QUAKER CHEMICAL Reports Dismal Fourth Quarter Revenue of -76.0 Million, Down 519.0% Y-o-Y.

March 21, 2023

Earnings Overview

For the fourth quarter of FY2022, QUAKER CHEMICAL ($NYSE:KWR) reported total revenue of USD -76.0 million, representing a decrease of 519.0% compared to the same quarter in the previous year. Net income for the period was USD 484.8 million, which was an 8.4% increase from the year before.

Transcripts Simplified

Quaker Chemical reported a 24% increase in price index, partially offset by a 9% decline in total sales volumes and a 7% unfavorable impact from foreign exchange for their fourth quarter. Sequentially, a 4% increase in price was offset by a 6% decline in volumes. Gross margins in the fourth quarter were 32.2% compared to 31.1% in the prior year, and 32.7% in last quarter. SG&A expenses on a non-GAAP basis increased by 8% compared to the prior year period, largely due to inflationary pressures on labor costs.

Adjusted EBITDA was $68 million in the fourth quarter, an increase of 12% compared to the prior year. All segments reported double-digit sales growth compared to the prior year, driven by significant increases in selling prices, however volumes were most pronouncedly down in the Asia-Pacific region due to the direct and indirect impacts of COVID on customers in China.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Quaker Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 1.94k | -15.84 | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Quaker Chemical. More…

| Operations | Investing | Financing |

| 41.79 | -40.19 | 24.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Quaker Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.82k | 1.54k | 71.33 |

Key Ratios Snapshot

Some of the financial key ratios for Quaker Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.7% | 12.5% | 2.0% |

| FCF Margin | ROE | ROA |

| 0.7% | 1.9% | 0.9% |

Stock Price

The stock opened at $197.8 and closed at $194.0, down by 0.4% from the previous day’s closing price of $194.8. Investors expressed concerns over the company’s ability to bounce back from this significant loss as the company continues to grapple with the economic impact of the pandemic. The company is currently taking steps to improve its operations and return to profitability, such as reducing costs and increasing efficiency. However, investors are still apprehensive about the company’s future prospects as it remains to be seen if QUAKER CHEMICAL will be able to recover from the dismal fourth quarter revenue numbers. Live Quote…

