LANDSTAR SYSTEM Reports Profitable Fiscal Year 2023 Q2 Results

August 4, 2023

☀️Earnings Overview

On June 30, 2023, LANDSTAR SYSTEM ($NASDAQ:LSTR) released their financial results for the second quarter of FY2023, which ended on July 26, 2023. Revenue reached USD 1373.9 million, showing a year-over-year decrease of 30.4%. Meanwhile, net income decreased 40.9% year-on-year to USD 66.6 million.

Share Price

On Wednesday, LANDSTAR SYSTEM announced their fiscal year 2023 Q2 results, which were very positive. The company’s stock opened at $203.8 and closed at $205.4, up by 1.2% from prior closing price of 203.0. This marks the third consecutive quarter that LANDSTAR SYSTEM has reported growth in its key financial metrics.

Overall, LANDSTAR SYSTEM had a very successful fiscal year 2023 Q2, and shareholders are quite pleased with the results. The company remains strongly optimistic about its future prospects and is confident that it will be able to continue delivering strong returns to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Landstar System. More…

| Total Revenues | Net Income | Net Margin |

| 6.3k | 338.27 | 5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Landstar System. More…

| Operations | Investing | Financing |

| 666.73 | -24.77 | -475.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Landstar System. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.84k | 844.2 | 27.64 |

Key Ratios Snapshot

Some of the financial key ratios for Landstar System are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.8% | 25.9% | 7.0% |

