JOYY INC Reports Record-Breaking Revenue for Q3 of FY2022, Net Income Down 9.8% YOY

December 31, 2022

Earnings report

On November 29, 2022, JOYY INC ($NASDAQ:YY) reported its earnings results for the third quarter of FY2022 as of September 30, 2022. JOYY INC is a leading Chinese digital media and live broadcasting company that operates a suite of multi-platform social products. These include YY, Bigo, Huya, imo, and LIKE. For the third quarter of FY2022, JOYY INC achieved record-breaking total revenue of USD 515.2 million, up 6733.6% year over year. This growth was driven by strong performances in its online video services and live streaming services segments.

Despite the significant increase in total revenue, JOYY INC reported net income of USD 586.7 million, down 9.8% year over year. This decrease was mainly due to higher operating expenses related to the company’s continued product and technology innovation efforts, as well as increased marketing expenses for user acquisition and engagement. Overall, JOYY INC reported a strong third quarter performance, with total revenue increasing significantly year over year and net income decreasing slightly. Going forward, the company is focused on further expanding its user base, strengthening its product and technology capabilities, and delivering even more value to its users.

Share Price

On Tuesday, JOYY INC reported record-breaking revenue for the third quarter of fiscal year 2022. The stock opened at $28.2 and closed at $29.9, signifying an 8.6% increase from the previous day’s closing price. Despite the record-breaking revenue, the company’s net income for the quarter was down 9.8% year-over-year compared to the same period last year. This was due to increasing expenses such as higher costs for research and development, as well as higher marketing and promotional costs associated with the company’s new product launches. The results were a reflection of JOYY INC’s increased focus on innovation and product development in order to remain competitive in the market. The company has invested heavily in research and development projects, resulting in new products that have helped drive their revenue up.

Additionally, the company has launched several new marketing campaigns to attract more customers and drive up their sales. Overall, despite the decrease in net income year-over-year, JOYY INC reported solid results for the third quarter of fiscal year 2022. The company’s record-breaking revenue was driven by its focus on innovation and product development, as well as its marketing and promotional efforts. With these strategies in place, JOYY INC is well poised to continue its positive growth in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.47k | 570.53 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 210.42 | 789.59 | -723.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.39k | 3.51k | 78.38 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.2% | -14.9% | 29.2% |

