REA GROUP Reports 8.9% Decrease in Revenue for Second Quarter of FY2023, Despite 0.2% Increase in Net Income.

February 16, 2023

Earnings report

On February 10 2023, REA ($ASX:REA) Group reported their earnings results for the second quarter of FY2023, ending December 31 2022. REA Group is a global online real estate advertising company, headquartered in Australia, and listed on the Australian Securities Exchange. The quarter’s total revenue was AUD 201.6 million, representing a 8.9% decrease from the same period the year prior. This was primarily due to a decrease in revenue from their real estate operations segment. Despite the decrease in overall revenue, net income reported was AUD 732.9 million, a 0.2% increase year over year. Despite the challenging market environment, REA Group was able to achieve a positive net income thanks to cost cutting measures and a focus on higher margin businesses. These measures included reorganizing certain segments of their operations, reducing headcount, and shifting their focus to higher margin businesses such as rentals and property management services.

Despite the decrease in revenue, the company’s outlook remains optimistic. REA Group executive chairman Tracey Fellows commented that “Despite the challenging market environment, our focus on cost efficiency and new product initiatives has allowed us to maintain profitability and deliver a healthy balance sheet for the quarter.” Initiatives such as cost cutting measures have helped the company stay afloat during this difficult time. The company’s focus on digital products and services have also been helpful in maintaining customer engagement and growth. As the pandemic continues, REA Group is well-positioned for success in the upcoming quarters, with a focus on digital services, cost efficiency, and new product initiatives.

Market Price

REA Group, the public multinational digital advertising company, reported an 8.9% decrease in revenue for the second quarter of FY2023, despite a 0.2% increase in net income. On Friday, REA GROUP stock opened at AU$122.9 and closed at AU$121.1, down by 2.7% from the previous closing price of 124.4. The decrease in revenue was mainly attributed to the global economic downturn caused by the ongoing pandemic. In order to cope with the current market conditions, the company has implemented several cost-cutting initiatives. This includes reducing headcount and cutting back on non-essential expenses like travel and entertainment.

Despite this, the company maintained its core investments in technology and people, which enabled it to maintain its strong position in the market. Overall, the second quarter performance of REA Group is a testament to its ability to weather difficult times and remain profitable despite a decrease in revenue. The company’s stock price may have experienced a dip in the short term, but the company appears to be in a good position to benefit from an economic recovery in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rea Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.43k | 365.1 | 25.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rea Group. More…

| Operations | Investing | Financing |

| 479.9 | -200.1 | -333.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rea Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.5k | 1.05k | 10.56 |

Key Ratios Snapshot

Some of the financial key ratios for Rea Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.2% | 9.4% | 37.6% |

