GENERAC HOLDINGS Reports 50.3% Decrease in Total Revenue for FY2022 Q4

March 13, 2023

Earnings Overview

On February 15, 2023, GENERAC HOLDINGS ($NYSE:GNRC) reported their fourth quarter FY2022 earnings results, with total revenue of USD 71.0 million – a decrease of 50.3% from the same period in the prior year. Net income for the quarter was USD 1049.2 million, a 1.7% decrease from the prior year.

Transcripts Simplified

In the fourth quarter of 2022, net sales decreased 2% to $1.05 billion. Residential product sales declined 19% to $575 million, commercial and industrial product sales increased 27% to $361 million, and other products and services increased 46% to $113 million. Gross profit margin was 32.7%, operating expenses increased 26%, and adjusted EBITDA before deducting for noncontrolling interest was $174 million or 16.6% of net sales. Net sales for the full year 2022 increased 22% to approximately $4.56 billion.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Generac Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 4.56k | 399.5 | 8.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Generac Holdings. More…

| Operations | Investing | Financing |

| 58.52 | -134.23 | 64.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Generac Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.17k | 2.8k | 36.76 |

Key Ratios Snapshot

Some of the financial key ratios for Generac Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.5% | 15.1% | 12.3% |

| FCF Margin | ROE | ROA |

| -0.6% | 15.4% | 6.8% |

Share Price

The company’s stock opened at $127.6 and closed at $135.2, an increase of 8.0% from the previous closing price of 125.2. The decrease in revenue is attributed to lower sales due to the pandemic. GENERAC HOLDINGS noted that the decrease in total revenue was also due to higher investments in research and development initiatives, as well as higher expenses related to the acquisition of new companies. Overall, these results demonstrate GENERAC HOLDINGS’ continued commitment to making strategic investments even through difficult business conditions. Investors are encouraged by the company’s financial performance, as evidenced by the 8.0% increase in stock price on Wednesday. Live Quote…

