ETHAN ALLEN INTERIORS Reports 4.8% Revenue Increase, 2.4% Net Income Decrease in Q2 FY2023.

February 2, 2023

Earnings report

Ethan Allen Interiors ($NYSE:ETD) Inc. reported earnings results for the second quarter of FY2023, ending December 31 2022. Ethan Allen Interiors is a publicly traded company that designs, manufactures, and retails home furnishings and accessories in North America and internationally. Total revenue for the quarter was USD 28.2 million, a 4.8% increase compared to the same period in the previous year. This increase was mainly attributed to higher sales in both retail and wholesale operations.

However, net income was USD 203.2 million, a 2.4% decrease year over year. The company attributed the decrease in net income to higher expenses related to marketing initiatives and investments in technology, as well as higher costs associated with labor and raw materials. Despite the decrease in net income, Ethan Allen Interiors reported a strong increase in sales for the quarter and remains optimistic about the future. The company has implemented strategic initiatives such as expanding its digital presence, launching new product lines, and increasing its presence in key markets. Overall, it is clear that Ethan Allen Interiors is continuing to see positive returns for its investments and is confident in its ability to further capitalize on the opportunities available to it in the future. The company’s strong revenue growth combined with its strategic initiatives make it a good investment for those looking for a long-term return.

Market Price

ETHAN ALLEN INTERIORS reported a 4.8% revenue increase in the second quarter of its fiscal year 2023 compared to the same period last year.

However, the company also reported a 2.4% decrease in net income for the same period. On Wednesday, ETHAN ALLEN INTERIORS stock opened at $28.0 and closed at $27.8, down by 1.3% from the previous closing price of 28.2. ETHAN ALLEN INTERIORS has made significant progress over the past year in terms of expanding its product offerings and developing its presence in the home furnishings industry. The company has also made strategic investments in its online platform, which has helped to drive sales growth. Despite these efforts, the company’s net income decreased in Q2 of FY2023 due to increased costs associated with marketing and higher product costs. ETHAN ALLEN INTERIORS remains committed to providing high quality furniture and home decor products to its customers. The company believes that its focus on product innovation and customer service will help it to remain competitive in the market and to continue to grow its revenue.

In addition, ETHAN ALLEN INTERIORS plans to continue to focus on expanding its online presence and leveraging its data-driven insights to make strategic decisions in order to maximize its profits. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ETD. More…

| Total Revenues | Net Income | Net Margin |

| 845.03 | 114.28 | 13.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ETD. More…

| Operations | Investing | Financing |

| 87.59 | -62.26 | -45.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ETD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 713.98 | 276.92 | 17.24 |

Key Ratios Snapshot

Some of the financial key ratios for ETD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.0% | 53.2% | 18.1% |

