CINCINNATI FINANCIAL Reports 31.3% Decrease in Total Revenue for FY2022 Fourth Quarter

March 26, 2023

Earnings Overview

At the end of the fourth quarter of FY2022 (December 31 2022), CINCINNATI FINANCIAL ($BER:CCJ) reported total revenue of USD 1.0 billion, a decrease of 31.3% as compared to the same period of the year before. Net income for the quarter was USD 3.1 billion, 6.3% lower than the corresponding period in the prior year.

Stock Price

This was compared to the same quarter the previous year. The company’s stock opened at €106.2 and closed at €106.2, representing a slight increase of 0.6% from the previous closing price of 105.6. The decrease in revenue was due to several factors, including lower premiums earned from policies, lower investment income and higher expenses related to the company’s growth initiatives. Despite these negative factors, the company’s performance was still strong as evidenced by its strong stock price on Monday.

The company remains committed to its goal of achieving long term profitable growth, and has implemented several measures to help it overcome the current challenging environment. These include expanding its customer base through an increase in digital channels, as well as investing in new products and services. CINCINNATI FINANCIAL is determined to continue providing value to its shareholders through strong financial results and continued growth in the future. As the company looks ahead, it believes that its strategies will help bring improved performance in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cincinnati Financial. More…

| Total Revenues | Net Income | Net Margin |

| 6.56k | -486 | -7.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cincinnati Financial. More…

| Operations | Investing | Financing |

| 2.05k | -933 | -994 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cincinnati Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.74k | 19.2k | 67.03 |

Key Ratios Snapshot

Some of the financial key ratios for Cincinnati Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.1% | – | -9.8% |

| FCF Margin | ROE | ROA |

| 31.1% | -4.0% | -1.3% |

Analysis

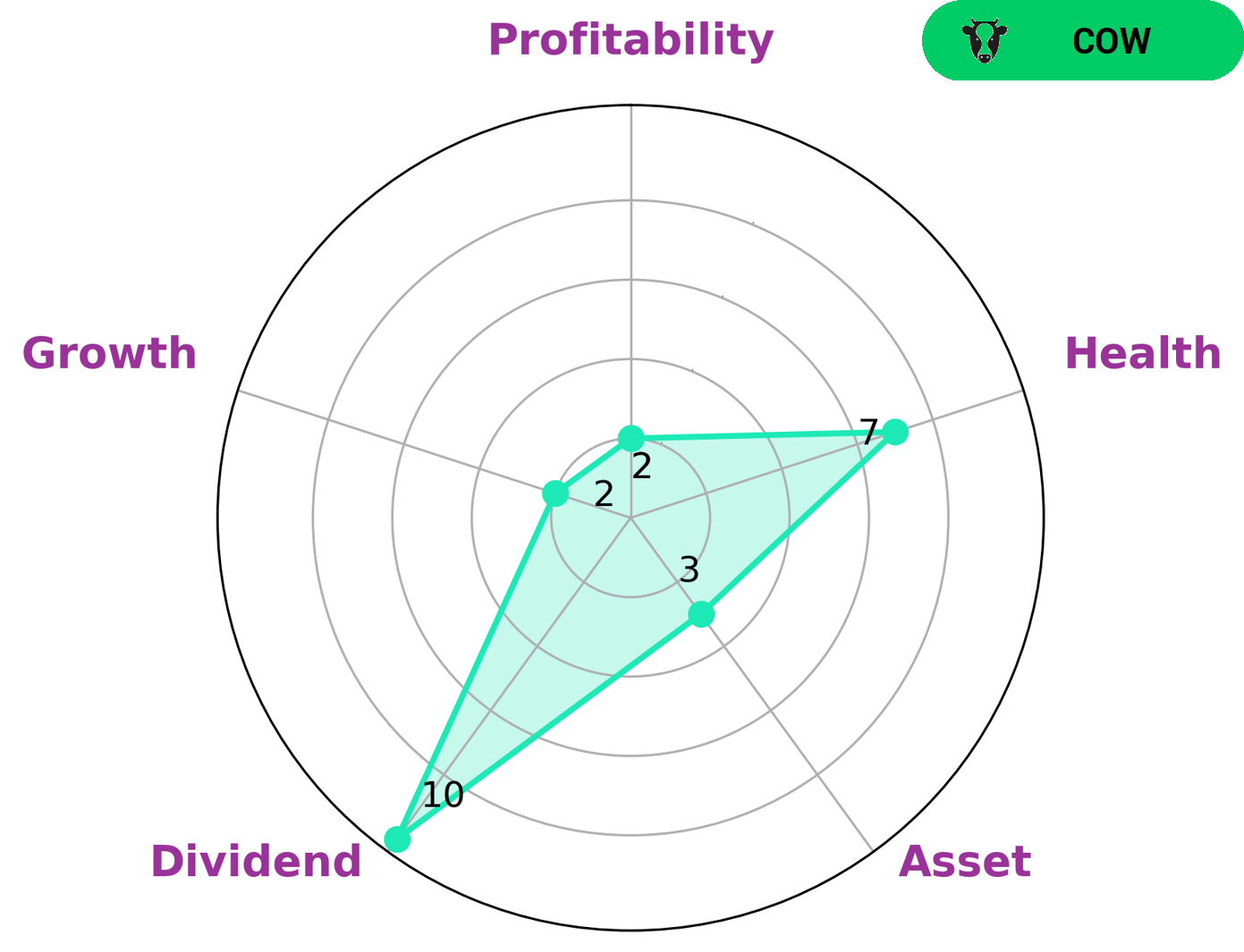

GoodWhale recently performed an analysis of CINCINNATI FINANCIAL‘s financials, and based on our Star Chart, CINCINNATI FINANCIAL is strong in dividend, and weak in asset, growth, and profitability. Based on this analysis, we classified CINCINNATI FINANCIAL as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This would make such a company attractive to investors looking to generate income from their investments. CINCINNATI FINANCIAL also has a high health score of 7/10 with regard to its cashflows and debt, indicating it is capable of sustaining operations in times of crisis. More…

Summary

CINCINNATI FINANCIAL reported total revenue of USD 1.0 billion in the fourth quarter of FY2022, a decrease of 31.3% year-over-year. Net income came in at USD 3.1 billion, 6.3% lower than the same period of the previous year. Given the company’s revenue and income decrease, investors should exercise caution when considering CINCINNATI FINANCIAL as it is unclear how the company will respond going forward. The company’s performance should be monitored and further research conducted to determine whether investing in CINCINNATI FINANCIAL will yield a positive return.

Recent Posts