Analysis

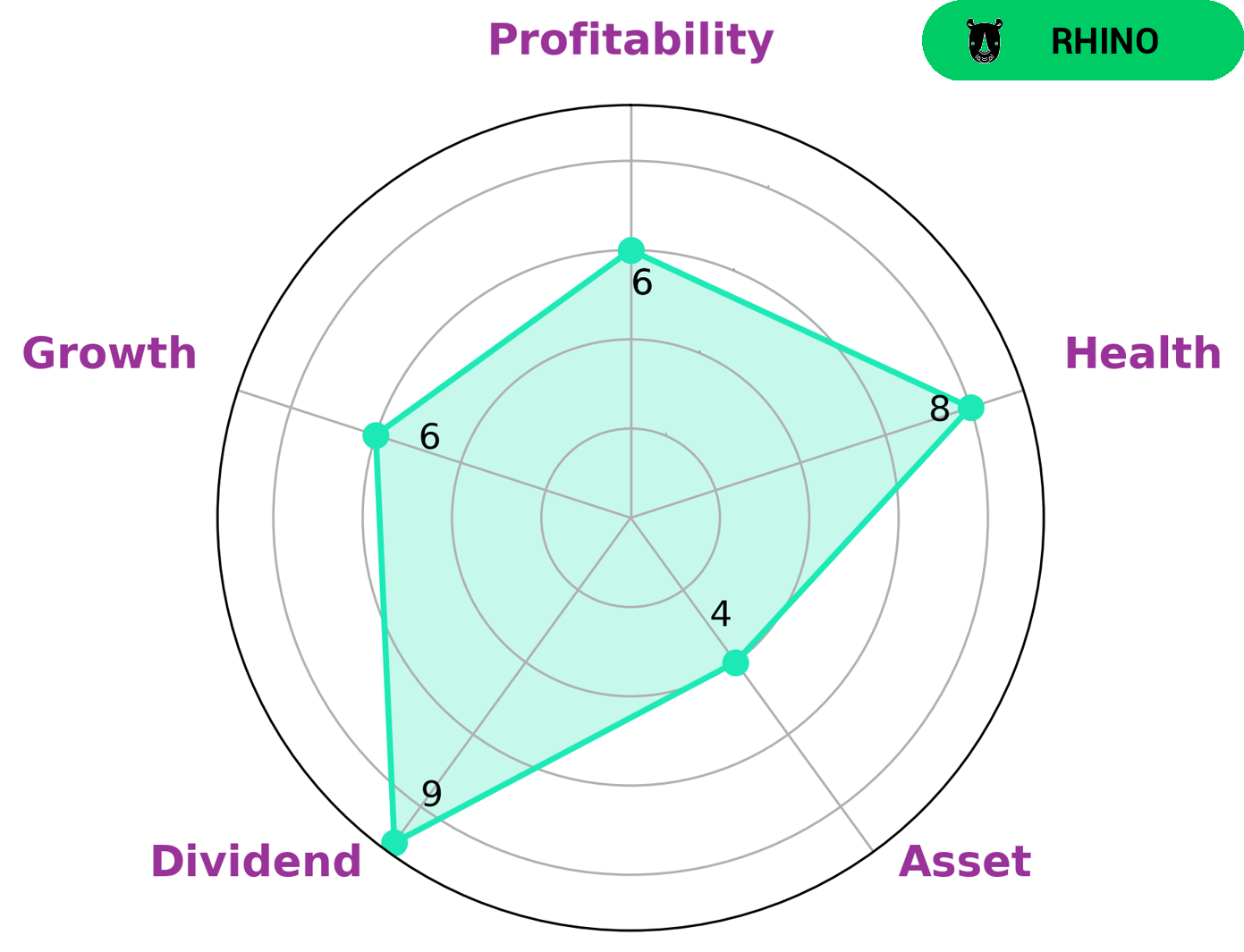

At GoodWhale, we conducted an analysis of QUAKER CHEMICAL‘s wellbeing. We classified the company as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. QUAKER CHEMICAL is strong in dividend, and medium in asset, growth, and profitability — all indications of a healthy company. Moreover, QUAKER CHEMICAL has a high health score of 8/10 with regard to its cashflows and debt, which means it is capable to safely ride out any crisis without the risk of bankruptcy. Considering these factors, QUAKER CHEMICAL might be an attractive option for a range of investors, from income seekers to those looking for stable returns over the long term. And for those seeking capital gains, QUAKER CHEMICAL could be an interesting option due to its moderate growth prospects. More…

Peers

The company operates in over 30 countries and serves more than 50,000 customers in the automotive, aerospace, industrial, electronics, and medical industries. Quaker Houghton’s competitors include Koei Chemical Co Ltd, Yasuhara Chemical Co Ltd, and Tangshan Sanyou Chemical Industries Co Ltd.

– Koei Chemical Co Ltd ($TSE:4367)

Koei Chemical Co Ltd is a Japanese company that manufactures and sells chemicals. The company has a market cap of 11.37B as of 2022 and a Return on Equity of 3.23%. Koei Chemical Co Ltd manufactures and sells chemicals for use in the electronics, automotive, and construction industries.

– Yasuhara Chemical Co Ltd ($TSE:4957)

As of 2022, Yasuhara Chemical Co Ltd has a market cap of 5.37B and a Return on Equity of 4.42%. The company produces and sells chemicals, plastics, and other products.

– Tangshan Sanyou Chemical Industries Co Ltd ($SHSE:600409)

Tangshan Sanyou Chemical Industries Co Ltd is a leading chemical company in China with a market cap of 12.51B as of 2022. The company has a strong focus on research and development and has a return on equity of 10.01%. Tangshan Sanyou Chemical Industries Co Ltd produces a wide range of chemical products including fertilizers, pesticides, and petrochemicals. The company has a strong customer base and a good reputation in the industry.

Summary

Quaker Chemical Corporation has reported its fourth quarter financial results for the fiscal year 2022, ending December 31, 2022. Total revenue for the quarter amounted to USD 76.0 million, a decrease of 519.0% compared to the same period in the previous year. Despite the decrease in revenue, net income for the quarter increased 8.4% year over year to USD 484.8 million. Investors looking to invest in Quaker Chemical should consider these figures when evaluating potential investment opportunities.

Additionally, investors should assess the company’s ability to generate positive returns in the future and review its competitive position within the chemical industry.

Recent Posts