Graphic Packaging Holding Reports Significant 300% YoY Revenue Increase and 20% YoY Net Income Growth for Q4 FY2022.

March 5, 2023

Earnings report

Graphic Packaging Holding ($NYSE:GPK) (GPH) released its earnings results for the fourth quarter of FY2022 on February 7 2023, which demonstrated impressive growth. GPH reported total revenue of USD 156.0 million, representing a 300.0% year-over-year (YoY) increase from the same period in the previous year. The stellar revenue growth was driven by a strong performance across all of its business segments, particularly in the consumer and industrial product divisions. This strong financial performance was attributed to GPH’s successful strategies of cost optimization and efficient working capital management.

Overall, GPH’s strong performance for the quarter speaks to the success of its strategic vision and prudent capital allocation. With its strong financial position and experienced leadership team, GPH is in an excellent place to capitalize on opportunities and continue its growth trajectory in the years ahead.

Market Price

On Tuesday, GRAPHIC PACKAGING HOLDING reported a significant 300% increase in revenue year-on-year (YoY) and 20% YoY increase in its net income for Q4 FY2022. This was reflected in stock prices as GRAPHIC PACKAGING HOLDING opened at $23.0 and closed the day at $22.1, a 6.4% drop from its previous closing price of $23.7. Despite the dip in stock prices, investors continued to remain pleased with the company’s overall financial performance. The strong financial performance of GRAPHIC PACKAGING HOLDING has been largely credited to its effective cost-reduction strategies and technological innovations which have been implemented in recent quarters. The company has been able to scale up its product portfolio, boost operational efficiency and increase customer satisfaction through a variety of initiatives.

Moreover, GRAPHIC PACKAGING HOLDING has also benefited from the increased demand arising from the rapid growth of the e-commerce industry. Going forward, GRAPHIC PACKAGING HOLDING looks well-positioned to continue its impressive growth. The company is expected to remain focused on measures that will boost efficiency and profitability while expanding its product portfolio in order to remain competitive. With its robust financial fundamentals, GRAPHIC PACKAGING HOLDING appears well-poised to capitalize on the opportunities ahead and deliver further value for its shareholders in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GPK. More…

| Total Revenues | Net Income | Net Margin |

| 9.44k | 522 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GPK. More…

| Operations | Investing | Financing |

| 1.09k | -435 | -666 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GPK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.33k | 8.18k | 7 |

Key Ratios Snapshot

Some of the financial key ratios for GPK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 21.9% | 9.7% |

