CHEGG Reports Decreased Revenue and Net Income for FY2022 Q4

March 7, 2023

Earnings report

On December 31 2022, CHEGG ($NYSE:CHGG) reported its earnings results for FY2022 Q4 for the fourth quarter. Total revenue achieved was USD 1.9 million, a significant decrease of 92.3% from the same period the previous year. While this decrease in revenue is a negative outcome, net income reported was USD 205.2 million, still representing a decrease of 1.1% from the same period the year before. This decrease in net income has been credited to the increasing pressure put on CHEGG’s operations and services due to the global pandemic and its related travel restrictions. These restrictions have significantly impacted CHEGG’s business model, which relies heavily on offering a wide range of services for college students.

To make up for the decrease in revenue, CHEGG has been implementing cost-cutting measures, such as closing down offices and reducing staff. Despite the decreasing levels of revenue and net income, CHEGG continues to move forward with expanding its services and functionality. The company remains committed to delivering the best education solutions to its customers and is making use of new technologies such as machine learning and artificial intelligence to do so. CHEGG is optimistic that this will result in an increase in revenue in the coming year.

Share Price

On Monday, CHEGG reported decreased revenue and net income in its fourth quarter of fiscal year 2022. The company’s stock opened at $21.0 and closed at the same price, down 1.5% from the previous closing price of $21.3. This signals a decrease in investor confidence in CHEGG’s current performance.

Although the company provided no details on why their fiscal year 2022 Q4 numbers were lower than expected, investors are hoping that the company will take corrective action to prevent further losses. The decrease in revenue and net income is a cause for concern for investors and it remains to be seen how CHEGG will respond. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Chegg. More…

| Total Revenues | Net Income | Net Margin |

| 766.9 | 266.64 | 34.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Chegg. More…

| Operations | Investing | Financing |

| 255.74 | 104.89 | -744.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Chegg. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.47k | 1.35k | 8.83 |

Key Ratios Snapshot

Some of the financial key ratios for Chegg are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.1% | -20.6% | 14.3% |

