BROOKDALE SENIOR LIVING Reports 68.6% Increase in Q4 FY2022 Revenue to -$25.6 Million

March 14, 2023

Earnings Overview

On February 21 2023, BROOKDALE SENIOR LIVING ($NYSE:BKD) announced that their total revenue for the fourth quarter of FY2022 (ending December 31 2022) had increased by 68.6%, totalling USD -25.6 million compared to the same quarter of the previous year. Net income was also reported to be 8.1% higher year over year at USD 695.7 million.

Transcripts Simplified

Brookdale Senior Living accomplished a lot in 2022, especially on the top line, but there were areas of the business where they didn’t meet expectations, causing adjusted EBITDA results to fall below guidance. Brookdale achieved guidance for RevPAR growth of 10% for the full year, and total revenue and other operating income exceeded expectations. Fourth quarter facility operating expenses were higher than expected due to labor expenses and unforeseen expense from Winter Storm Elliott.

Brookdale has been diligently trying to attract the best associates and reduce premium labor costs, but did not deliver the expected progress in the fourth quarter. For 2023, Brookdale is taking actions to support significant adjusted EBITDA growth this fiscal year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BKD. More…

| Total Revenues | Net Income | Net Margin |

| 2.74k | -238.43 | -10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BKD. More…

| Operations | Investing | Financing |

| 3.28 | -67.43 | 100.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BKD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.94k | 5.35k | 3.11 |

Key Ratios Snapshot

Some of the financial key ratios for BKD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.2% | -65.4% | -1.0% |

| FCF Margin | ROE | ROA |

| -7.1% | -3.2% | -0.3% |

Market Price

On Tuesday, BROOKDALE SENIOR LIVING reported a 68.6% increase in its Q4 FY2022 revenue to -$25.6 million. The stock opened the day at $3.0 and closed at the same price, down by 1.6% from its prior closing price of $3.1. Overall, BROOKDALE SENIOR LIVING reported a 68.6% increase in revenue for the quarter ending March 31, 2022, but its stock closed 1.6% lower on Tuesday than its prior closing price of $3.1. The company’s same-store occupancy increased slightly and its total assets and liabilities both increased during the quarter. Live Quote…

