MINISO GROUP Reports 26.2% Year-on-Year Increase in Total Revenue for Third Quarter of FY2023

June 18, 2023

☀️Earnings Overview

For the third quarter of FY2023 ending March 31 2023, MINISO GROUP ($NYSE:MNSO) reported a year-over-year increase in total revenue of 26.2%, amounting to CNY 2954.2 million. Net income for the same period saw a remarkable growth of 383.8%, reaching CNY 465.5 million. The results were revealed on May 16 2023.

Analysis

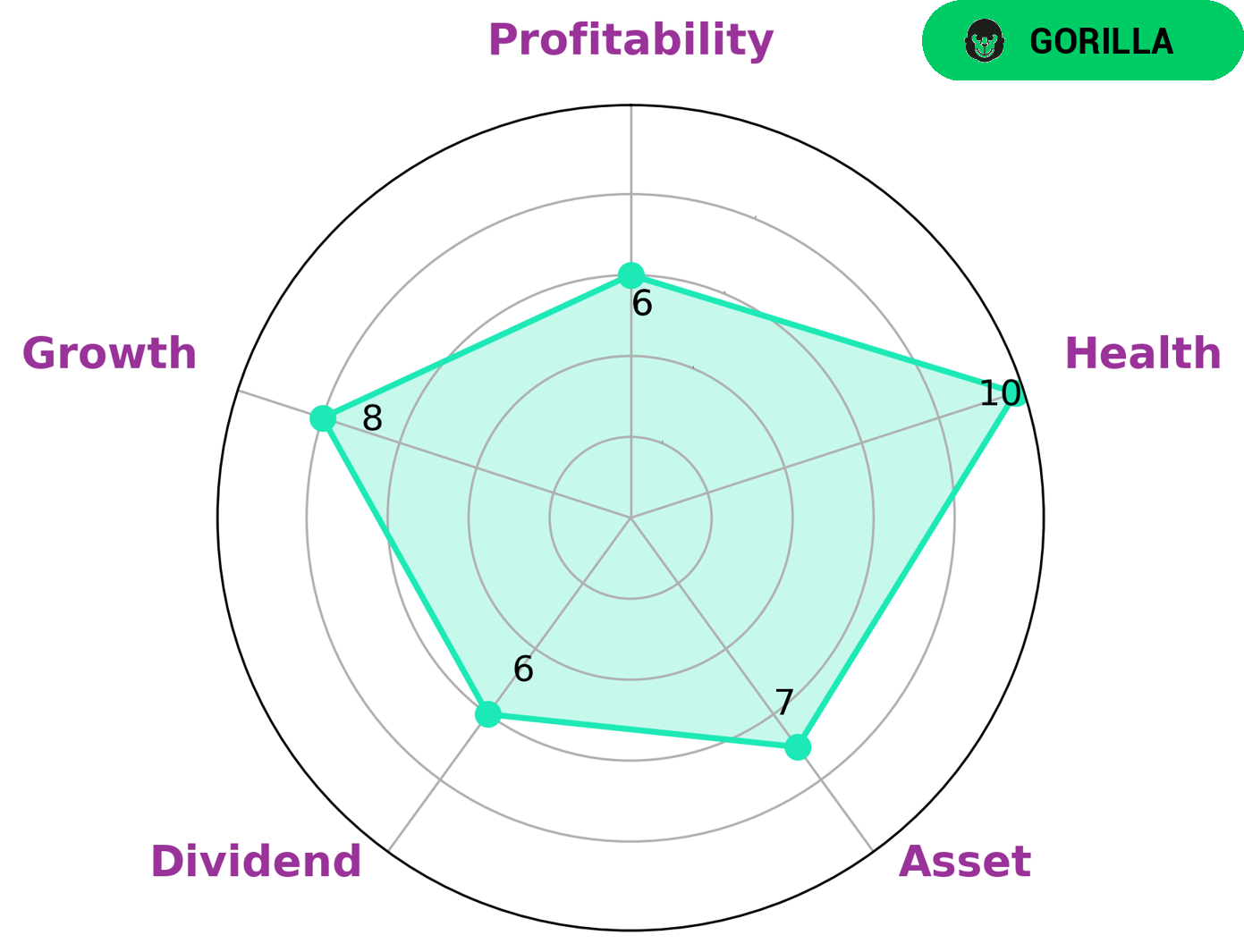

GoodWhale has conducted an analysis of MINISO GROUP‘s financials, and the results are extremely positive. According to the Star Chart, MINISO GROUP achieves a high health score of 10/10, indicating that it is capable of covering its debt and funding its future operations. Based on these results, the company is classified as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. Investors may be interested in MINISO GROUP due to its strong asset base and medium performance in terms of dividend, growth, and profitability. With this analysis, it is likely that MINISO GROUP will continue to be a profitable and viable company. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Miniso Group. More…

| Total Revenues | Net Income | Net Margin |

| 10.54k | 1.43k | 13.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Miniso Group. More…

| Operations | Investing | Financing |

| 1.11k | -2.13k | -733.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Miniso Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.56k | 4.28k | 26.19 |

Key Ratios Snapshot

Some of the financial key ratios for Miniso Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.4% | -7.3% | 18.3% |

| FCF Margin | ROE | ROA |

| 8.7% | 15.0% | 9.6% |

Summary

MINISO GROUP reported strong third quarter results for FY2023, with total revenue increasing 26.2% year over year and net income increasing 383.8%. Despite this good news, the stock price moved down on the day of the announcement. Investors should consider the strong revenue growth and potential for further improvement when considering investing in MINISO GROUP.

The company’s financials are strong and have been improving, making it a good potential investment for those looking for long-term returns. Further research should be done to gain a more complete understanding of the company’s financials before making any investing decisions.

Recent Posts