Concentrix Corporation misses earnings and revenue estimates in Q3

September 29, 2022

Trending News 🌧️

In a press release, the company announced that its non-GAAP earnings per share for the quarter was $2.95, missing analysts’ estimates by $0.02. Additionally, revenue for the quarter came in at $1.58 billion, missing estimates by $10 million. The company attributed the misses to lower-than-expected performance in its healthcare business. Concentrix($NASDAQ:CNXC) said that it is taking steps to improve its performance in this business segment, including hiring a new leadership team and investing in new technology and processes.

Earnings

In the earning report of FY2022 Q2, CONCENTRIX CORPORATION earned 5968.0M USD in total revenue, earned 457.3M USD in net income. Compared to previous year, 6.8% increase in total revenue, 12.7% increase in net income. CONCENTRIX CORPORATION’s total revenue reached from 4719.5M USD to 5968.0M USD in the last 3 years.

Price History

The news sentiment around CONCENTRIX CORPORATION stock is mostly negative. However, on Wednesday the stock opened at $113.2 and closed at $117.5, up 3.5% from the previous closing price of $113.5. This could be due to a number of factors, including the company’s recent announcement of plans to expand its operations in the Philippines.

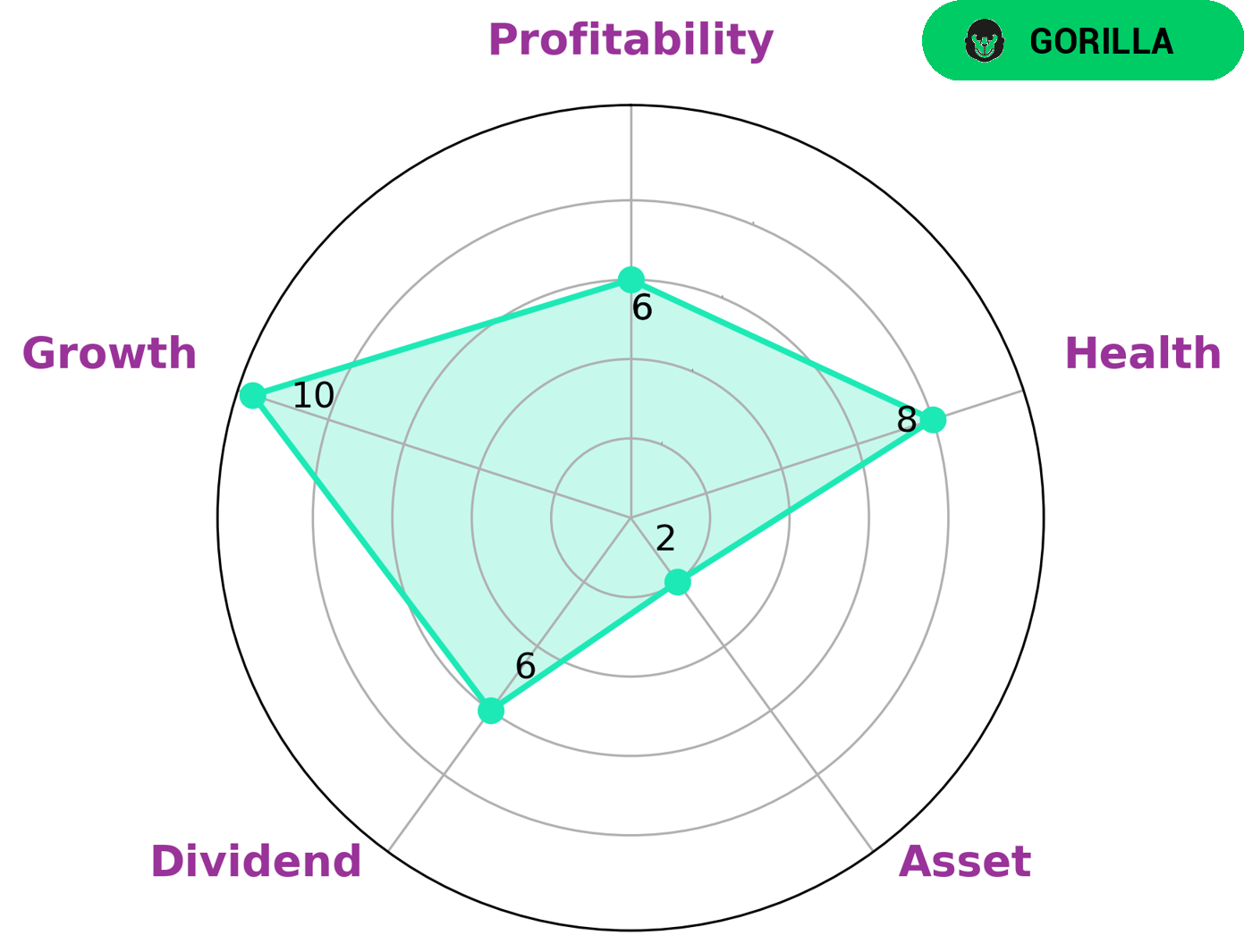

VI Analysis

Concentrix Corporation is a strong company with high growth potential. Its fundamentals reflect its long term potential, and its cash flows and debt levels indicate that it is capable of sustaining future operations in times of crisis. However, the company is weak in terms of dividend payouts and asset management, and is therefore classified as a ‘gorilla’ company. a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. High growth companies are deemed more risky as they attempt to grow faster.

Summary

The stock price moved up the same day, however, the sentiment around the company is mostly negative. Some believe that the company is not well-positioned to weather an economic downturn. Others are concerned about the company’s high debt levels.

Recent Posts