Despegar.com Intrinsic Value Calculator – DESPEGAR.COM Reports Q4 2022 Revenue Decrease of 48.3% Year-on-Year

March 31, 2023

Earnings Overview

For the fourth quarter of its fiscal year 2022, which concluded on December 31 2022, DESPEGAR.COM ($NYSE:DESP) reported total revenue of USD -15.2 million, a 48.3% decrease compared to the same period the year prior. Net income, however, experienced an increase of 16.8% year-on-year, amounting to USD 145.5 million.

Transcripts Simplified

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Despegar.com. More…

| Total Revenues | Net Income | Net Margin |

| 537.97 | -68.53 | -12.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Despegar.com. More…

| Operations | Investing | Financing |

| 26.06 | -50.18 | -15.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Despegar.com. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 804.17 | 931.32 | -0.48 |

Key Ratios Snapshot

Some of the financial key ratios for Despegar.com are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.8% | – | -0.3% |

| FCF Margin | ROE | ROA |

| -0.9% | 1.1% | -0.1% |

Price History

On Thursday, DESPEGAR.COM reported a 48.3% decrease in its fourth quarter revenue compared to the same period last year. This news caused the stock to open at $5.3 and close at $5.5, representing a 2.2% increase from its prior closing price of $5.4. The decline in DESPEGAR.COM’s fourth quarter revenue can be attributed to the ongoing pandemic, which has caused travel restrictions and a decline in international tourism. The company’s core business is online travel booking, which has been severely impacted by the pandemic-related restrictions. Despite the revenue decrease, DESPEGAR.COM has managed to remain profitable by cutting costs, diversifying its services and expanding into new markets.

The company has also reported an increase in digital purchases, which is an encouraging sign for future growth. In light of this news, investors remain cautiously optimistic about DESPEGAR.COM’s future. The company is expected to continue to seek out new growth opportunities while maintaining cost-efficiency to remain profitable in the long term. Live Quote…

