS ($NASDAQ:RRR) announced its Q4 FY2022 earnings results on February 7 2023, with total revenue at USD 91.8 million, representing a 38.3% decrease from the same period the previous year.

Transcripts Simplified

Red Rock Resorts reported strong fourth quarter and full year 2022 earnings, with fourth quarter net revenue at $425.5 million and adjusted EBITDA of $194.4 million. Las Vegas operations, excluding the impact from closed properties, reported fourth quarter net revenue of $419.7 million and adjusted EBITDA of $206.9 million. For the full year, net revenue was $1.6 billion and adjusted EBITDA was $743.9 million. These results demonstrate the resilience of the company’s business model, the sustainability of its margins, and the ability of its management team to execute on strategy even in a challenging environment.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RRR. More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | 205.46 | 14.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RRR. More…

| Operations | Investing | Financing |

| 542.22 | -442.14 | -290.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RRR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.35k | 3.31k | 0.75 |

Key Ratios Snapshot

Some of the financial key ratios for RRR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.6% | 30.3% | 33.9% |

| FCF Margin | ROE | ROA |

| -1.1% | 926.4% | 10.6% |

Share Price

On Tuesday, RED ROCK RESORTS, one of the largest gaming and hospitality companies in the United States, reported that its total revenue for the fourth quarter of FY2022 decreased by 38.3%. Despite the decrease in revenue, RED ROCK RESORTS stock opened at $46.9 and closed at $48.5, up 3.1% from the previous closing price of $47.0. The decreased revenue was attributed to lower customer visits to their casino-resorts due to the ongoing pandemic. RED ROCK RESORTS has been actively implementing new safety protocols and initiatives, such as expanded cleaning and sanitization procedures, in order to protect both their customers and their employees. Despite the drop in revenue, the company is still optimistic that they will be able to rebound in the coming months.

They have plans to further enhance their digital offerings, such as creating mobile apps and ramping up their online gaming presence. They also plan to continue investing in their Las Vegas properties in order to improve their customer experience. It remains to be seen how RED ROCK RESORTS will fare in the future as they adjust to the new normal brought on by the pandemic. With their comprehensive safety protocols and improved digital offerings, they are confident that they will be able to overcome this difficult period and return to profitability. Live Quote…

