Northwest Pipe Reports 250.7% Increase in Total Revenue and 4.2% Increase in Net Income for FY2022 Q4

March 22, 2023

Earnings Overview

On March 15th 2023, NORTHWEST PIPE ($NASDAQ:NWPX) reported total revenue of USD 8.0 million and net income of USD 106.8 million for the fourth quarter of FY2022, ending December 31 2022, representing a year-on-year increase of 250.7% and 4.2%, respectively.

Transcripts Simplified

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Northwest Pipe. More…

| Total Revenues | Net Income | Net Margin |

| 457.67 | 31.15 | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Northwest Pipe. More…

| Operations | Investing | Financing |

| 17.54 | -23.05 | 6.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Northwest Pipe. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 601.34 | 283.07 | 32.06 |

Key Ratios Snapshot

Some of the financial key ratios for Northwest Pipe are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | 16.0% | 9.8% |

| FCF Margin | ROE | ROA |

| -1.2% | 9.0% | 4.7% |

Price History

The company reported a 250.7% increase in total revenue, compared to the same quarter of the previous year, and a 4.2% increase in net income. This impressive financial performance is a testament to the hard work and dedication of the company’s management and employees. In addition to the impressive financial performance, NORTHWEST PIPE‘s stock opened at $37.5 and closed at $36.4, representing a 5.4% drop from the previous closing price of $38.5. Despite the minor drop, analysts remain optimistic about the future of NORTHWEST PIPE, citing the strong financial performance and positive outlook for the company’s future prospects.

Overall, NORTHWEST PIPE’s latest financial report provides investors with confidence in the company’s future performance and potential for long-term growth. In addition to the impressive financial results, investors should be encouraged by the company’s commitment to providing quality products and services that meet the needs of its customers. Live Quote…