Analysis – Despegar.com Intrinsic Value Calculator

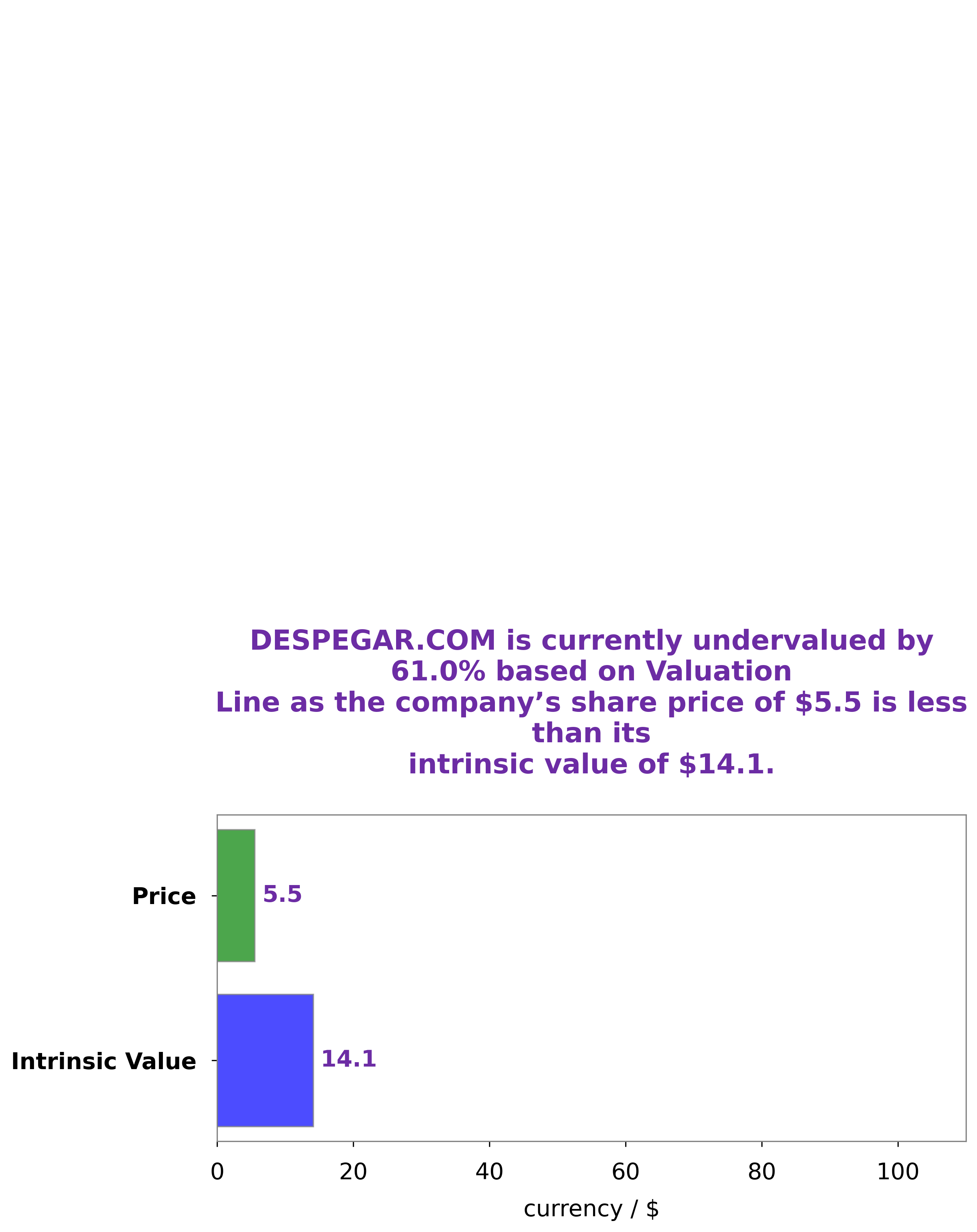

We at GoodWhale have conducted an analysis of DESPEGAR.COM‘s financials and concluded that the fair value of their share is around $14.1. This value was calculated using our proprietary Valuation Line. As of now, the stock of DESPEGAR.COM is trading at $5.5, which is undervalued by 61.0% relative to its fair value. We believe that it is a good time for investors to buy the stock as it is currently undervalued. More…

Peers

It competes with other online travel companies such as Yatra Online Inc, W&E Source Corp, and Travel+Leisure Co. These companies all strive to provide the best services to their clients by offering competitive prices, extensive travel options, and excellent customer service.

– Yatra Online Inc ($NASDAQ:YTRA)

Yatra Online Inc is an Indian online travel services company which provides customers with a platform to research and plan their travel, book flights, hotels, and other services. As of 2023, Yatra Online Inc has a market capitalization of 111.59 million USD. The company’s return on equity (ROE) is -12.28%, which indicates a decrease in profitability compared to the previous year. This can be attributed to increased competition in the online travel services space, as well as the effects of the COVID-19 pandemic on the travel industry.

– W&E Source Corp ($OTCPK:WESC)

W&E Source Corp is a business and technology services company that provides services ranging from IT consulting to managed services and project implementation. The company has experienced strong growth over the last few years, reflected in its market cap of 793.52k as of 2023. Additionally, W&E Source Corp has been able to achieve a Return on Equity of 49.09%, which is higher than the industry average. This suggests that the company is efficiently using its assets and is well-positioned to generate higher returns in the future.

– Travel+Leisure Co ($NYSE:TNL)

Travel+Leisure Co is a travel, hospitality, and lifestyle company that provides customers with an array of travel-related services and products. It has a market capitalization of 3.02 billion dollars as of 2023, which means that its stocks are valued at 3.02 billion dollars. Additionally, its Return on Equity (ROE) of -46.67% indicates that the company has had a poor financial performance in recent years. This could be due to a number of factors, including the pandemic which has affected the travel industry significantly.

Summary

DESPEGAR.COM’s fourth quarter performance for FY 2022 showed mixed results, with total revenue declining significantly by 48.3% year-on-year but net income increasing by 16.8%. For investors, the focus should be on the company’s ability to turn revenue declines into profit increases, as well as its long-term strategy for revenue growth. Furthermore, investors should monitor the company’s cash flow and liquidity position to ensure it has the capital needed to achieve long-term success.

Recent Posts