FLOWSERVE CORPORATION Reports 625.2% Increase in Total Revenue for Fourth Quarter of 2022 Fiscal Year

March 28, 2023

Earnings Overview

On February 21, 2023, Flowserve Corporation ($NYSE:FLS) reported total revenue of USD 121.3 million for the fourth quarter of their 2022 fiscal year, which ended on December 31, 2022. This was a 625.2% increase from the previous year and net income from the same period was USD 1039.0 million, a 13.0% increase from the year before.

Transcripts Simplified

Flowserve Corporation reported strong fourth quarter adjusted EPS of $0.63, with year-over-year revenue growth of 13%, or 18.6% on a constant currency basis, marking its highest quarterly revenue level since 2019. Earnings per share for the quarter was $0.92, primarily the result of a $0.45 tax valuation allowance reversal, as well as $0.06 of benefits related to the reversals of prior expenses. North American Seals business was a solid contributor to earnings.

Gross margin decreased 40 basis points to 28.8%, primarily due to realization of some longer-dated backlog booked in tougher times as well as materials and labor cost inflation. SG&A was roughly flat compared to the prior year, but down 200 basis points as a percentage of sales to 18.4%.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Flowserve Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 3.62k | 188.69 | 5.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Flowserve Corporation. More…

| Operations | Investing | Financing |

| -40.01 | -6.09 | -150.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Flowserve Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.79k | 2.93k | 13.99 |

Key Ratios Snapshot

Some of the financial key ratios for Flowserve Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.9% | -23.3% | 5.5% |

| FCF Margin | ROE | ROA |

| -3.2% | 7.2% | 2.6% |

Price History

This impressive increase has caused their stock price to open at $35.4 and close at $34.9, still a 2.9% decrease from the previous closing price of 35.9. FLOWSERVE CORPORATION attributes the success to their expansion of their product portfolio, along with the growth of their digital solutions, making them more competitive in the global market. Their products range from pumps and valves to seals and automation systems, which have been utilized in various industries such as oil and gas, power generation, and chemical processing. The increased revenue comes as a result of the increase in global demand for their products, as well as their continuous effort to develop innovative technologies and solutions to help customers reach their goals.

The revenue increase is seen as a sign of the company’s potential long-term success, as they continue to expand and develop their products further. This is an encouraging sign for investors, as the company continues to innovate and expand to become more competitive in the global market. Live Quote…

