INSPIRE MEDICAL SYSTEMS Reports Record Fourth Quarter Revenue and Net Income Growth of 231.8% and 75.9% Respectively.

March 7, 2023

Earnings Overview

For the fourth quarter ending December 31 2022, INSPIRE ($NYSE:INSP) MEDIAL SYSTEMS reported total revenue of USD 3.1 million and a net income of USD 137.9 million, which represented an increase of 231.8% and 75.9% respectively from the same period in the preceding fiscal year.

Transcripts Simplified

In the fourth quarter of 2022, Inspire Medical Systems generated total revenue of $137.9 million, a 76% increase from the prior year period. U.S. revenue was $134.3 million, a 78% increase from the prior year period, driven by higher utilization, the addition of new implanting centers, expanded direct to consumer marketing, and a higher number of territory managers. Gross margin was 83.9%, compared to 85.8% in the prior year period, primarily due to higher costs of certain component parts and additional costs associated with the transition to silicone-based leads. Total operating expenses for the fourth quarter were $116.1 million, an increase of 68% as compared to $69.1 million in the prior year period.

Net income for the fourth quarter was $3.2 million, compared to a $2.4 million net loss in the prior year period. The diluted net income per share for the fourth quarter was $0.10, compared to the net loss per share of $0.09 in the fourth quarter of 2021.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for INSP. More…

| Total Revenues | Net Income | Net Margin |

| 407.86 | -44.88 | -11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for INSP. More…

| Operations | Investing | Financing |

| 11.57 | -19.6 | 235.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for INSP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 564.88 | 68.87 | 17.1 |

Key Ratios Snapshot

Some of the financial key ratios for INSP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 70.7% | – | -10.4% |

| FCF Margin | ROE | ROA |

| 0.6% | -5.5% | -4.7% |

Share Price

This impressive growth was reflected in the price of their stock, which opened at $241.6 and closed at $249.6, up by 2.3% from the previous closing price of 244.0. The company attributed their success to higher procedure volume and continued customer adoption of their implantable neurostimulator technology. The company is continuing to expand its portfolio of innovative treatments and will continue to focus on driving long-term growth for shareholders in the coming year. Live Quote…

