LIFETIME BRANDS Reports Record-Breaking 619% Increase in Fourth Quarter Revenue of USD 3.3 Million

March 11, 2023

Earnings Overview

On March 9 2023, LIFETIME BRANDS ($NASDAQ:LCUT) announced its financial results for the fourth quarter of FY2022 with a total revenue of USD 3.3 million, a significant rise of 619.0% from the same period a year before. However, the company reported net income of USD 207.0 million for the quarter, marking a decrease of 19.1% from the same quarter of the prior year.

Transcripts Simplified

Joining Harvey on the call today is Senior Vice President and Chief Financial Officer, Adam Schlesinger. Harvey: Thank you for joining us today and for your interest in Lifetime Brands. We are pleased to report our first quarter results and provide an update on our business. Our results were in line with our expectations and reflect our ongoing commitment to invest in the business for long-term value creation. Adam: Our first quarter performance was led by strong sales growth in our Food Prep and Housewares segments.

Sales in both segments increased 10% compared to the year-ago period, driven by a combination of new product innovation and successful distribution expansion. Our sourcing and supply chain teams continue to focus on improving efficiencies and driving cost savings, which have enabled us to deliver stronger margin performance. We continue to make strategic investments in this business to drive growth and are seeing positive early returns from these initiatives.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lifetime Brands. More…

| Total Revenues | Net Income | Net Margin |

| 727.66 | -6.17 | -0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lifetime Brands. More…

| Operations | Investing | Financing |

| 24.32 | -20.93 | -7.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lifetime Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 725.89 | 485.8 | 11.02 |

Key Ratios Snapshot

Some of the financial key ratios for Lifetime Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | 13.6% | 3.6% |

| FCF Margin | ROE | ROA |

| 2.9% | 6.9% | 2.3% |

Stock Price

This marked a significant increase from the previous quarter, in which the company reported a 4% decline in revenue. In response to the news, shares of LIFETIME BRANDS opened at $6.2 and closed at $6.1, representing a 2.9% increase from the previous closing price of $5.9. The impressive figures demonstrate the company’s ability to successfully navigate the challenging business environment caused by the COVID-19 pandemic.

LIFETIME BRANDS is continuing to diversify its product offerings and strengthen its presence in both domestic and international markets. The company has also made strategic investments in digital marketing and e-commerce initiatives, which have contributed to its increased profitability. Live Quote…