| FCF Margin | ROE | ROA |

| 1.0% | 8.4% | 4.8% |

VI Analysis

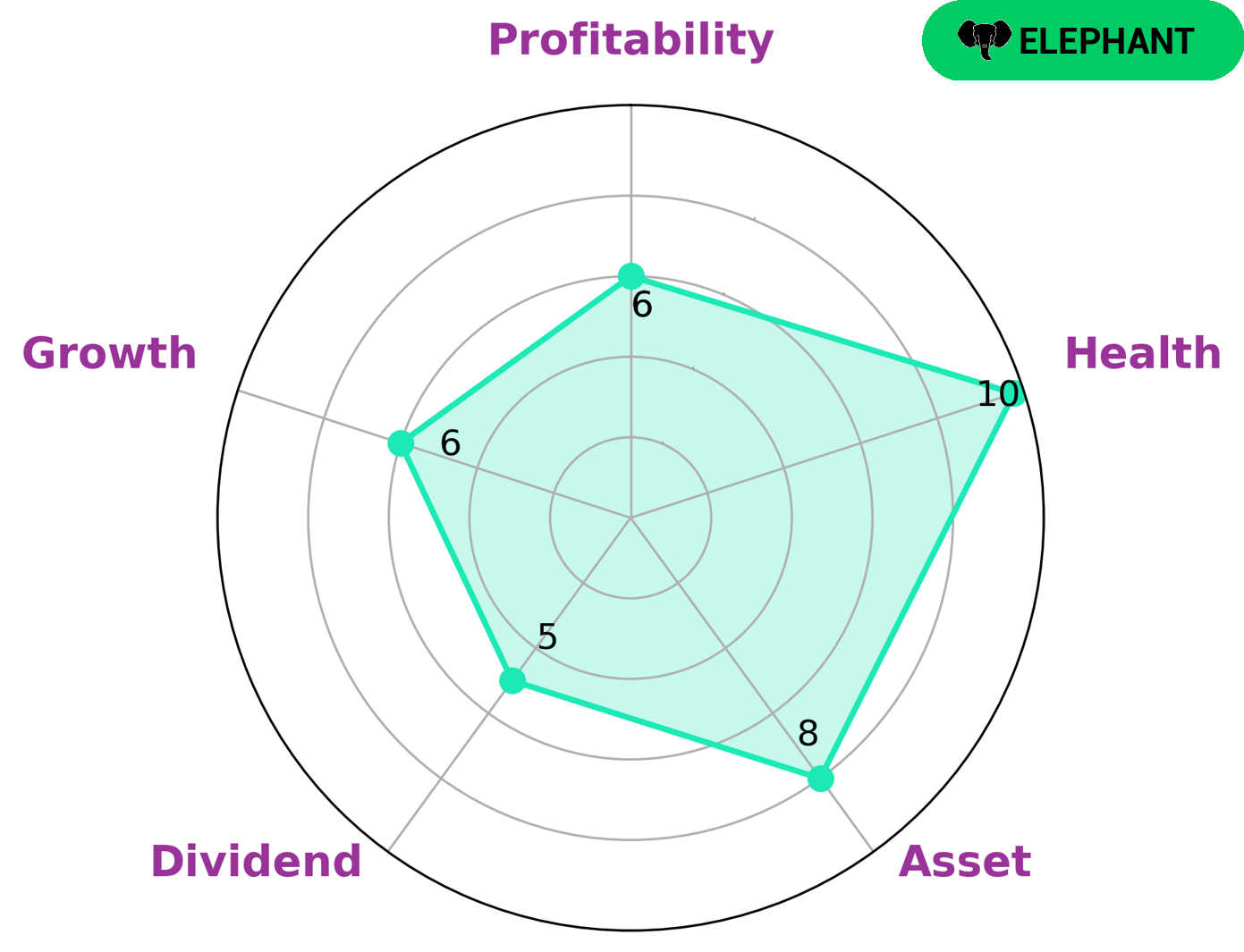

JOYY INC is a company with strong fundamentals, which reflects its long term potential. As per the VI Star Chart, JOYY INC has a high health score of 10/10 with regard to its cashflows and debt. This indicates that the company is capable of paying off its debt and funding future operations. Furthermore, JOYY INC is classified as an ‘elephant’, which means that it has plenty of assets after deducting liabilities. Investors who are looking for a secure investment may be interested in JOYY INC. The company is strong in asset and has medium scores in other areas such as dividend, growth, and profitability. This means that it is a low risk investment that can provide steady returns over the long term. Additionally, the company’s strong financial position makes it a good option for investors who are looking for stability. Moreover, JOYY INC has also been successful in expanding its operations over the years. This suggests that the company is likely to continue to grow and provide investors with returns in the future. Therefore, investors who are looking for a balanced portfolio may be interested in this company. More…

VI Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

Investing in JOYY INC has become increasingly attractive following their Q3 FY2022 earnings report. The company achieved total revenue of $515.2 million, a remarkable 6733.6% increase year-over-year. Although net income was down 9.8% from the same period last year, investors were still buoyed by the impressive revenue growth. Trading activity surrounding JOYY INC spiked as the stock price rose on the news. Short-term traders were encouraged by the strong quarterly results, and many investors chose to buy in anticipation of further growth potential.

Long-term investors were also attracted to the company’s consistent revenue and income growth in the past several quarters, suggesting that it has the potential to deliver steady returns over time. Given JOYY INC’s impressive performance in Q3 FY2022 and its overall growth prospects, it is a worthwhile investment opportunity for both short-term and long-term investors. For those looking to capitalize on its recent momentum, it may be best to buy in now before the share price rises further. For those looking to invest for the long haul, it may be prudent to hold onto the stock and watch for any indications of sustainable growth in the future.

Recent Posts