CONCENTRIX CORPORATION Reports Fourth Quarter 2022 Results with 15.4% Revenue Decrease and 11.9% Net Income Increase

January 28, 2023

Earnings report

On November 30, 2022, CONCENTRIX CORPORATION ($NASDAQ:CNXC) reported their earnings results for the fourth quarter of the fiscal year 2022. CONCENTRIX CORPORATION is a leading global provider of technology-based services, offering solutions for clients in the financial services, telecom, retail and media industries. The total revenue for the period was USD 104.9 million, a decrease of 15.4% when compared to the same period the previous year. This decrease may be attributed to the pandemic-related slowdown in the industries served by CONCENTRIX CORPORATION as well as the decreased demand for their services. Despite this, net income was USD 1640.7 million, an increase of 11.9% when compared to the same quarter the year before.

This increase is likely due to cost-cutting measures implemented by management and the increased efficiency of their operations. Overall, these results demonstrate CONCENTRIX CORPORATION’s resilience in a difficult economic environment, as well as their ability to adapt to changing market conditions and capitalize on new opportunities. They have also shown that they can maintain profitability despite reduced revenues. These results are encouraging and demonstrate the potential for future growth for the company.

Market Price

CONCENTRIX CORPORATION reported its fourth quarter 2022 results on Thursday. The company reported a 15.4% decrease in revenue compared to the same period last year, while net income increased by 11.9%. Following the announcement, the company’s stock opened at $143.2 and closed at $143.0, down 0.9% from the prior closing price of $144.3. The lower revenue was attributed to a decrease in demand for the company’s services and products, as well as higher costs associated with servicing existing clients. In spite of this, CONCENTRIX CORPORATION managed to increase its net income through cost-cutting measures and an increase in efficiency. The company’s management team is confident that the company’s performance will improve in the coming quarters due to its focus on improving customer service, developing new products and services, and expanding its reach into new markets.

The company is also investing heavily in research and development and is confident that its efforts will yield positive results in the future. Overall, CONCENTRIX CORPORATION’s fourth quarter 2022 results were mixed. The company’s revenue decreased significantly, but its net income increased due to cost-cutting measures and improved efficiency. The company’s stock price was down 0.9% after the announcement, but its management team is confident that its performance will improve in the coming quarters due to its focus on improving customer service, developing new products and services, and expanding its reach into new markets. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Concentrix Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 6.32k | 435.05 | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Concentrix Corporation. More…

| Operations | Investing | Financing |

| 547.09 | -78.65 | -401.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Concentrix Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.67k | 3.97k | 52.76 |

Key Ratios Snapshot

Some of the financial key ratios for Concentrix Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 29.6% | 10.7% |