Analysis

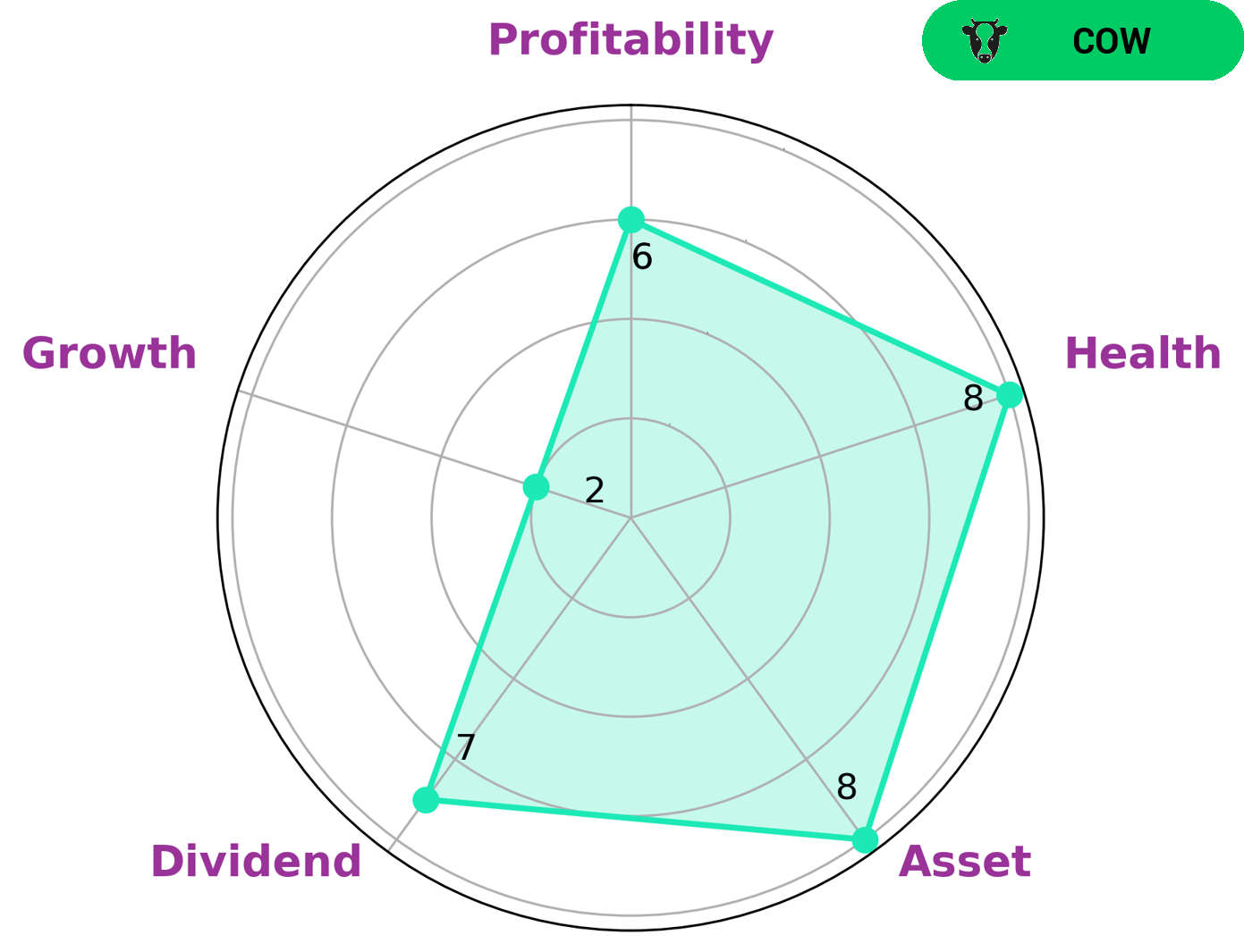

Analyzing the fundamentals of Lifetime Brands, it is clear that their performance is strong in asset and dividend, however medium in profitability and weak in growth. This classifies them as a ‘cow’ company, meaning they have a track record of paying out consistent and sustainable dividends. As such, investors who are looking for steady income or companies to invest in with little risk may be interested in Lifetime Brands. Due to their financial health score of 8/10, it is clear that they are able to safely ride out any crises without the risk of bankruptcy. More…

Peers

In the highly competitive world of home improvement and furnishings, Lifetime Brands Inc has been pitted against some tough competition. Westwing Group SE, Howden Joinery Group PLC, and Bloom Dekor Ltd are all companies that offer similar products and services. Each company has its own unique selling points, which it uses to attract customers. In order to stay ahead of the competition, Lifetime Brands Inc has to continuously come up with new and innovative products and services that appeal to its target market. It is only through continuous innovation and excellent customer service that Lifetime Brands Inc will be able to maintain its position as a leading player in this industry.

– Westwing Group SE ($OTCPK:WTWGF)

Westwing Group SE is a German home and living e-commerce company headquartered in Munich. It offers a curated selection of home décor and furnishing products. The company operates in 11 countries: Austria, Belgium, Czech Republic, France, Germany, Italy, Netherlands, Poland, Portugal, Spain, and Switzerland. As of December 31, 2020, Westwing Group SE had 2,958 employees.

– Howden Joinery Group PLC ($LSE:HWDN)

Howden Joinery Group PLC is a British company that manufactures and sells kitchens, joinery and timber products. It has a market capitalization of £2.9 billion as of March 2021 and a return on equity of 28.49%. The company operates through two segments: Joinery and Timber. The Joinery segment manufactures and sells kitchens, joinery and related products through its Howdens brand in the United Kingdom, France, Belgium, the Netherlands and Ireland. The Timber segment manufactures and sells timber products, including flooring, decking, fencing and cladding, through its Timberland brand in the United Kingdom.

– Bloom Dekor Ltd ($BSE:526225)

Bekor Ltd is a publicly traded company with a market capitalization of 123.64M as of 2022. The company has a return on equity of -27.74%. Bekor Ltd is engaged in the business of manufacturing and selling decorative products. The company’s products include wallpapers, fabrics, and other home decor items.

Summary

Investors in the LIFETIME BRANDS company saw a 619.0% increase in total revenue in the fourth quarter of FY2022 compared to the same quarter of the previous year. However, net income decreased 19.1% in the same period, indicating that further improvements need to be made in order to increase profitability. Despite the decrease in net income, investors should take solace in the substantial revenue growth and wait for further information to assess whether or not this trend will continue.

Recent Posts