Analysis

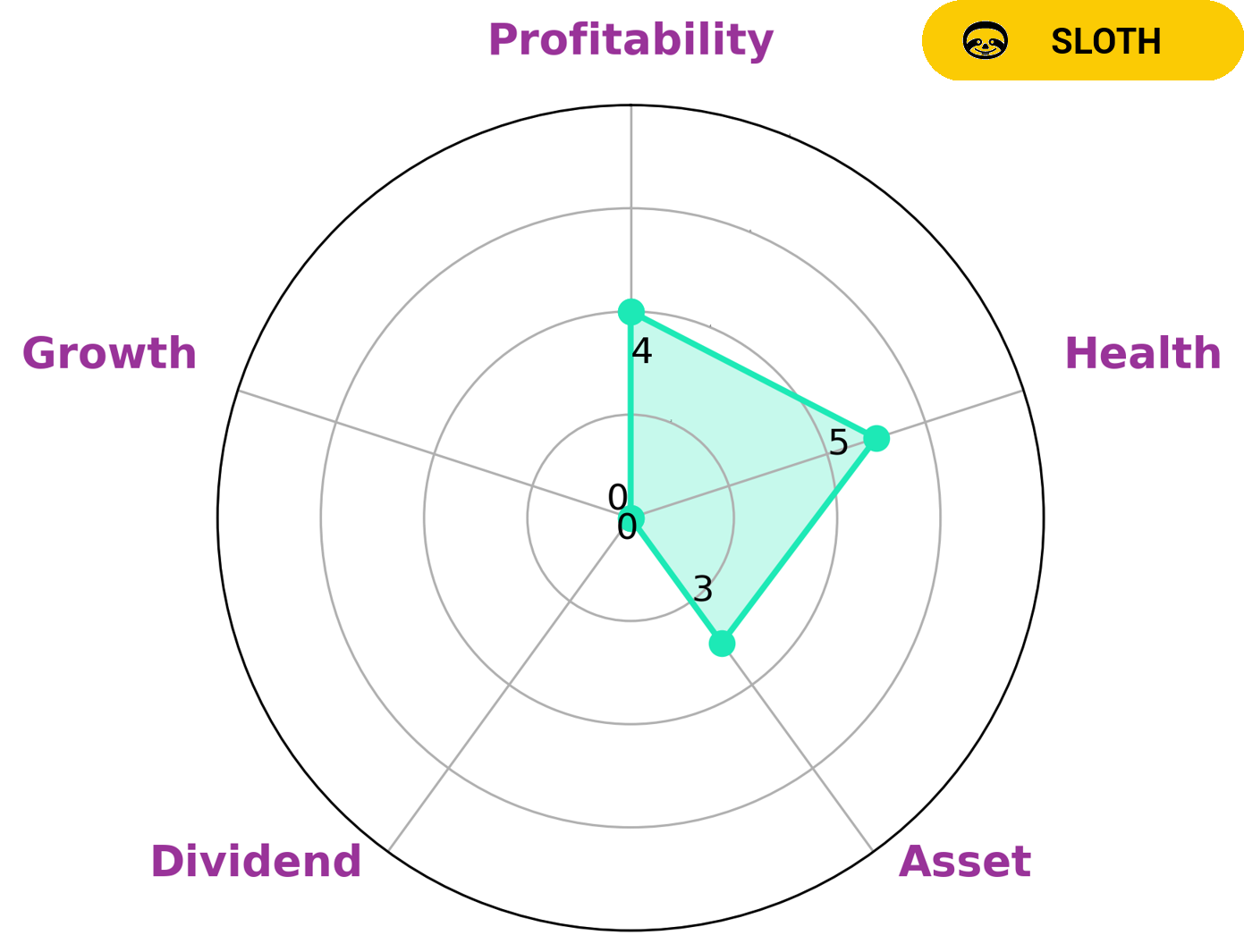

GoodWhale has conducted an analysis of BROOKDALE SENIOR LIVING’s wellbeing. According to our Star Chart, the company is strong in terms of liquidity, medium in terms of profitability and weak in terms of asset, dividend and growth. We have classified BROOKDALE SENIOR LIVING as a ‘sloth’, meaning it has achieved revenue or earnings growth slower than the overall economy. Given its intermediate health score of 5/10 with regard to its cashflows and debt, BROOKDALE SENIOR LIVING might be able to sustain future operations in times of crisis. Therefore, investors interested in value investing, those focusing on dividend yields, and those looking for long-term investments with a more steady return profile might be interested in such company. More…

Peers

Brookdale Senior Living Inc. is one of the largest senior living providers in the United States. It is headquartered in Nashville, Tennessee and has over 1,000 senior living communities in 44 states. Brookdale’s competitors include Summerset Group Holdings Ltd, National Healthcare Corp, and Amedisys Inc.

– Summerset Group Holdings Ltd ($NZSE:SUM)

Summerset Group Holdings Ltd is a New Zealand-based company engaged in the manufacture, sale and provision of retirement village, homecare and cemetery services. The Company operates through three segments: Retirement Villages, Homecare Services and Cemeteries. It offers a range of products and services to meet the needs of retirees, their families and loved ones. The Company’s subsidiaries include Summerset Management Services Limited, which is engaged in the provision of management services to the Company’s retirement villages; Summerset Homes Limited, which is engaged in the design and construction of retirement village homes; and Summerset Cemeteries Limited, which is engaged in the operation of cemeteries.

– National Healthcare Corp ($NYSEAM:NHC)

National Healthcare Corporation is a diversified healthcare company that owns and operates long-term care facilities, retirement centers, and home health care businesses. The company has a market capitalization of 920.8 million as of 2022 and a return on equity of 2.92%. National Healthcare Corporation’s long-term care facilities provide skilled nursing, rehabilitation, and assisted living services to seniors. The company’s retirement centers offer independent and assisted living, as well as memory care services. National Healthcare Corporation’s home health care businesses provide home health care services, including skilled nursing, physical therapy, and home health aides.

– Amedisys Inc ($NASDAQ:AMED)

Amedisys Inc is a healthcare services company with a market cap of 2.98B as of 2022. The company has a return on equity of 11.56%. Amedisys Inc provides home health, hospice, and personal care services to patients in the United States. The company was founded in 1982 and is headquartered in Baton Rouge, Louisiana.

Summary

BROOKDALE SENIOR LIVING reported strong financial results for the fourth quarter of FY2022 with total revenue increasing 68.6% year over year to -25.6 million USD. Net income also rose 8.1% to 695.7 million USD. This strong performance can be seen as a positive sign for potential investors, signaling that BROOKDALE SENIOR LIVING is able to generate profits despite difficult market conditions. This may indicate that the company has good potential to continue to grow in the future, making it an attractive option for investors.

Recent Posts