H.B. FULLER Reports Lower Revenue, But Higher Net Income for Fourth Quarter of FY2022

January 30, 2023

Earnings report

H.B. FULLER ($NYSE:FUL) is an American global adhesives manufacturer and technology company that offers products and solutions for customers in the aerospace, consumer, healthcare and industrial markets, among others. On November 30, 2022, H.B. FULLER reported their earnings results for the fourth quarter of FY2022, which ended on January 19, 2023. The company earned total revenue of USD 48.3 million, a decrease of 25.4% from the same period last year.

However, net income was USD 958.2 million, an increase of 6.8% year over year. The company attributed the revenue decline to lower sales volumes in most of its business segments as a result of the global pandemic and the continued impact of foreign exchange headwinds. Despite this, the company was able to achieve better net income due to cost-cutting initiatives and improved gross margins. Going forward, H.B. FULLER is focusing on accelerating the implementation of its strategic initiatives, including further cost-cutting measures, expanding its presence in high-growth markets and developing innovative new products in order to drive long-term growth and shareholder value. The company also plans to invest in digital capabilities and expand its e-commerce platform to better serve customers. In the near term, H.B. FULLER expects to return to growth as the global economy gradually recovers from the pandemic.

Share Price

The company’s stock opened at $71.5 and closed at $69.1, down by 3.8% from its previous closing price of 71.8. The decrease in share prices could be attributed to investors’ concerns about the decrease in revenue for the fourth quarter. H.B. FULLER‘s CEO, Deborah Henretta, said in a statement that the company had managed to maintain a steady increase in their net income over the course of the year despite the challenging economic environment. She added that the company was still on track to achieve their long-term goals of sustained growth and profitability. The company’s Chief Financial Officer, Bill Foote, said that they had managed to offset the decrease in revenue with cost-cutting measures and a focus on efficiency.

He also said that they had taken advantage of the current low interest rates to reduce debt and strengthen their balance sheet. Overall, H.B. FULLER reported lower revenue but higher net income for the fourth quarter of FY2022, despite the challenging economic environment. The company is continuing to focus on cost-cutting measures and efficiency in order to drive further growth and profitability over the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for H.b. Fuller. More…

| Total Revenues | Net Income | Net Margin |

| 3.75k | 180.31 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for H.b. Fuller. More…

| Operations | Investing | Financing |

| 256.51 | -375.29 | 160.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for H.b. Fuller. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.46k | 2.85k | 30 |

Key Ratios Snapshot

Some of the financial key ratios for H.b. Fuller are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.0% | 12.6% | 9.2% |