| FCF Margin | ROE | ROA |

| 19.9% | 6.4% | 2.8% |

Analysis

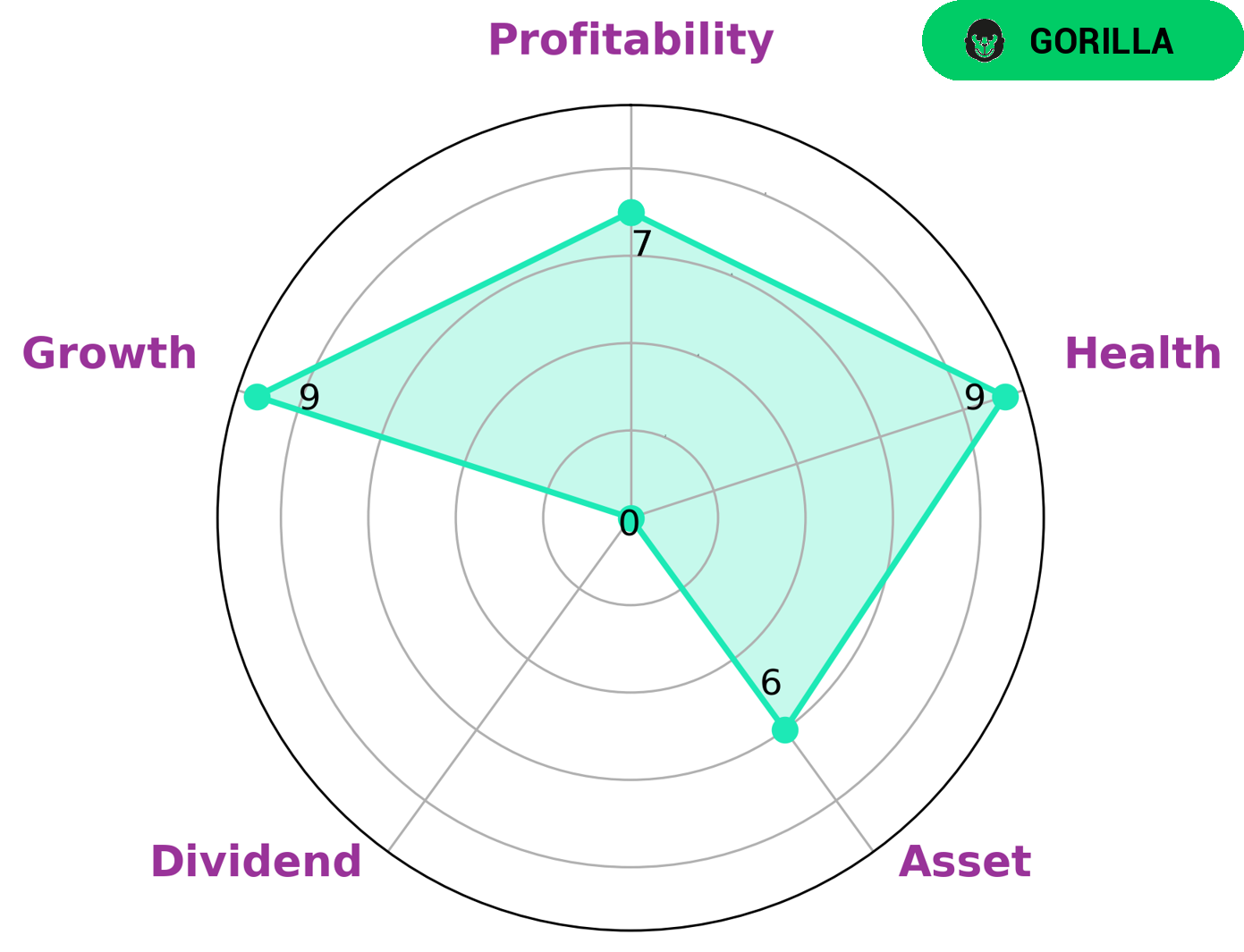

As GoodWhale conducted a fundamental analysis of CHEGG‘s performance, we identified that it was classified as a ‘gorilla’ according to the Star Chart. This means that CHEGG has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given CHEGG’s impressive performance, investors that are looking for strong returns would be highly interested in investing in such a company. Furthermore, with a health score of 9/10, CHEGG is in a strong financial position, with the capability to pay off debt and fund future operations. In terms of its performance across factors, CHEGG is strong in growth and profitability, while it is medium in asset quality. Lastly, it is a weak dividend stock. Taking into consideration these performance metrics, CHEGG has the potential to be of interest to many investors. More…

Peers

Chegg Inc is an American education technology company based in Santa Clara, California. The company offers digital and physical textbook rentals, online tutoring, and other student services. Chegg is one of the largest online textbook rental companies in the United States. The company has been criticized for its business model, which has been likened to textbook flipping, and for its environmental impact.

Chegg’s competitors include: CognaEducacao SA, Perdoceo Education Corp, Wah Fu Education Group Ltd.

– CognaEducacao SA ($OTCPK:COGNY)

Cogna Educacao SA is a publicly traded company with a market capitalization of 1.07 billion as of 2022. The company operates in the education sector and provides educational services and products in Brazil and internationally. The company has a return on equity of 2.54%.

– Perdoceo Education Corp ($NASDAQ:PRDO)

Perdoceo Education Corporation is a provider of higher education operating primarily through its two universities, Colorado Technical University and American InterContinental University. The company offers bachelor’s and master’s degrees in a variety of disciplines, including business, computer science, engineering, nursing, and more. Perdoceo Education Corporation is headquartered in Colorado Springs, Colorado.

– Wah Fu Education Group Ltd ($NASDAQ:WAFU)

Wah Fu Education Group Ltd. is a provider of educational services in Mainland China. The Company operates its business through four segments. The Pre-school Education segment offers educational programs and services for children aged three to six. The K-12 Education segment provides educational programs and services for students aged six to 18. The Adult and Other Education segment offers educational programs and services for adults. The International Education segment provides international education programs and services. The Company operates a number of schools, including Wah Fu Kindergarten, Wah Fu Bilingual School, Wah Fu International School and others.

Summary

Chegg Inc. is a media technology company that provides online educational tools and services to students. In light of the current economic climate, Chegg’s financial performance presents a mixed picture for potential investors to consider. Although total revenue dropped dramatically, net income is still consistent and suggests a reasoned approach to cost-cutting and investing.

Recent Posts