Analysis

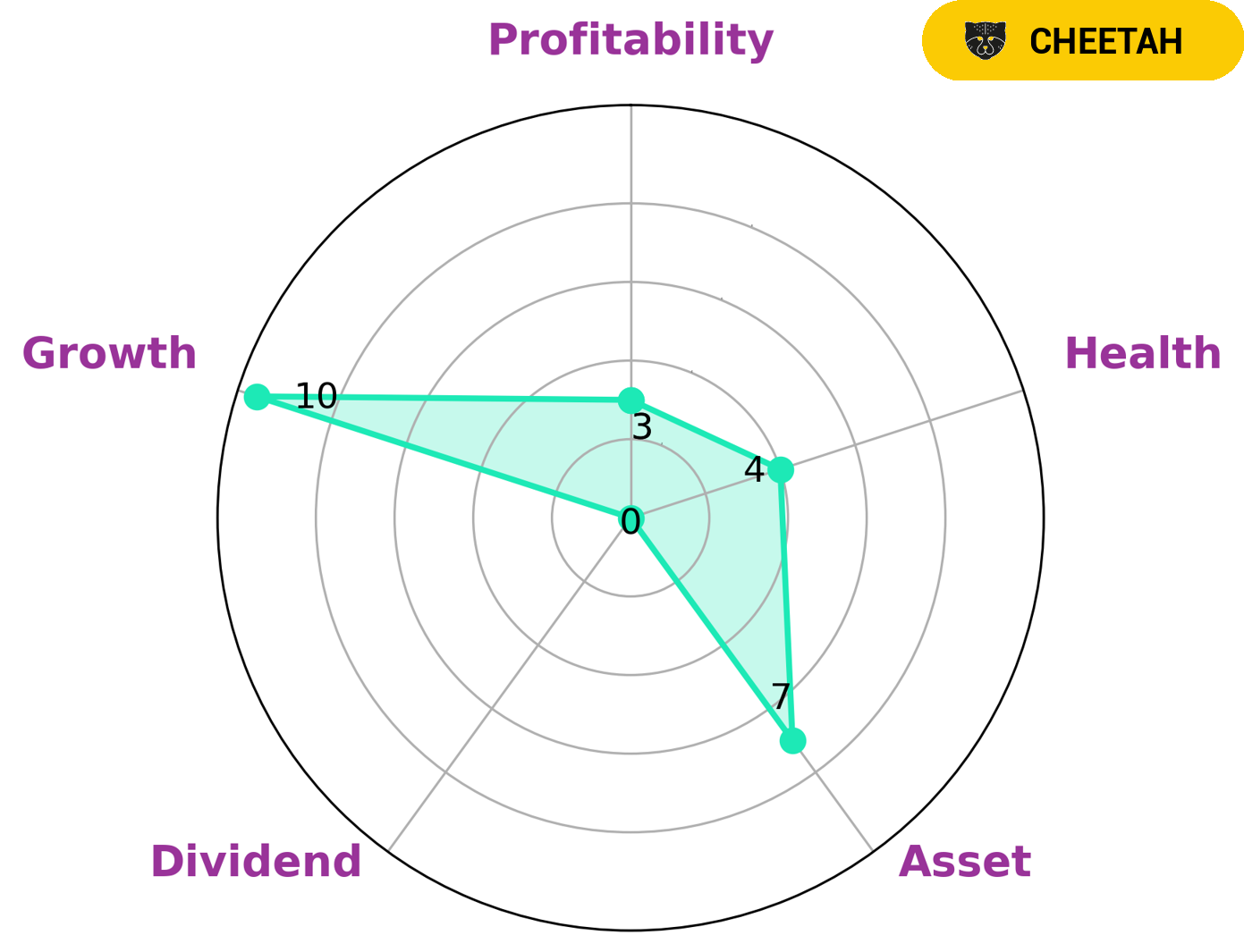

GoodWhale has conducted an analysis of INSPIRE MEDICAL SYSTEMS’ wellbeing. Based on GoodWhale’s Star Chart, INSPIRE MEDICAL SYSTEMS is classified as ‘cheetah’, which is a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors looking for high returns, but there is more risk involved than with other types of companies. INSPIRE MEDICAL SYSTEMS is strong in asset and growth, but weak in dividend and profitability. This indicates that the company may be a good short-term investment, but investors should be aware of the risks involved. Additionally, INSPIRE MEDICAL SYSTEMS has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it might be able to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The company’s competitors include ShockWave Medical Inc, InMode Ltd, and INVO Bioscience Inc.

– ShockWave Medical Inc ($NASDAQ:SWAV)

ShockWave Medical Inc is a medical device company that uses shockwave technology to treat cardiovascular disease. The company has a market cap of 9.73B as of 2022 and a return on equity of 19.56%. The company’s products are used to treat a variety of cardiovascular diseases, including coronary artery disease, peripheral artery disease, and heart failure.

– InMode Ltd ($NASDAQ:INMD)

InMode Ltd is a medical technology company that develops and manufactures minimally invasive aesthetic solutions. The company has a market capitalization of $2.71 billion as of 2022 and a return on equity of 41.58%. InMode’s products are used by physicians and patients in over 90 countries and the company has a strong presence in the United States, Europe, Asia, and Latin America. InMode’s products are backed by clinical research and have been featured in numerous peer-reviewed journals.

– INVO Bioscience Inc ($NASDAQ:INVO)

INVO Bioscience Inc is a medical device company that has developed a patented in vivo intravaginal culture (IVC) system, which is used to treat infertility. The company’s IVC system is designed to provide a more natural environment for embryo development and is intended to improve the success rates of in vitro fertilization (IVF). INVO Bioscience’s IVC system is currently being used at fertility clinics in the United States and Europe.

Summary

INSPIRE MEDIAL SYSTEMS has reported remarkable results for their fourth quarter ending December 31 2022. Total revenue increased by 231.8%, reaching USD 3.1 million and net income was up 75.9%, amounting to USD 137.9 million. These results demonstrate INSPIRE MEDIAL SYSTEMS’ strong earnings and financial performance, making it an attractive investment option for those seeking to capitalize on its growth potential. Investors should take into consideration its record of consistent growth and solid financial performance in assessing whether to invest in the company.

Recent Posts