Analysis

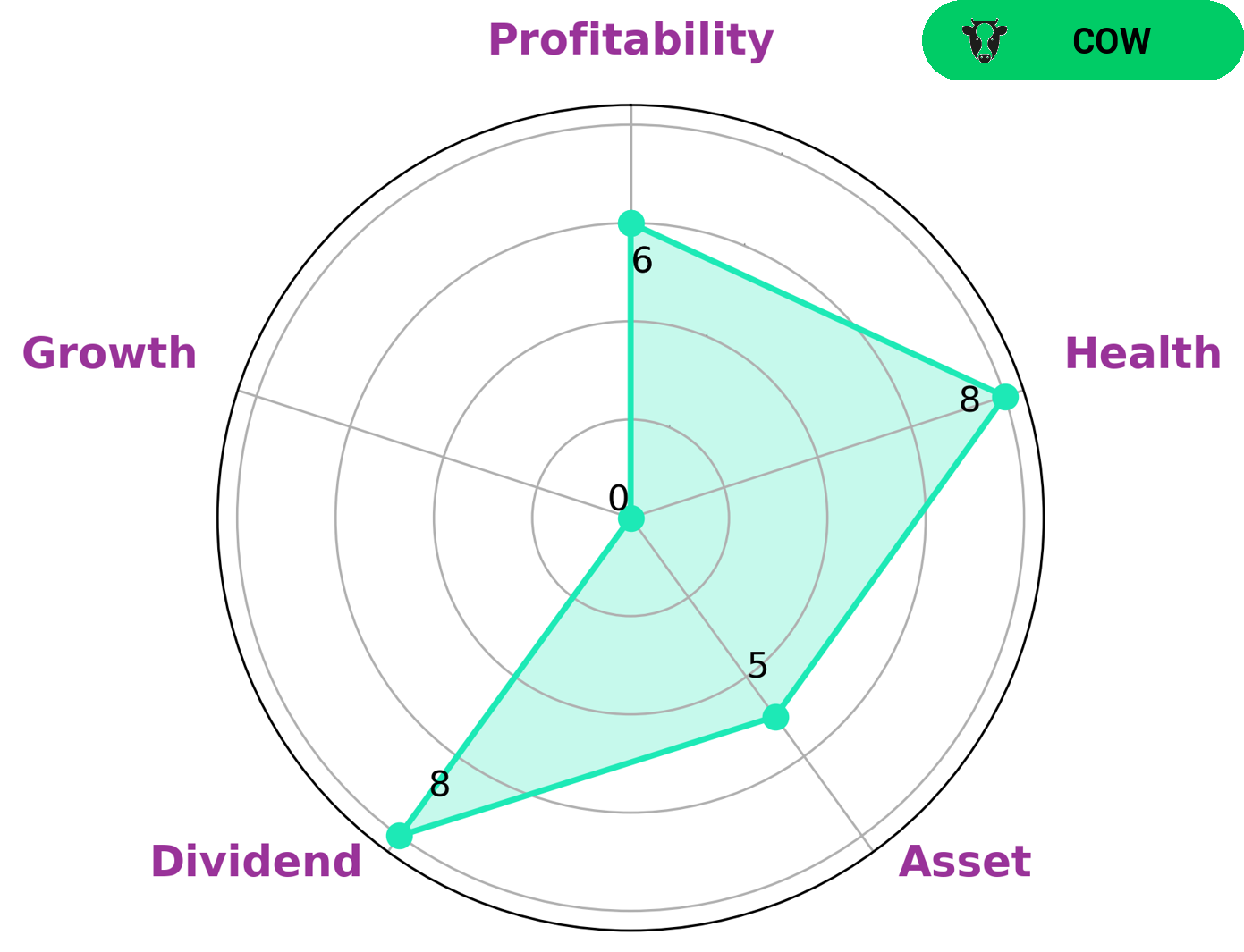

GoodWhale performed an analysis of FLOWSERVE CORPORATION‘s wellbeing and our results showed that the company is strong in dividend, medium in asset, profitability and is weak in growth. Through our Star Chart analysis and health score, we concluded that FLOWSERVE CORPORATION has a high health score of 8/10 with regard to its cashflows and debt and is capable to sustain future operations in times of crisis. Furthermore, by classifying FLOWSERVE CORPORATION as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends, we concluded that this type of company may be of interest to investors looking for long term investments with relatively steady returns. This type of investor may include those who are hoping to build a reliable dividend income or those interested in stability and low volatility. More…

Peers

Its competitors include ITT Inc, Shanghai Zhenhua Heavy Industries Co Ltd, Sintokogio Ltd.

– ITT Inc ($NYSE:ITT)

3M’s market cap as of 2022 is 5.86B. The company has a return on equity of 12.81%. 3M is a diversified technology company that operates in a variety of industries, including healthcare, industrial, and consumer markets. The company’s products include adhesives, abrasives, laminates, and electro- and optical materials.

– Shanghai Zhenhua Heavy Industries Co Ltd ($SHSE:600320)

Shanghai Zhenhua Heavy Industries Co Ltd is a heavy industries company with a market cap of 14.22B as of 2022. The company has a return on equity of 7.11%. The company manufactures a range of products including cranes, construction machinery, and railway equipment. Shanghai Zhenhua Heavy Industries Co Ltd is a publicly traded company listed on the Shanghai Stock Exchange.

– Sintokogio Ltd ($TSE:6339)

Sintokogio Ltd is a Japanese company that manufactures automotive parts. As of 2022, the company has a market capitalization of 35.83 billion dollars and a return on equity of 2.76%. The company’s products include engine parts, suspension parts, and body parts.

Summary

For investors looking for growth potential, FLOWSERVE CORPORATION is a promising option. The total revenue for the fourth quarter of the 2022 fiscal year ended on December 31, 2022, was reported on February 21, 2023 and amounted to USD 121.3 million, a 625.2% increase from the previous year. Net income for the quarter was USD 1039.0 million, a 13.0% increase from the same period in the previous year. This indicates that the company is continuing to grow and is an attractive option for investors who are looking for significant returns in the future.

Recent Posts