MINISO GROUP Reports 40.3% Increase in Total Revenue for Fiscal Year Ended June 30 2023

October 20, 2023

☀️Earnings Overview

As of August 23 2023, MINISO GROUP ($NYSE:MNSO) reported total revenue of CNY 3252.2 million for their fiscal year ending June 30 2023, a 40.3% increase from the prior year. Net income for the same period was CNY 539.3 million, up 163.3% year over year.

Analysis

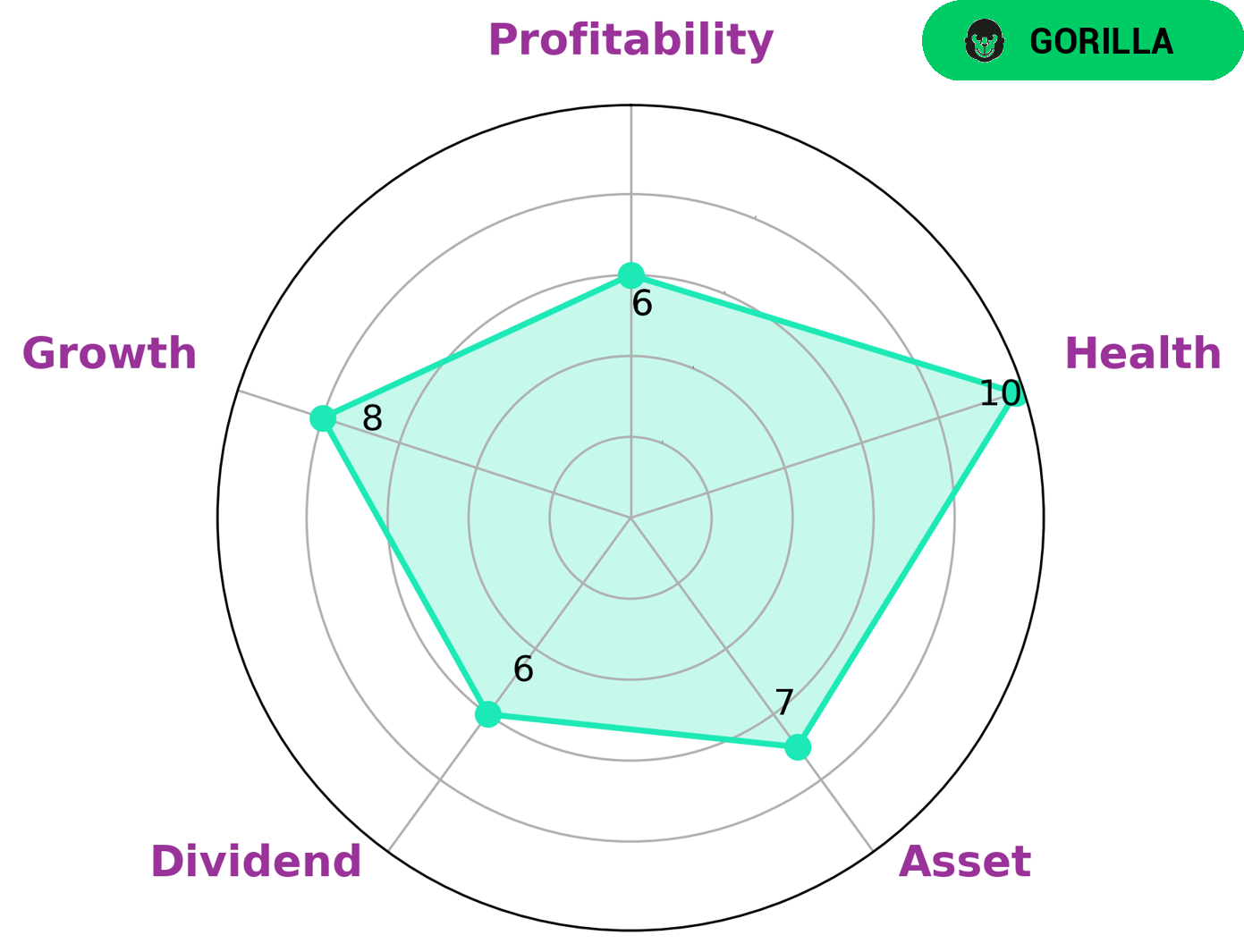

GoodWhale has conducted an analysis of MINISO GROUP‘s wellbeing. According to the Star Chart, MINISO GROUP is classified as a ‘cheetah’ type of company, which implies that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who have a higher tolerance for risk and who are looking for potential short-term gains. The MINISO GROUP also has a strong asset health score of 10/10, indicating that the company has the financial resources to weather any crisis without the risk of bankruptcy. In terms of dividend, growth and profitability, the company is rated as medium. With its strong asset health score and its medium performance in other categories, MINISO GROUP could be an ideal option for investors looking for potential gains over the short-term without taking on too much risk. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Miniso Group. More…

| Total Revenues | Net Income | Net Margin |

| 11.47k | 1.77k | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Miniso Group. More…

| Operations | Investing | Financing |

| 1.11k | -2.13k | -733.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Miniso Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.45k | 4.53k | 28.17 |

Key Ratios Snapshot

Some of the financial key ratios for Miniso Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.5% | 40.2% | 20.6% |

| FCF Margin | ROE | ROA |

| 8.0% | 17.2% | 11.0% |

Summary

Investing in MINISO GROUP is a promising opportunity for investors, as evidenced by the company’s performance for the fiscal year ended June 30 2023. Revenue increased by 40.3% year-on-year to CNY 3252.2 million, while net income rose 163.3% to CNY 539.3 million. Furthermore, the stock price increased on the same day as these results were reported.

Recent Posts