| FCF Margin | ROE | ROA |

| 6.5% | 15.8% | 6.3% |

VI Analysis

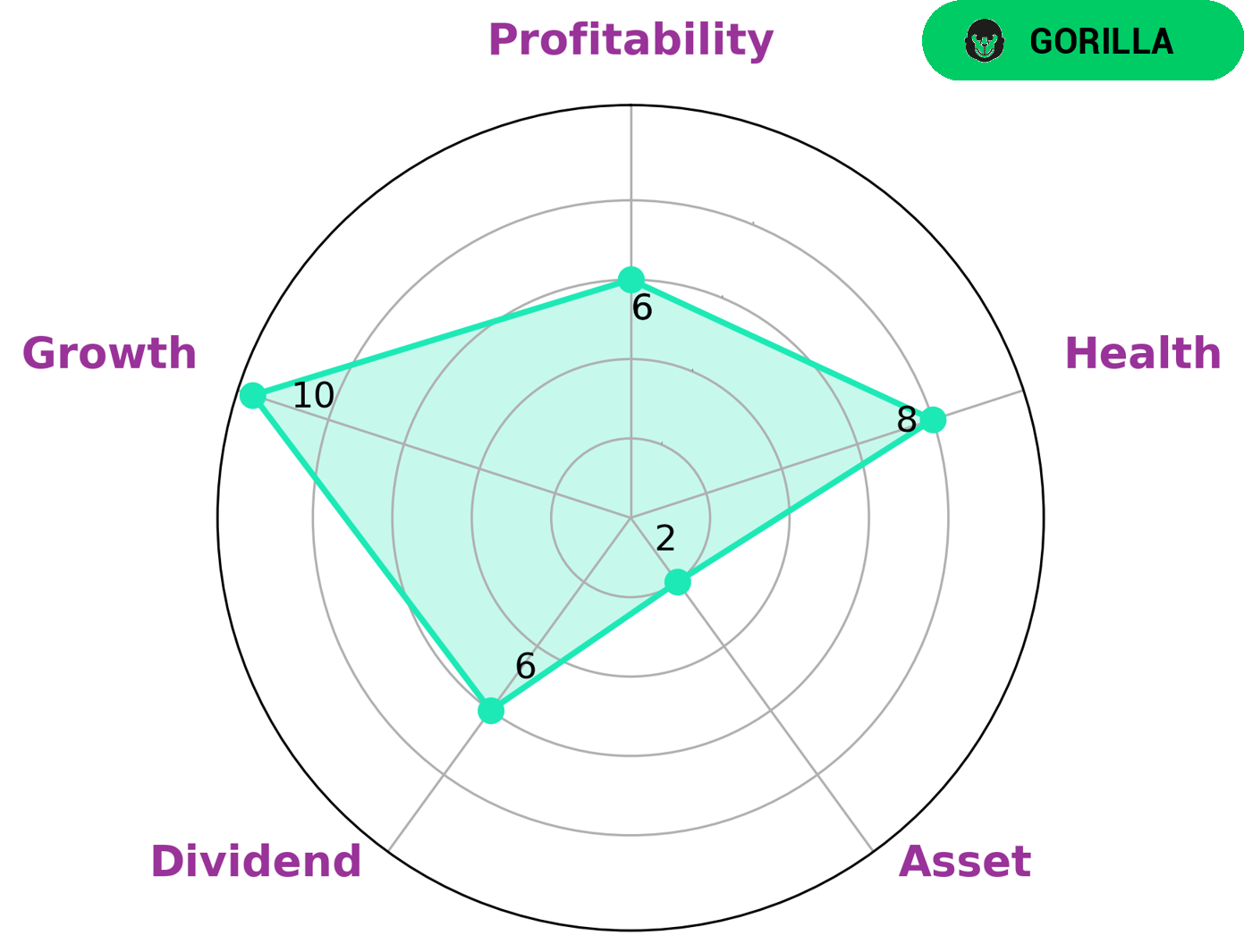

Investors looking for a company with robust long-term potential may consider CONCENTRIX CORPORATION, which is classified as a “gorilla” in the VI Star Chart. This type of company has achieved stable and high revenue or earning growth due to its strong competitive advantage. CONCENTRIX CORPORATION has a high health score of 8/10, meaning it is able to safely ride out any crisis without the risk of bankruptcy due to its secure cashflows and debt. The company is strong in growth, medium in dividend, and weak in asset. Moreover, CONCENTRIX CORPORATION has a strong track record of consistent performance over the years, with the potential for further growth in the future. Its management team is experienced and has a proven track record of success. Furthermore, the company is well-positioned in its industry and has access to technology and resources that will help it remain competitive. In conclusion, CONCENTRIX CORPORATION is an attractive option for investors looking for a reliable and profitable company with long-term potential. Its strengths in growth, dividend and profitability, combined with its secure cashflows and debt, make it a safe investment. The company’s experienced management team and access to technology and resources further strengthen its position in the market. More…

VI Peers

The company has a strong presence in the US, Europe, and Asia-Pacific regions. Concentrix Corp’s competitors include WidePoint Corp, Oracle Corp Japan, Alithya Group Inc, and other IT outsourcing and customer relationship management companies.

– WidePoint Corp ($NYSEAM:WYY)

As of 2022, WidePoint Corporation’s market capitalization is $22.18 million. The company’s return on equity is -30.85%. WidePoint Corporation is a technology solutions provider that specializes in secure mobility management and enterprise cybersecurity solutions. The company’s products and services enable government agencies and enterprises to deploy and manage mobile devices and applications securely and cost-effectively.

– Oracle Corp Japan ($TSE:4716)

Oracle Corporation Japan is a Japanese subsidiary of Oracle Corporation. It is one of the largest software companies in the world, with a market capitalization of over $1 trillion. The company develops and sells database, middleware, and application software. Oracle Corporation Japan has a return on equity of 37.48%.

– Alithya Group Inc ($TSX:ALYA)

Alithya Group Inc is a global technology and management consulting firm. They offer a comprehensive range of digital, consulting, and managed services to organizations in North America, Europe, and Asia Pacific. They have a market cap of 232M as of 2022 and a Return on Equity of -4.33%. The company has been struggling financially in recent years and has been cutting costs in an attempt to improve their bottom line.

Summary

The recently reported financial results of CONCENTRIX CORPORATION for the fourth quarter of fiscal year 2022 have shown that the company experienced a decrease in total revenue of 15.4%, but an increase in net income of 11.9% when compared to the same period of the previous year. This clearly indicates that the company has managed to improve its profitability despite the decrease in revenue, indicating a positive outlook for future performance. Investors should be encouraged by the fact that CONCENTRIX CORPORATION has managed to increase its net income despite the decrease in total revenue. This suggests that the company has made significant improvements in its operational efficiency and cost control measures. Furthermore, the company’s financial position is strong, with no long-term debt, and a cash balance of USD 1 billion. Therefore, investors should be confident in the company’s ability to sustain its positive performance in the long run.

In addition, CONCENTRIX CORPORATION is well-positioned to benefit from the current market environment. The company has a diversified portfolio of services and products, and is well-established in its industry. Therefore, the company should be able to capitalize on any potential growth opportunities in the market. Overall, investors should be encouraged by the recent financial performance of CONCENTRIX CORPORATION, as it has demonstrated a strong commitment to generating increased profitability despite decreased revenue. The company is well-positioned to capitalize on any potential growth opportunities and should provide investors with a solid return on their investments in the long run.

Recent Posts