Analysis

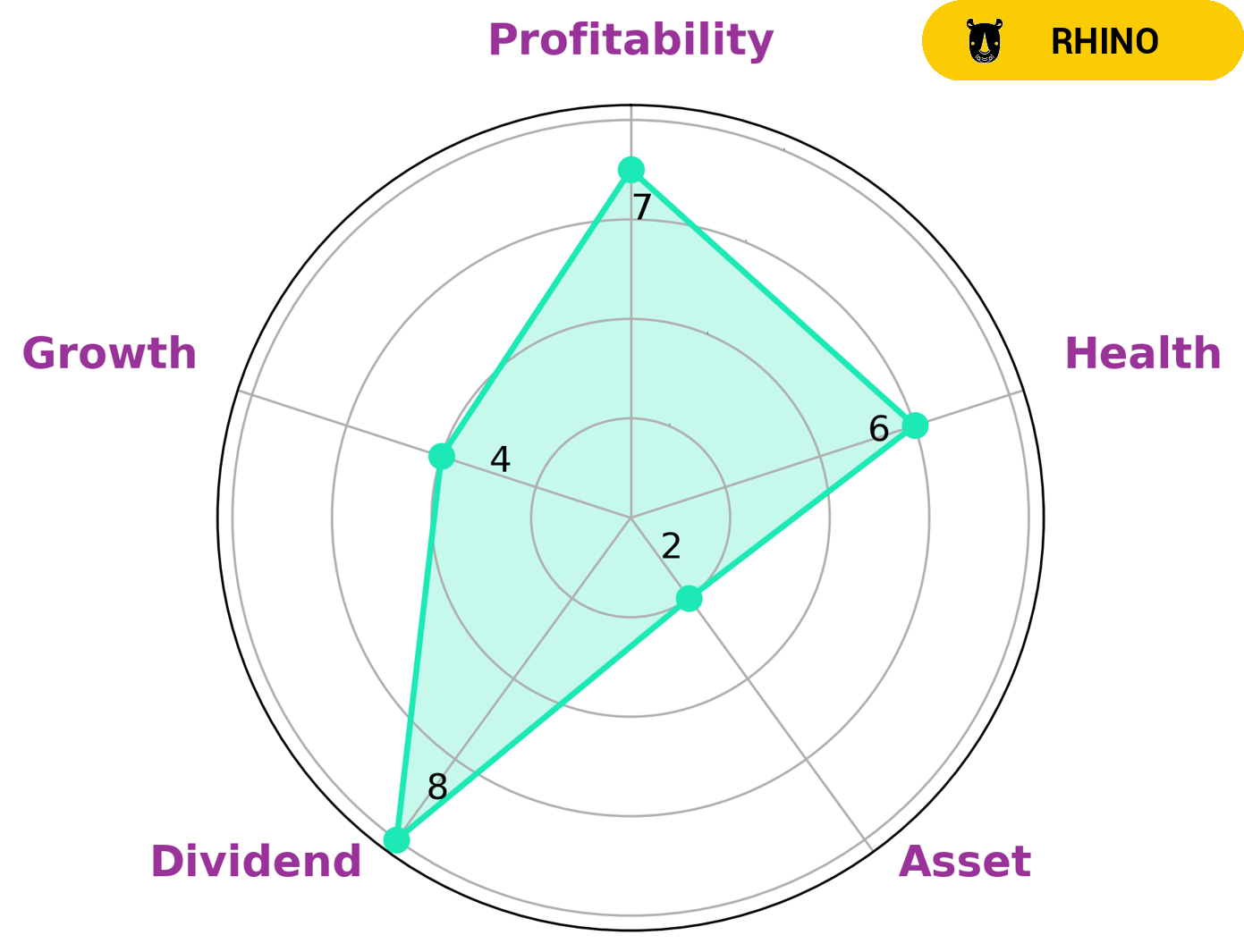

At GoodWhale, our analysis shows that RED ROCK RESORTS has an intermediate health score of 6/10 when considering its cashflows and debt. This implies that the company is likely to have the financial ability to pay off debt and fund future operations. Specifically, our Star Chart analysis revealed that RED ROCK RESORTS is strong in dividend and profitability, medium in growth, and weak in assets. Furthermore, we classify RED ROCK RESORTS as a ‘Rhino’, a type of company that has achieved moderate revenue or earnings growth. Given RED ROCK RESORTS’ financial health and history of moderate growth, investors who are looking for a stable yet growing company may be interested in investing in RED ROCK RESORTS. It is worth noting that while the company may not be as appealing to those who are looking for high-growth opportunities, RED ROCK RESORTS may be a suitable choice for investors who are looking for stability and consistent returns. More…

Peers

The company’s main competitors are Boyd Gaming Corp, Golden Entertainment Inc, and Bloomberry Resorts Corp.

– Boyd Gaming Corp ($NYSE:BYD)

Boyd Gaming Corporation is a leading diversified owner and operator of 22 gaming entertainment properties located in Nevada, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi and Ohio. Boyd Gaming press releases are available at boydgaming.com. Additional information about Boyd Gaming can be found at https://www.boydgaming.com/.

The company has a market cap of 5.86B as of 2022 and a ROE of 36.77%. The company operates gaming entertainment properties located in various states in the US.

– Golden Entertainment Inc ($NASDAQ:GDEN)

As of 2022, Golden Entertainment, Inc. had a market capitalization of 1.19 billion and a return on equity of 28.98%. The company is a gaming and hospitality company that owns and operates casinos, taverns, and gaming machines in the United States.

– Bloomberry Resorts Corp ($PSE:BLOOM)

The company’s market cap stands at 77.45B as of 2022 and its ROE is 11.83%. The company is engaged in the business of developing, owning and operating resorts.

Summary

RED ROCK RESORTS reported its fourth quarter financial results for the fiscal year 2022 on February 7, 2023. Total revenue was reported to be USD 91.8 million, a 38.3% decrease compared to the previous year. Net income, however, increased by 0.7%, tallying up to USD 425.5 million. The stock price responded positively to the announcement on the day of the report and it appears to be a good investment opportunity for those looking for stocks with potential for growth in the long term.

Analysts have suggested that the company’s strategy and focus on cost reduction, along with their portfolio of strategic investments could bolster their future performance. Investors should also be aware of the company’s debt level and liquidity, which could affect the stock price.

Recent Posts