FANHUA INC Reports CNY 70.6 Million in Revenue for 2022 Q4, Year-on-Year Increase of 544.9%

March 16, 2023

Earnings Overview

FANHUA INC ($NASDAQ:FANH) reported total revenue of CNY 70.6 million for the fourth quarter of its 2022 fiscal year, registering a year-on-year growth of 544.9%. However, net income for the same period declined by 4.4% compared to the same period last year to CNY 767.4 million. The results were reported on December 31, 2022.

Transcripts Simplified

FANHUA INC. Our speakers today are FANHUA’s CEO, Mr. Wang Xian, and CFO, Ms. Zhang Meifeng. Before we begin, I would like to remind everyone that this call will include forward-looking statements and that actual results may differ materially from those discussed today. With that said, I will now turn the call over to Mr. Wang. Our business model remains very resilient and is generating strong returns for our shareholders. We also continued to invest in R&D initiatives and launched several products in the quarter, including a new software platform for data analytics and a new artificial intelligence-enabled customer service platform.

Our investments in new technologies are helping us to remain competitive and expand our customer base. Ms. Zhang: Thank you, Mr. Wang. We achieved these strong results despite increased expenses related to our investments in R&D initiatives. In conclusion, I am pleased with our strong results this quarter and confident that our investments in new technologies will continue to drive growth in the future. Thank you for your time today.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fanhua Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.78k | 100.27 | 3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fanhua Inc. More…

| Operations | Investing | Financing |

| 137.75 | -127.56 | -20.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fanhua Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.09k | 1.36k | 28.28 |

Key Ratios Snapshot

Some of the financial key ratios for Fanhua Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.1% | -28.9% | 6.1% |

| FCF Margin | ROE | ROA |

| 5.0% | 6.6% | 3.4% |

Price History

On Tuesday, FANHUA INC released its financial report for the fourth quarter of 2022, revealing a record-high revenue of CNY 70.6 million—a whopping 544.9% year-on-year increase. Investors were pleased with the news, as the company’s stock opened at $8.1 and closed at $8.0, up 0.1% from the previous day’s closing price of 8.0. The impressive revenue growth is attributed to the successful launch of several new products and services in the fourth quarter of 2022, as well as FANHUA INC’s strong commitment to further developing its business model.

In addition, the company has been investing heavily in research and development in order to stay ahead of the curve, as well as in strategic partnerships that have enabled FANHUA INC to expand its sales channels. FANHUA INC’s impressive performance in the fourth quarter of 2022 is indicative of the company’s future prospects, and many investors are optimistic that the CNY 70.6 million in revenue will be just the beginning for the firm. With a strong focus on product development, strategic partnerships, and innovative marketing strategies, FANHUA INC is well-positioned to continue its success in the coming quarters. Live Quote…