| FCF Margin | ROE | ROA |

| 10.1% | 28.7% | 15.1% |

Analysis

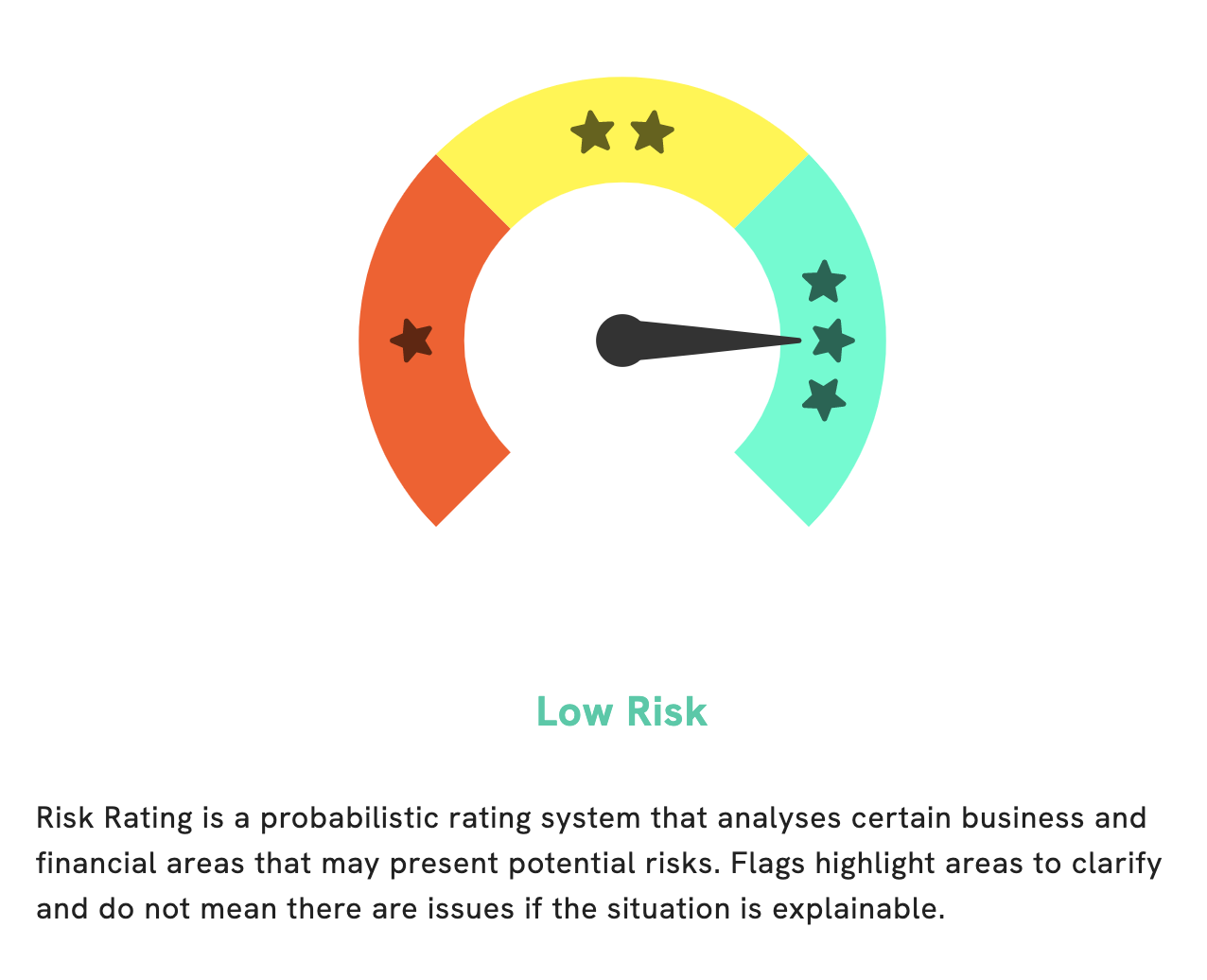

At GoodWhale, we believe in helping investors make informed decisions based on the best available information. That’s why we have analyzed the financials of LANDSTAR SYSTEM, Inc. Based on our Risk Rating, we have determined that LANDSTAR SYSTEM is a low risk investment in terms of financial and business aspects. This means that you can be sure that your money will be secure if you choose to invest in this company. We have also detected one risk warning in the income sheet of LANDSTAR SYSTEM. If you want to know more about this, please register with us so that we can provide you with additional information. We believe that it is important for investors to be aware of potential risks before making their investments. More…

Peers

The company offers a full range of services including truckload, less-than-truckload, intermodal, airfreight, ocean freight, and logistics management services. Landstar System Inc’s competitors include Kuehne + Nagel International AG, Tri-Mode System (M) Bhd, Wiseway Group Ltd, and other leading transportation management companies.

– Kuehne + Nagel International AG ($OTCPK:KHNGF)

Kuehne + Nagel International AG is a leading global logistics company that provides innovative and comprehensive supply chain solutions for customers in a wide range of industries. The company’s market cap is 28.7B as of 2022 and its ROE is 76.87%. Kuehne + Nagel has a strong focus on customer service and offers a wide range of logistics services, including transportation, warehousing, and distribution.

– Tri-Mode System (M) Bhd ($KLSE:0199)

Tri-Mode System (M) Bhd is a company with a market cap of 68.06M as of 2022. The company has a ROE of 11.4%. Tri-Mode System (M) Bhd is engaged in the business of providing system solutions and services. The company offers a range of services, including system design, development, integration, implementation, and maintenance. Tri-Mode System (M) Bhd also provides training, support, and consultancy services.

– Wiseway Group Ltd ($ASX:WWG)

Wiseway Group Ltd is a publicly traded company with a market capitalization of $10.87 million as of 2022. The company has a return on equity of -17.59%. Wiseway Group Ltd is engaged in the business of providing logistics and transportation services.

Summary

Investors may be disappointed in the results of Landstar System‘s second quarter of fiscal year 2023, as revenue decreased by 30.4% and net income declined by 40.9%. However, investors should take into account that this was against the backdrop of a challenging business environment due to the global pandemic. Investors should look for improvements in Landstar System’s third and fourth quarters, as well as any potential strategic acquisitions or expansions, to decide whether or not to invest in the company.

Recent Posts