MARRIOTT VACATIONS WORLDWIDE Reports 36.1% Revenue Increase and 6.9% Net Income Growth for Q4 FY 2022

March 4, 2023

Earnings report

MARRIOTT VACATIONS WORLDWIDE ($NYSE:VAC) reported an impressive 36.1% increase in revenue and a 6.9% growth in net income for the fourth quarter of their fiscal year 2022, ending on February 22, 2023. The total revenue for the quarter amounted to USD83.0 million, a significant increase from the same period in the prior year. Net income was announced at USD 1176.0 million, highlighting a 6.9% increase from the same quarter one year prior. The recording of such incremental increases in both revenue and net income by MARRIOTT VACATIONS WORLDWIDE demonstrates the company’s sustainability and ability in creating new streams of income.

Such financial performance enabled the company to garner more profits which can be used to further expand their operations, services, and products they offer to their customers. Overall, MARRIOTT VACATIONS WORLDWIDE had an impressive financial performance in their fourth quarter of the 2022 fiscal year, with significant increases in both revenue and net income. This shows that their strategies and operations are effective in driving financial gains for the business.

Stock Price

This marks the sixth consecutive quarter of strong revenue and net income growth for the company. Despite this, the stock opened at $155.0 and closed at $154.6, down by just 0.1% from the previous closing price of $154.7. Overall, this was an encouraging report from MARRIOTT VACATIONS WORLDWIDE, demonstrating strong growth in both revenue and net income, as well as a trend of continued success in the face of market volatility. The stock’s slight dip was likely due to market conditions, rather than any indication of underperformance from the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VAC. More…

| Total Revenues | Net Income | Net Margin |

| 4.62k | 353 | 9.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VAC. More…

| Operations | Investing | Financing |

| 522 | 16 | -486 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VAC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.64k | 7.14k | 66.59 |

Key Ratios Snapshot

Some of the financial key ratios for VAC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | 9.8% | 14.1% |