Analysis

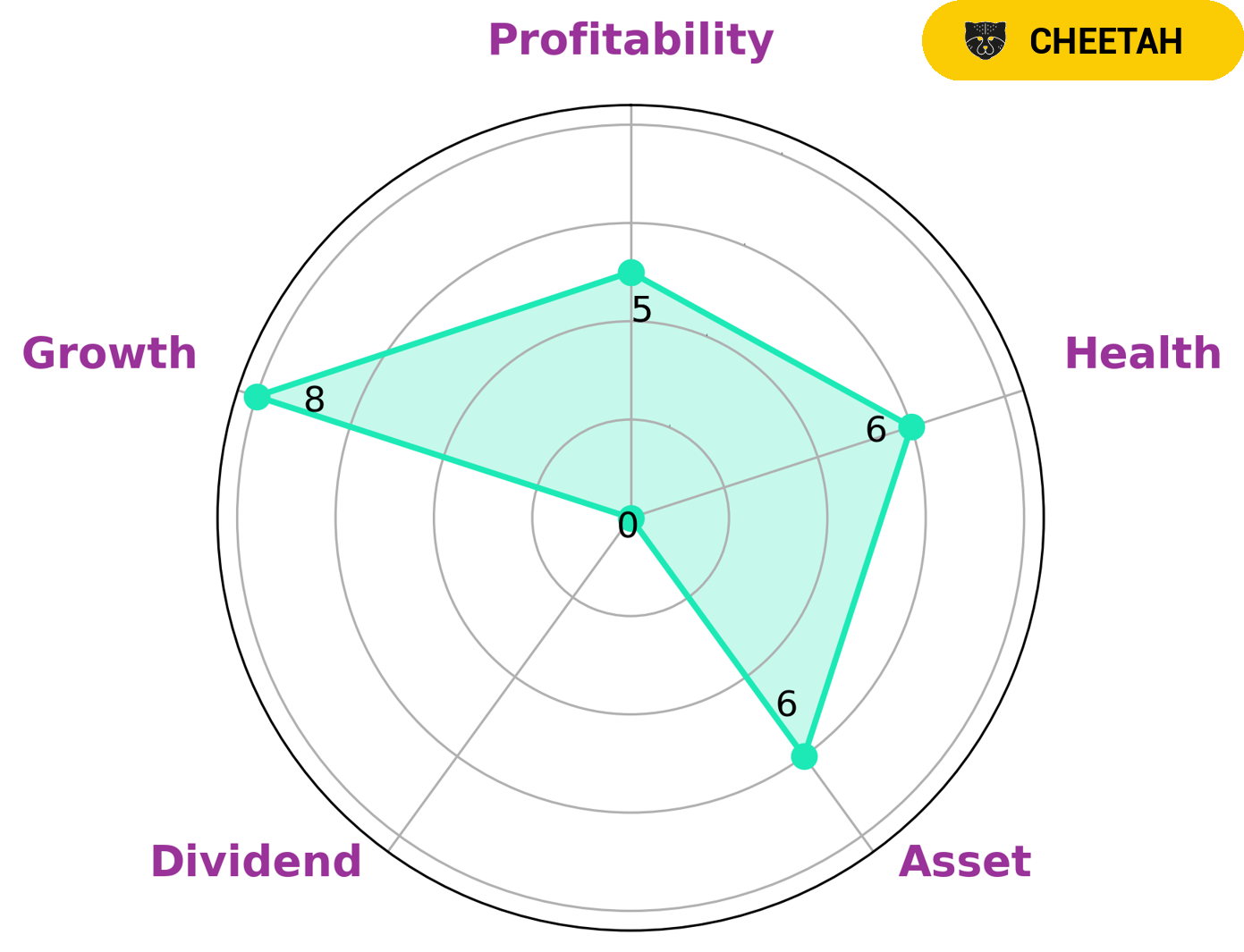

GoodWhale recently conducted an analysis of NORTHWEST PIPE‘s wellbeing. Our Star Chart shows that NORTHWEST PIPE is strong in growth, medium in asset, profitability and weak in dividend. Although NORTHWEST PIPE has an intermediate health score of 6/10, considering its cashflows and debt, we believe the company may be able to safely ride out any crisis without the risk of bankruptcy. Our team concluded that NORTHWEST PIPE is classified as a ‘cheetah’—a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors interested in this type of company are likely those seeking a higher risk-reward profile and looking for companies with potential for large returns. More…

Peers

The company’s primary competitors are Seychelle Environmental Technologies Inc, Mueller Water Products, Inc., Water Now, Inc.

– Seychelle Environmental Technologies Inc ($OTCPK:SYEV)

Seychelle Environmental Technologies Inc is a company that produces and sells water filtration products. The company has a market cap of 63.94k as of 2022 and a return on equity of -2.17%. The company’s products are designed to remove contaminants from water, making it safe to drink. The company’s products are sold in over 60 countries around the world.

– Mueller Water Products, Inc. ($NYSE:MWA)

Mueller Water Products, Inc. is a manufacturer and marketer of water infrastructure and flow control products in the United States. The company operates in three segments: Infrastructure, Residential, and Industrial. The Infrastructure segment provides water and gas distribution products, service, and solutions for the water, gas, and energy industries. The Residential segment provides water service line and plumbing repair products, and solutions for the residential do-it-yourself and professional markets. The Industrial segment provides flow control products and solutions for the oil and gas, mining, power generation, and other industrial applications. Mueller Water Products, Inc. was founded in 1857 and is headquartered in Atlanta, Georgia.

– Water Now, Inc. ($OTCPK:WTNW)

Water Now, Inc. is a leading provider of water treatment solutions. The company has a market cap of 40.45k and a ROE of 29.93%. The company’s products are used in a variety of industries, including oil and gas, power generation, food and beverage, pharmaceuticals, and more. Water Now is committed to providing innovative, cost-effective solutions to meet the challenges of water scarcity and water pollution.

Summary

NORTHWEST PIPE recently reported total revenue of USD 8.0 million and net income of USD 106.8 million for FY2022 Q4, ending December 31 2022. This implies a year-over-year growth in revenue of 250.7% and net income of 4.2%. Despite the impressive financial results, the stock price declined the same day, indicating that investors may be cautious about the outlook for the company. Analysts should carefully evaluate NorthWest Pipe‘s performance to assess its potential for long-term returns.

Recent Posts