Analysis

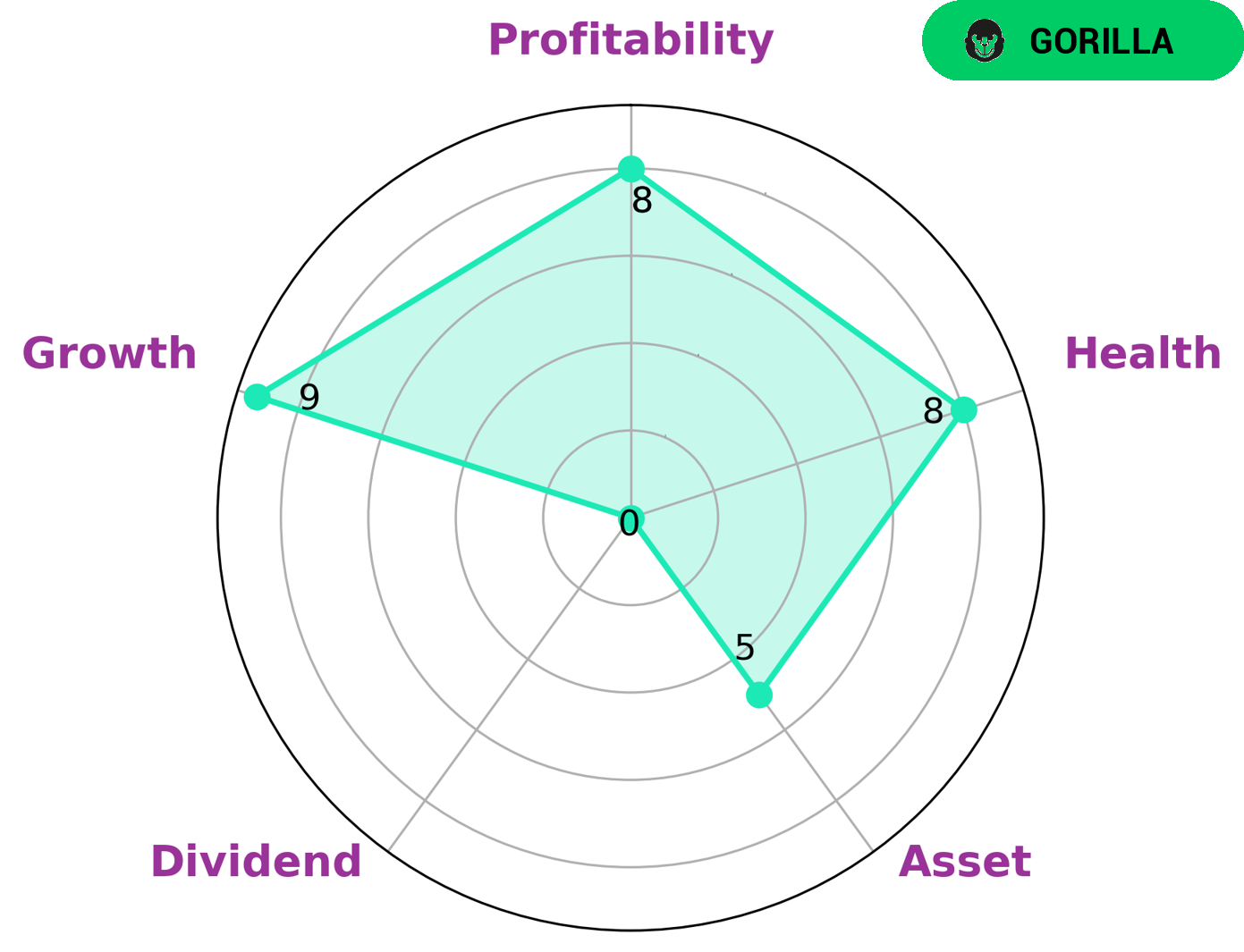

GoodWhale has taken a deep dive into analysing the fundamentals of GENERAC HOLDINGS. After a thorough analysis, we observed that GENERAC HOLDINGS is strong in growth and profitability according to the Star Chart and is medium in asset and weak in dividend. We classified GENERAC HOLDINGS as a ‘gorilla’, a company that achieved stable and high revenue or earning growth due to its strong competitive advantage. Considering the strength of GENERAC HOLDINGS, it will be interesting to know what type of investors may be interested in such a company. Generally, investors who are interested in long-term, high-growth stocks may find GENERAC HOLDINGS attractive. Furthermore, GENERAC HOLDINGS has a high health score of 8/10 considering its cashflows and debt and is capable to pay off debt and fund future operations. This adds to the company’s appeal with investors. More…

Peers

In the market for standby generators, Generac Holdings Inc is up against some stiff competition from the likes of Musashi Co Ltd, Taihai Manoir Nuclear Equipment Co Ltd, and Weg SA.

However, the company has managed to stay ahead of the pack thanks to its innovative products and efficient manufacturing processes.

– Musashi Co Ltd ($TSE:7521)

As of 2022, Musashi Co Ltd has a market cap of 9.64B and a Return on Equity of 5.68%. The company manufactures and sells automotive parts, including engine valves, pistons, and crankshafts. It also provides engineering services.

– Taihai Manoir Nuclear Equipment Co Ltd ($SZSE:002366)

The company has a market capitalization of 4.67 billion as of 2022 and a return on equity of 697.02%. It is a manufacturer of nuclear equipment and supplies. The company’s products include reactors, nuclear fuel, nuclear power plant equipment, and nuclear waste disposal products.

– Weg SA ($OTCPK:WEGZY)

Weg SA is a Brazilian company that manufactures electric motors and generators. It has a market cap of 27.73B as of 2022 and a Return on Equity of 21.06%. The company is headquartered in Jaraguá do Sul, Santa Catarina, and has over 30,000 employees. Weg SA is one of the largest manufacturers of electric motors and generators in the world.

Summary

Investors in GENERAC HOLDINGS were likely encouraged by the company’s Q4 FY2022 earnings results, which showed a decrease in revenue of 50.3% over the same period in the prior year, but a smaller drop of 1.7% in net income. This may have prompted a jump in the stock price on the news, as investors weighed the performance against expectations. Going forward, potential investors should assess the company’s financials and operations to determine if GENERAC HOLDINGS is a suitable long-term investment.

Recent Posts