| FCF Margin | ROE | ROA |

| 3.4% | 13.5% | 4.8% |

VI Analysis

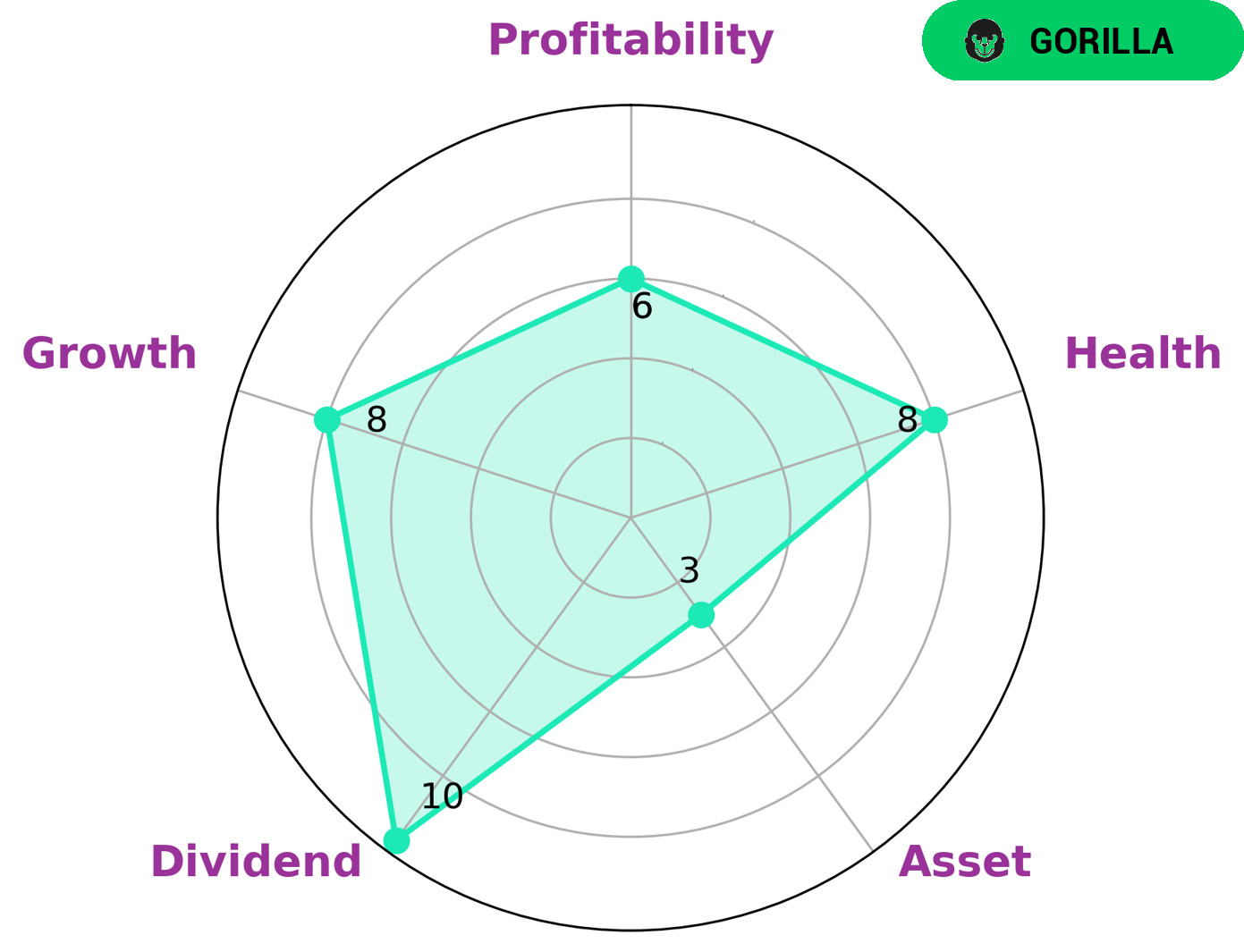

The fundamentals of a company are an important indicator of its long term potential. The VI app makes it easy to analyse a company’s fundamentals and make an informed decision. The classification of H.B. FULLER as a ‘gorilla’ company reflects its ability to achieve stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such a company are those looking for long-term, reliable returns with less risk. H.B. FULLER also has a high health score of 8/10 with regard to its cashflows and debt, meaning it is capable of riding out any crisis without the risk of bankruptcy. This makes it an attractive option for investors who are looking for a low-risk, stable investment. Overall, H.B FULLER demonstrates the importance of analysing company fundamentals when making an investment decision. By understanding the performance of a company’s core metrics, investors can make an informed decision and confidently invest in a company with strong long-term potential. More…

VI Peers

H.B. Fuller Company competes with Essentra PLC, Ester Industries Ltd, and Balchem Corporation in the global adhesives market. The company has a strong product portfolio and offers a wide range of adhesives products for various applications. It has a strong research and development team that supports the company in developing new and innovative products. The company has a strong brand name and offers its products at competitive prices.

– Essentra PLC ($LSE:ESNT)

Essentra PLC is a multinational company that manufactures and sells small plastic and fibre products. Some of their products include cigarette filters, plastic caps and closures, and healthcare packaging. The company has a market cap of 636.57M as of 2022 and a Return on Equity of 5.25%.

– Ester Industries Ltd ($BSE:500136)

Ester Industries Ltd is a publicly traded company with a market capitalization of 14.81 billion as of 2022. The company has a return on equity of 23.17%. Ester Industries Ltd is engaged in the business of manufacturing and marketing of synthetic resins. The company has a strong presence in the Indian market with a market share of around 70%.

– Balchem Corp ($NASDAQ:BCPC)

Balchem Corporation, together with its subsidiaries, develops, manufactures, and markets specialty performance ingredients and products for the food, nutritional, feed, pharmaceutical, and medical sterilization industries in the United States and internationally. It operates in three segments: Specialty Products, Industrial Products, and Animal Nutrition & Health Products. The company was founded in 1967 and is headquartered in New Hampton, New York.

Summary

Investing in H.B. FULLER is an attractive option for potential investors due to the company’s strong financial performance in the fourth quarter of FY2022. Despite a 25.4% year-on-year decrease in total revenue, H.B. FULLER was able to increase net income by 6.8%.

Additionally, the stock price moved down the same day, suggesting that the market has not yet fully recognized the strong fundamentals of the company. Investors should consider H.B. FULLER’s strong balance sheet and diversified portfolio of products and services. The company’s financial position is sound, with a low debt-to-equity ratio and a solid cash flow. Furthermore, H.B. FULLER has been successfully expanding its market presence internationally, entering new markets and increasing its customer base in existing ones. This has helped to further diversify the company’s revenue streams, making it less vulnerable to economic downturns. Overall, H.B. FULLER is a well-managed and highly profitable company with a solid financial position and a diverse portfolio of products and services. It is likely to continue to generate strong returns over the coming years, making it an attractive investment option for potential investors.

Recent Posts