| FCF Margin | ROE | ROA |

| 25.9% | 24.9% | 13.5% |

Analysis

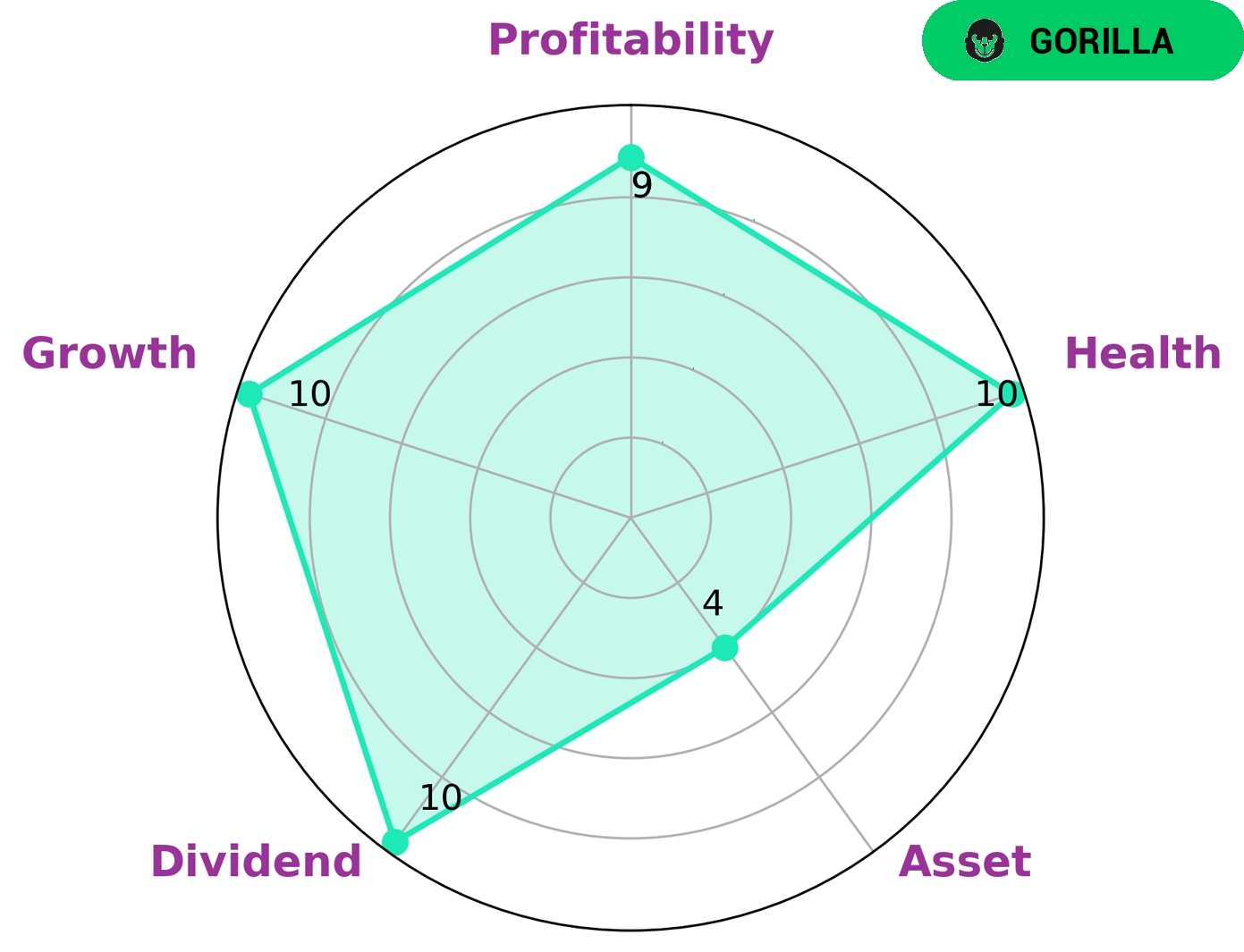

REA GROUP has earned a high rating according to the GoodWhale Star Chart. It is classified as a ‘gorilla’ due to its strong competitive advantage, resulting in stable and high revenue and earning growth. This type of company is always attractive to investors, such as venture capitalists and private equity firms, who are looking for a high return on their investments. REA GROUP also scored very high in terms of health, with a rating of 10 out of 10. This means that the company is in a strong financial position, with enough cash flow to pay off debt and fund future operations. The company also demonstrated a strong performance in terms of dividend, growth and profitability. Its assets are rated as medium, indicating that while there is potential for further growth, it has yet to be fully realized. Overall, REA GROUP has proven to be a strong and stable investment, with high potential for future growth. Its strong competitive advantage, combined with its healthy finances and performance, makes it a very attractive choice for investors. More…

Peers

The competition between REA Group Ltd and its competitors, Domain Holdings Australia Ltd, Firstlogic Inc, and Entreparticuliers SA, has been fierce in recent years. As the online real estate market continues to grow, each of these companies has sought to establish a competitive edge over the others to gain a larger share of the market. As a result, they have been locked in a constant battle to innovate and provide the best services to their customers.

– Domain Holdings Australia Ltd ($ASX:DHG)

Domain Holdings Australia Ltd is an Australian-based publicly-listed company that provides real estate, media and technology services. As of 2022, the company has a market capitalization of 1.85B and a Return on Equity of 4.18%. Domain Holdings Australia Ltd’s strong market capitalization is a reflection of investor confidence in the company, as it reflects the value of the company’s assets and future potential earnings. The Return on Equity (ROE) indicates that the company is able to generate a return on the shareholders’ investments by reinvesting its profits back into the business. This shows that the company is in good financial health and is able to make sound investment decisions. Domain Holdings Australia Ltd’s strong financial performance signals to investors that it is an attractive investment opportunity.

– Firstlogic Inc ($TSE:6037)

Firstlogic Inc is a global software and technology solutions provider that specializes in enterprise data management and analytics. With a market cap of 8.9B as of 2022, Firstlogic Inc has a strong presence in the technology and software industry. This is further reinforced by its Return on Equity (ROE) of 14.78%, which is higher than the industry average. This indicates that the company is able to generate more profits from its investments, thereby providing value to its investors. Firstlogic Inc’s innovative software and technology solutions are used by customers in a variety of industries, including retail, banking, healthcare, finance, and logistics.

– Entreparticuliers SA ($BER:99Q)

Entreparticuliers SA is a French online marketplace that connects individuals and professionals to buy and sell goods. The company has a market capitalization of 8.14M as of 2022, which means it has a relatively low market value compared to other companies in the same industry. The company’s return on equity (ROE) is -64.44%, which indicates that the company has been unprofitable over the past year and has not been able to generate adequate returns on its investments.

Summary

The REA Group has reported their earnings for the second quarter of FY2023, with total revenue of AUD 201.6 million, and a net income of AUD 732.9 million. This represents an 8.9% drop from the same quarter last year in terms of revenue, however a slight 0.2% increase in net income. From an investing perspective, the results are mixed and could cause concern for investors. On one hand, the company’s net income has increased and suggests that the company is generating healthy profits. On the other hand, the decline in revenue may indicate the company is struggling to retain customers or increase sales. This could be a sign of a decline in demand for the company’s products or services, or weak pricing power. For investors considering investing in REA Group, it is important to pay attention to any future earnings releases and factor in the current performance into their decision making.

Additionally, investors should research more into the company’s operations and potential market trends to gain more insight into the performance of REA Group.

Recent Posts