CONDUENT INCORPORATED Reports Total Revenue Decrease of 732.5% for Q4 FY2022.

March 12, 2023

Earnings Overview

CONDUENT INCORPORATED ($NASDAQ:CNDT) reported a total revenue decline of 732.5% for the fourth quarter of FY2022 ending December 31 2022, compared to the same period a year prior. Net income also decreased by 5.9%, to USD 986.0 million. The results were released on February 14 2023.

Transcripts Simplified

Conduent finished the year with strong sales metrics, including ACV, growing 22% in the quarter versus prior year to $194 million, and TCV growing 132% in Q4 2022. Government segment ACV was up 36% year-over-year, while Commercial segment ACV was up 14%. New business ARR was essentially flat both quarter-over-quarter and year-over-year. With strong components of NRR from three government deals, Conduent finished the year with results at the low end of their full year guided range.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Conduent Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 3.86k | -182 | -1.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Conduent Incorporated. More…

| Operations | Investing | Financing |

| 144 | 173 | -131 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Conduent Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.57k | 2.65k | 5.59 |

Key Ratios Snapshot

Some of the financial key ratios for Conduent Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.8% | 82.1% | -1.1% |

| FCF Margin | ROE | ROA |

| -0.2% | -2.5% | -0.8% |

Market Price

This is the company’s worst performance in recent history. As a result, CONDUENT INCORPORATED stock opened at $4.4 and closed at $4.3, down by 2.3% from its last closing price of $4.4. The decline in revenue is largely attributed to an ongoing decline in demand for its services due to the pandemic. The company has also been affected by a decrease in its operating performance due to cost-cutting measures implemented to stay afloat during this tough period. Analysts have expressed concern over the company’s future prospects as it struggles to find new sources of revenue to offset the losses.

The company’s inability to quickly adjust its business model and adapt to rapidly changing market conditions has been a major impediment to its success. With its total revenue decreasing by 732.5%, it remains to be seen how CONDUENT INCORPORATED will fare in the coming quarters. Investors are encouraged to exercise caution when considering the stock as the company’s future performance could be adversely impacted by mounting losses. Live Quote…