| FCF Margin | ROE | ROA |

| 5.7% | 27.8% | 5.5% |

Analysis

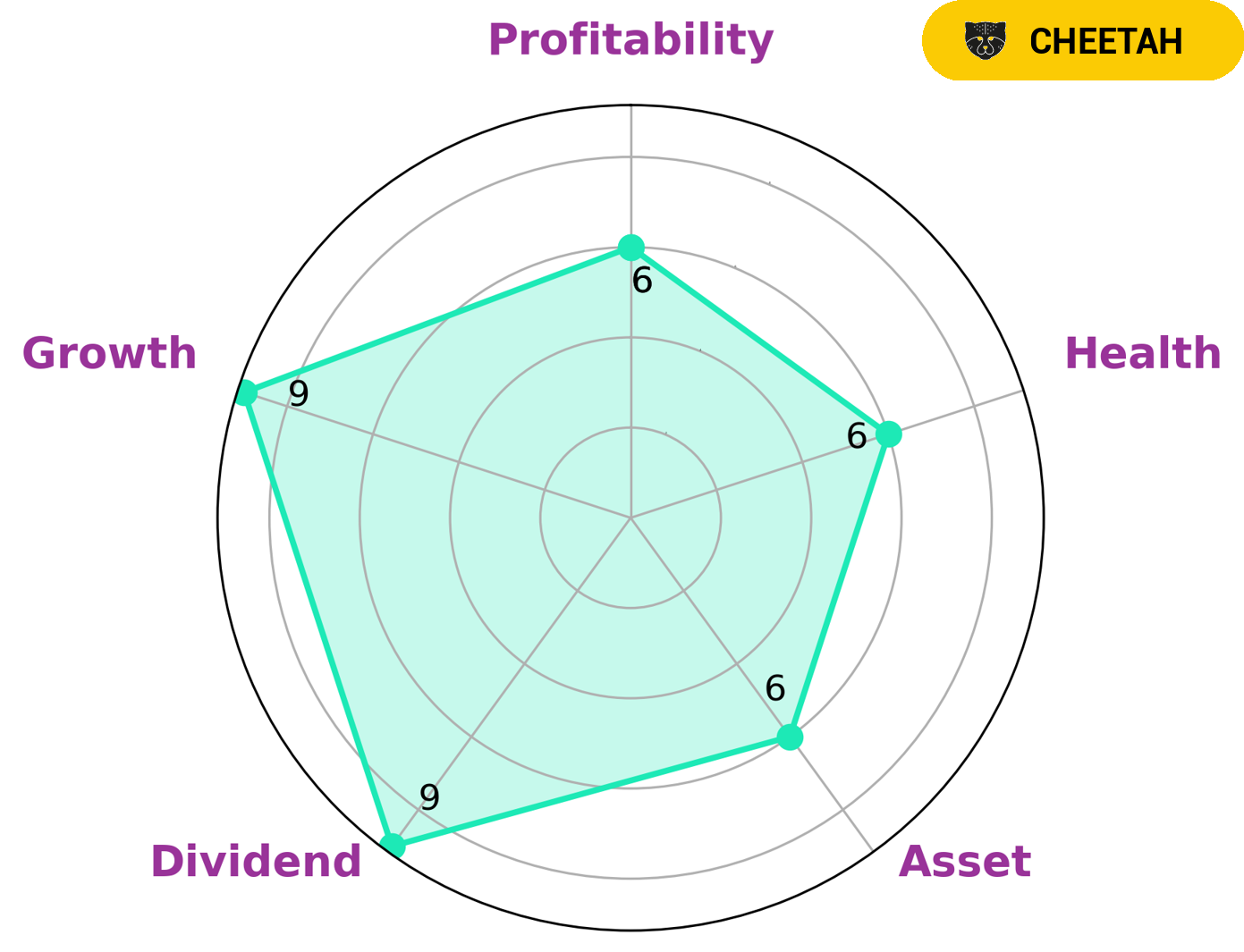

GoodWhale conducted an analysis of the wellbeing of GRAPHIC PACKAGING HOLDING which showed that the company is strong in dividend and growth, and has a medium rating when it comes to asset and profitability. Its overall health score was 6 out of 10, indicating that it is moderately healthy and may be able to survive without fear of bankruptcy during times of crisis. This type of company would be attractive to investors looking for high potential returns but also willing to take on the risk associated with higher volatility. Those with a higher risk tolerance and longer time horizons may find this company to be an appealing investment opportunity. More…

Peers

The competition in the packaging industry is fierce, with Graphic Packaging Holding Co leading the pack. Its competitors, WestRock Co, International Paper Co, and Sonoco Products Co, are all trying to keep up, but they are struggling to match Graphic Packaging’s innovation and efficiency.

– WestRock Co ($NYSE:WRK)

The company has a market cap of 8.51B as of 2022. The company’s return on equity is 8.61%. The company is engaged in the production of corrugated packaging products and solutions. The company has a diversified customer base, including producers of packaging, consumer and industrial products. The company operates in three segments: Corrugated Packaging, Consumer Packaging and Industrial Packaging. The Corrugated Packaging segment produces corrugated packaging products, including linerboard, medium and recycled medium. The Consumer Packaging segment produces folding cartons, cups, plates and bowls. The Industrial Packaging segment produces a range of packaging products, including containerboard, kraft paper, bleached paperboard and corrugated packaging products.

– International Paper Co ($NYSE:IP)

In 2022, International Paper Company had a market capitalization of 12.11 billion dollars and a return on equity of 11.61%. The company produces paper and packaging products and has operations in North America, Europe, Latin America, Russia, Asia, Africa, and the Middle East. International Paper is one of the world’s largest paper companies and has been in business for over 100 years.

– Sonoco Products Co ($NYSE:SON)

Sonoco Products Company is a global provider of packaging products and services. The company operates in four segments: Consumer Packaging, Industrial Packaging, Display and Packaging Services, and Sonoco Europe. The company’s products include steel and plastic drums, steel and plastic pails, steel and plastic intermediate bulk containers, steel and plastic closure rings and lids, steel and plastic food cans, steel and plastic paint cans, steel and plastic jar lids, steel and plastic tubes, composite cans, flexible packaging, and corrugated containers. The company also provides display packaging products, such as point-of-purchase displays, in-store merchandising displays, and packaging for the retail sector; and packaging services, such as design, prototyping, sourcing, manufacturing, logistics, and warehousing.

Summary

Graphic Packaging Holding Company had an impressive quarter, with total revenue of USD 156.0 million, a 300.0% increase from the same period in the previous year, and net income rising 20.0% year over year to USD 2386.0 million. Despite this strong financial performance, the stock price moved down on the same day, indicating that investors may be uncertain about future returns and the company’s prospects in the near term. Analysts believe the company is well-positioned for long-term growth and that any downturn should be viewed as a buying opportunity.

Recent Posts