| FCF Margin | ROE | ROA |

| 8.2% | 22.4% | 13.4% |

VI Analysis

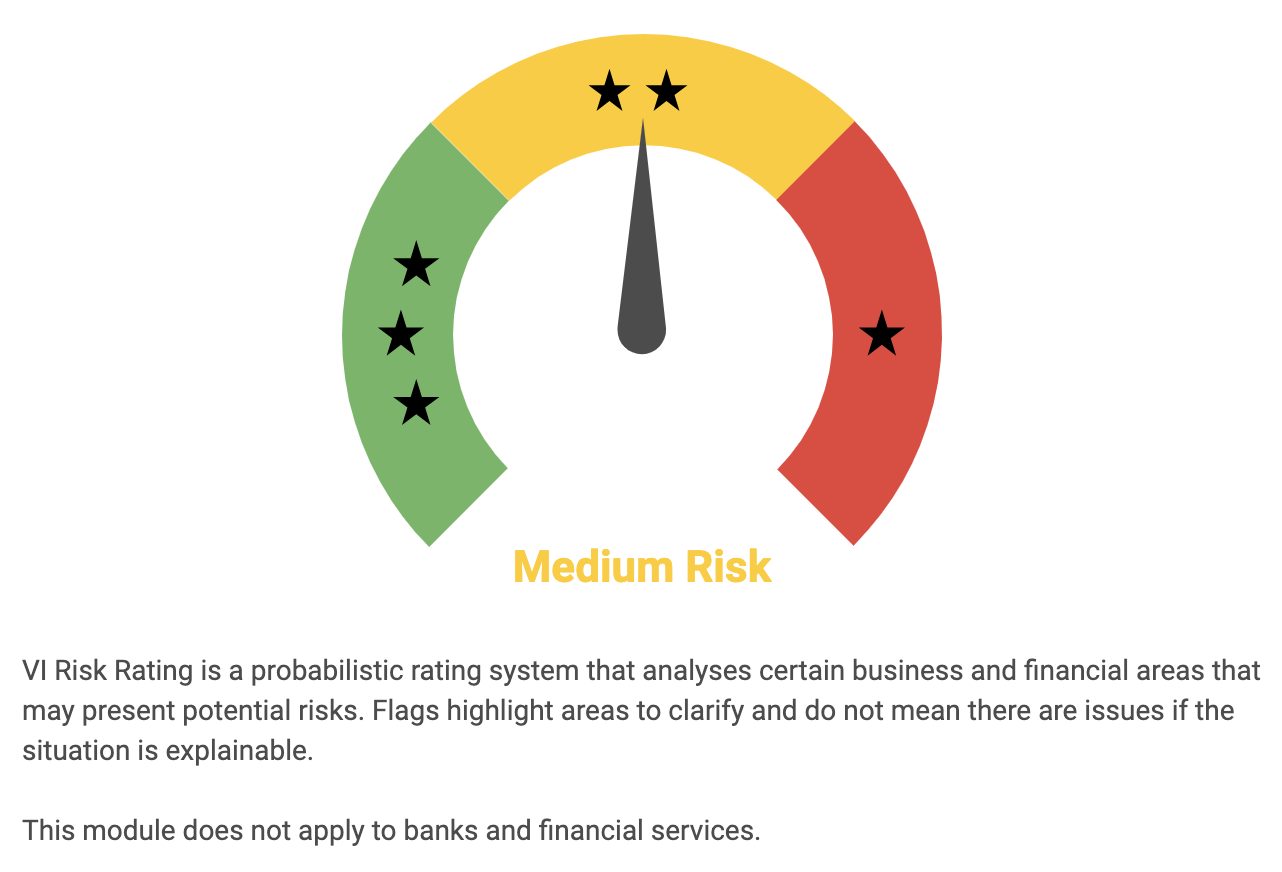

ETHAN ALLEN INTERIORS is an investment that can easily be analyzed with the Visual Intelligence (VI) app. It reflects the company’s long-term potential and provides insight into its risk rating. According to the VI Risk Rating, ETHAN ALLEN INTERIORS is a medium risk investment in terms of financial and business aspects. The app has detected one risk warning in the company’s balance sheet, but users must register to see it. The company also offers online tools and services to help customers design their spaces. With its strong brand presence, the company has managed to stay competitive in the market. The company has been successful in both its retail and wholesale operations, and its products are available in many countries around the world. It has also introduced new products such as outdoor furniture and accessories, as well as new services such as virtual design assistance. The company has also been expanding its presence in the home décor and furniture market. ETHAN ALLEN INTERIORS has a strong financial position and has been able to maintain its growth rate over the years. It has also been investing in research and development to expand its product lines and services. The company is also focusing on expanding its online presence, which has helped it reach a wider audience. Overall, ETHAN ALLEN INTERIORS is a medium-risk investment that should be considered if you are looking for a long-term investment. With its strong financial position and commitment to innovation, the company could be a good choice for those looking for a reliable and profitable investment.

However, it is important to keep in mind that the VI app did detect one risk warning in the company’s balance sheet, so it is important to be aware of this risk before investing.

Peers

The company offers a wide range of furniture products, including bedroom, dining room, and living room furniture, as well as office, outdoor, and home accents. Ethan Allen Interiors Inc operates through a network of company-owned stores and licensed dealers. Traeger Inc, Whirlpool Corp, and Tempur Sealy International Inc are all major competitors of Ethan Allen Interiors Inc.

– Traeger Inc ($NYSE:COOK)

Traeger Inc has a market cap of 438.66M as of 2022, a Return on Equity of -26.37%. The company manufactures and sells wood pellet grills and related products.

– Whirlpool Corp ($NYSE:WHR)

Whirlpool Corporation is an American multinational manufacturing and marketing company of home appliances, headquartered in Benton Harbor, Michigan. The company has annual revenue of approximately $21 billion, 92,000 employees, and more than 70 manufacturing and technology research centers around the world.

– Tempur Sealy International Inc ($NYSE:TPX)

Tempur Sealy International Inc is a leading manufacturer, marketer and distributor of bedding products. The company’s products include mattresses, pillows, cushions, and other sleep-related accessories. Tempur Sealy International Inc has a market cap of 5.09B as of 2022, a Return on Equity of -287.04%. The company’s products are sold through a network of retailers, including department stores, mass merchandisers, specialty bedding retailers, and its own direct-to-consumer website. Tempur Sealy International Inc is headquartered in Lexington, Kentucky.

Summary

ETHAN ALLEN INTERIORS reported a 4.8% increase in total revenue for their second quarter of FY2023, ending December 31 2022. Although this is a positive sign for investors, net income decreased by 2.4% year over year. Despite this decrease in net income, ETHAN ALLEN INTERIORS remains in a strong financial position and could be an attractive investment opportunity for investors. Investors may be interested in ETHAN ALLEN INTERIORS due to the company’s steady growth and consistent profitability. Over the past year, ETHAN ALLEN INTERIORS has increased their total revenue and managed to remain profitable despite a decrease in net income. The company’s ability to remain profitable and make a profit could be an attractive investment opportunity for investors who are looking for a steady return on their investments. ETHAN ALLEN INTERIORS is well positioned to take advantage of several growth opportunities. The company has a strong presence in the home furnishings market, which is expected to grow over the next few years.

In addition, the company has established a strong network of retail partners and suppliers, which could help them capitalize on future growth opportunities. In conclusion, ETHAN ALLEN INTERIORS may be an attractive investment opportunity for investors who are looking for steady returns and growth potential. The company has a strong presence in the home furnishings market, has increased its total revenue over the past year, and is well positioned to take advantage of growth opportunities in the future.

Recent Posts