Analysis

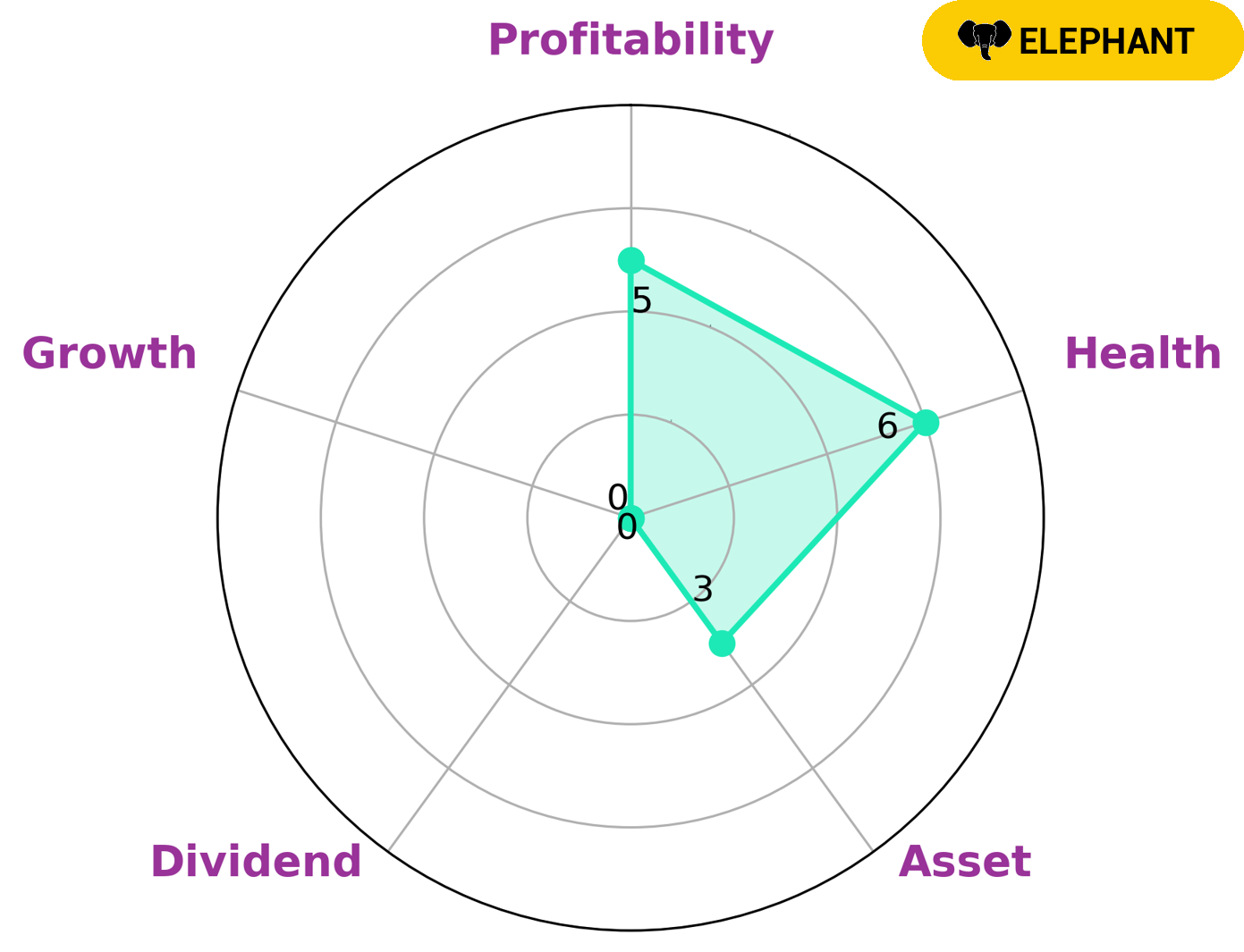

At GoodWhale, we’ve taken an in-depth look at CONDUENT INCORPORATED’s fundamentals. Our Star Chart analysis categorizes the company as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. These companies attract investors who are looking for stability and capital appreciation. We also assess CONDUENT INCORPORATED’s health score to be 6/10. This indicates that it is relatively healthy, and should be able to sustain future operations in times of crisis. We rate CONDUENT INCORPORATED as strong in cash flows and debt, medium in profitability and weak in assets, dividend and growth. For investors looking for a company with a good track record of consistent performance, CONDUENT INCORPORATED is a solid option. The company’s intermediate health score and its asset-rich fundamentals make it an attractive prospect for long-term investors. More…

Peers

Conduent Inc., a leading provider of business process services, competes with Beijing Jingyeda Technology Co Ltd, Ronglian Group Ltd, and Minds + Machines Group Ltd. in the market for business process services. Conduent Inc. has a strong market position and a well-established brand. Its competitors are smaller and less well-known.

– Beijing Jingyeda Technology Co Ltd ($SZSE:003005)

Beijing Jingyeda Technology Co Ltd is a technology company that focuses on providing information technology services. Its market cap as of 2022 was 7.65B, and its ROE was 2.33%. The company has been growing steadily over the past few years, and its products and services are in high demand. Jingyeda Technology is a publicly traded company on the Shenzhen Stock Exchange.

– Ronglian Group Ltd ($SZSE:002642)

Ronglian Group Ltd is a Chinese conglomerate with a market cap of 6.12 billion as of 2022. The company has a return on equity of 2.83%. Ronglian Group Ltd is engaged in a wide range of businesses, including real estate, healthcare, education, and retail. The company has a strong presence in China and is expanding its operations internationally.

– Minds + Machines Group Ltd ($OTCPK:TLVLF)

Minds + Machines Group Ltd is a top-level domain name registry. The company has a market capitalization of 10.63M as of 2022 and a return on equity of 3.18%. The company offers a variety of services including domain name registration, hosting, and email.

Summary

CONDUENT INCORPORATED reported considerable declines in both revenue and net income for their fourth fiscal quarter of 2022, when compared to the same quarter the prior year. Revenue dropped by 732.5%, amounting to a total of -333 million USD. Net income similarly decreased by 5.9%, to 986 million USD.

Despite the major losses, investors may find hope in the company’s ability to maintain profitability even in a challenging quarter. Further analysis of their financials may be beneficial in understanding the potential of CONDUENT INCORPORATED as an investment opportunity.

Recent Posts