| FCF Margin | ROE | ROA |

| 9.9% | 15.8% | 4.2% |

Analysis

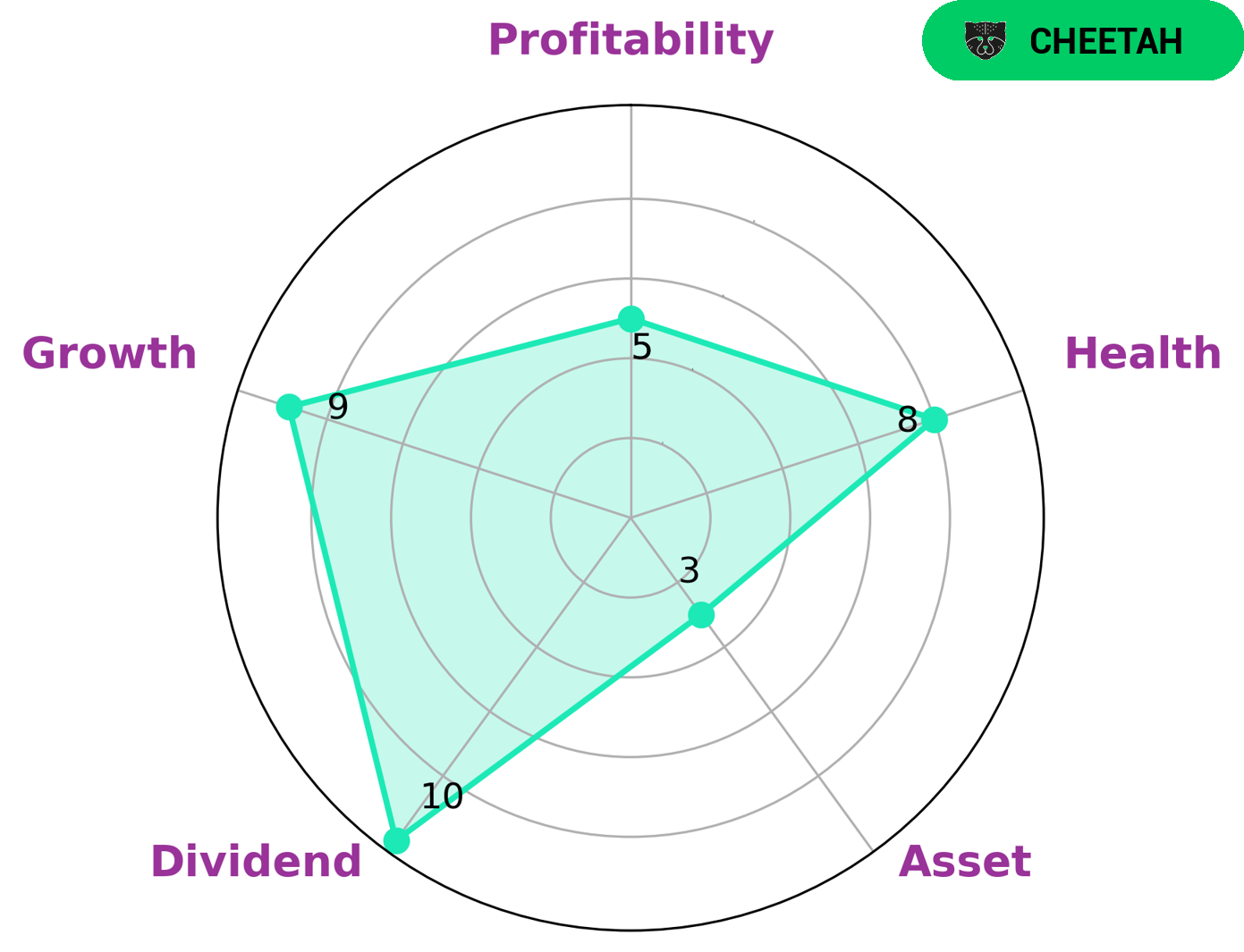

At GoodWhale, we conducted an analysis of Marriott Vacations Worldwide’s wellbeing and found that the company is classified as a ‘cheetah’, which denotes a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This means that investors looking for higher risk, higher reward investments may be interested in Marriott Vacations Worldwide. Looking at the Star Chart, we saw that Marriott Vacations Worldwide has a high health score of 8/10 with regards to its cashflows and debt; this indicates that the company is capable of paying off its debt and funding future operations. Additionally, Marriott Vacations Worldwide was found to be strong in terms of dividend and growth, medium in terms of profitability and weak in terms of assets. More…

Peers

In the vacation ownership and timeshare industry, Marriott Vacations Worldwide Corp is one of the largest and most well-known companies.

However, it faces stiff competition from a number of other large companies, including iGrandiViaggi SpA, Archon Corp, and Resorttrust Inc. While each of these companies has its own strengths and weaknesses, Marriott has been able to stay ahead of the competition by offering a wide variety of vacation ownership products and experiences that appeal to a broad range of customers.

– iGrandiViaggi SpA ($LTS:0R8E)

Hai Grandi Viaggi SpA is a company that provides travel services. It has a market capitalization of 36.65 million as of 2022 and a return on equity of 0.08%. The company offers a variety of travel-related services, including air travel, hotel accommodations, car rentals, and cruises.

– Archon Corp ($OTCPK:ARHN)

Archon Corporation is a holding company that operates through its subsidiaries. The Company, through its subsidiaries, is engaged in the business of real estate investment, development, management, construction, and brokerage.

– Resorttrust Inc ($TSE:4681)

Resorttrust Inc is a Japanese company that operates resorts and hotels. As of 2022, the company had a market capitalization of 248.83 billion yen and a return on equity of 11.02%. The company operates a total of 74 hotels and resorts, including 57 in Japan and 17 overseas. In addition to hotel and resort operations, the company also provides a range of services such as golf course management, real estate development, and food and beverage operations.

Summary

Marriott Vacations Worldwide reported total revenue of $83.0 million for the quarter, an increase of 36.1% over the same period in the prior year. Net income was reported at $1176.0 million, a 6.9% growth from the same quarter one year prior. These figures highlight the positive performance observed during this period, as investors are encouraged to consider Marriott Vacations Worldwide as a promising investment opportunity. The company also saw strong performance in key operating indicators such as occupancy and RevPAR, indicating strong demand for their vacation offerings.

Recent Posts