Analysis

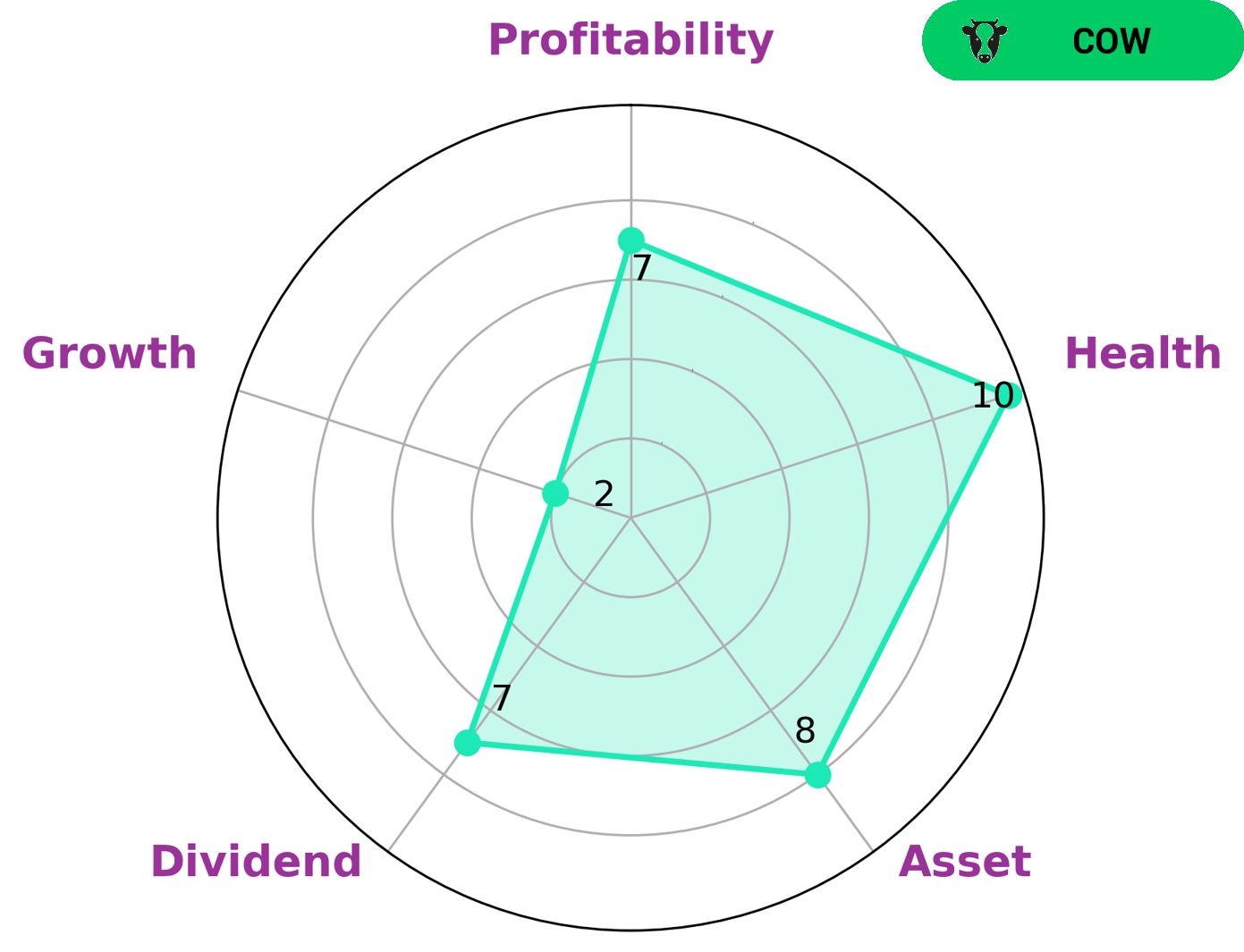

GoodWhale has done an analysis of FANHUA INC‘s financials and the results are interesting. The Star Chart shows that FANHUA INC is strong in asset, dividend, profitability, and weak in growth. This puts them in the category of ‘cows’, which are companies that have the track record of paying out consistent and sustainable dividends. This type of company should be attractive to investors looking for steady returns, as well as those seeking a safe haven during market crashes. In addition, FANHUA INC has a high health score of 10/10 with regard to their cashflows and debt, meaning they are capable of safely riding out any crisis without the risk of bankruptcy. This makes them an attractive option for investors looking for a secure and steady return on their investment. More…

Peers

The company has established itself as a major player in the Chinese insurance market along with its main competitors Tian Ruixiang Holdings Ltd, Golden Insurance Brokers Co Ltd and China United Insurance Service Inc.

– Tian Ruixiang Holdings Ltd ($NASDAQ:TIRX)

Tian Ruixiang Holdings Ltd is a Chinese financial service provider, focused on providing consumer-centric financial technology services. The company has a market cap of 3.24M in 2023, indicating that its stock is not widely available in the market. Its return on equity of -8.76% reveals that the company is not performing as well as expected. The company is not generating enough profits to cover the cost of capital, indicating that it needs to improve its business operations. Tian Ruixiang Holdings Ltd has the potential to grow, but the company needs to focus on improving its performance in order to increase its market share.

– Golden Insurance Brokers Co Ltd ($TPEX:6028)

Golden Insurance Brokers Co Ltd is a leading insurance broker with a market capitalization of 996M as of 2023. The company provides insurance brokering services, specializing in commercial and personal lines of business. The company’s strong financial performance is evident in its return on equity (ROE) of 16.14%. This indicates that the company is able to efficiently generate profits from its invested capital and is a good indicator of the company’s performance and potential growth.

– China United Insurance Service Inc ($OTCPK:CUII)

United Insurance Service Inc is a top-tier company providing a range of insurance services in the United States. As of 2023, the company has a market capitalization of 46.04 million USD, which means that the company is worth more than $46 million in comparison to its competitors. Additionally, with a Return on Equity (ROE) of 33.54%, United Insurance Service Inc has demonstrated an impressive ability to generate returns for its shareholders. This indicates that the company is a good investment for investors and that its management is efficient in utilizing its resources to produce strong returns.

Summary

FANHUA INC reported its fiscal year 2022 Q4 earnings on December 31, 2022, with total revenue of CNY 70.6 million, representing a 544.9% year-on-year increase. Net income for the quarter, however, decreased by 4.4% year over year to CNY 767.4 million. Investors should take note of the impressive revenue growth and steady net income figures when analyzing the company’s performance and potential for investments. Furthermore, they should consider evaluating the company’s future prospects through analyzing its financial performance and business strategies, as well as its competitive landscape.

Recent Posts