Joyy Inc Intrinsic Stock Value – JOYY Inc Reports Lower Revenue & Net Income in Q3 FY 2023

December 7, 2023

🌧️Earnings Overview

For its fiscal year 2023’s third quarter, JOYY INC ($NASDAQ:YY) reported total revenue of USD 567.1 million and net income of USD 72.9 million on November 30 2023. Compared to September 30 2023, these figures represented year-over-year decreases of 3.4% and 85.9%, respectively.

Market Price

On Thursday, JOYY Inc reported lower revenue and net income for the third quarter of fiscal 2023. The company’s stock opened at $38.8 before closing at $38.4, representing a 0.2% decrease from its previous closing price of $38.5. JOYY Inc attributed its lower revenue to lower demand from its core live streaming business in China, as well as its other international markets. The company also cited a decline in advertising revenue, which it attributed to a decrease in user engagement due to the global pandemic.

Despite the lower revenue and net income, the company’s CEO expressed optimism about the future of the business and said that JOYY Inc was well-positioned to capitalize on the recent growth in live streaming and ecommerce in China. He also noted that the company was continuing to invest in new technologies and products to stay competitive in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.3k | -78.2 | -8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 316.49 | -510.28 | -321.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.45k | 3.16k | 81.6 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -19.6% | -41.5% | 11.7% |

| FCF Margin | ROE | ROA |

| 10.7% | 3.4% | 2.0% |

Analysis – Joyy Inc Intrinsic Stock Value

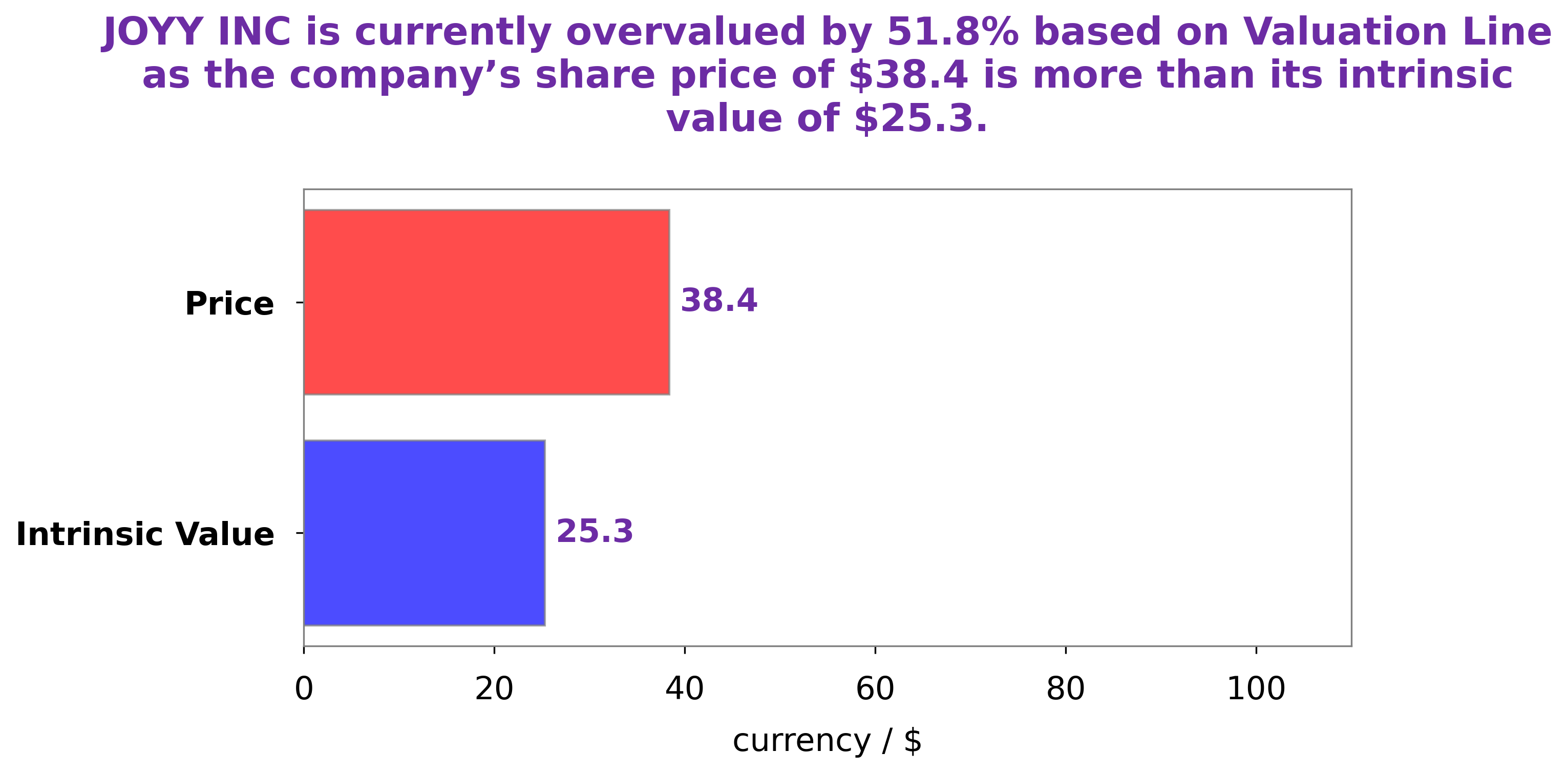

GoodWhale has conducted an analysis of JOYY INC‘s financials and our proprietary Valuation Line has calculated the intrinsic value of a JOYY INC share to be around $25.3. Currently, JOYY INC stock is being traded at $38.4, which is 51.7% overvalued compared to its intrinsic value. We believe that this discrepancy between the intrinsic and market values highlights the potential value that investors may be able to gain by investing in JOYY INC. More…

Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

Investors may be concerned about the latest financial results from JOYY Inc. for the third quarter of its fiscal year 2023, as it reported a 3.4% decrease in total revenue to USD 567.1 million and an 85.9% decrease in net income to USD 72.9 million. This could be seen as a red flag for potential investors, as it suggests a decline in the company’s profitability. Nevertheless, investors must look at the company’s long-term performance before making any decisions to invest.

Recent Posts