BASSETT FURNITURE INDUSTRIES Reports Lower Revenue and Net Income for Fourth Quarter of Fiscal Year 2022.

January 30, 2023

Earnings report

On January 24, 2023, BASSETT FURNITURE INDUSTRIES ($NASDAQ:BSET) announced their earnings results for the fourth quarter of fiscal year 2022 (ending November 30, 2022). BASSETT FURNITURE INDUSTRIES is a leading manufacturer and marketer of high-quality upholstered and wooden furniture products for the home. It is one of the top-producing furniture companies in the United States. BASSETT FURNITURE INDUSTRIES reported total revenue of USD 5.0 million for the fourth quarter of fiscal year 2022, a decrease of 0.2% compared to the same quarter a year prior. Net income was USD 121.0 million, a decrease of 6.8% year over year. The decreased net income was mainly attributed to an increase in advertising and promotional expenses, higher operating costs and lower gross margins.

Despite the lower revenue and net income, BASSETT FURNITURE INDUSTRIES remains committed to providing its customers with high-quality furniture products and services. The company is focused on expanding its product portfolio and increasing its presence in the home furnishings market. It has also implemented cost-saving measures and improved efficiency in its operations to help drive future growth. The company’s stock price was negatively impacted by the lower revenue and net income figures. Despite this, BASSETT FURNITURE INDUSTRIES remains confident in its ability to continue delivering value to its shareholders through its commitment to innovation, quality and customer service.

Price History

The company’s stock opened at $18.9 and closed at $18.9, up by 4.5% from its last closing price of 18.1. The lower revenue and net income was attributed to the impacts of the pandemic on the furniture industry. The company’s CEO commented that they are “disappointed” with their current performance, citing the impacts of the pandemic on the industry, as well as their ability to adapt to the changing consumer demand. The company’s lower earnings were partially offset by improved cost containment efforts and an increase in demand for home office furniture, as well as an increase in sales of products targeted at younger customers. BASSETT FURNITURE INDUSTRIES also noted an increase in their e-commerce sales, which they attribute to their focus on digital marketing and customer service.

Despite the lower earnings, BASSETT FURNITURE INDUSTRIES believes that their commitment to innovation and their focus on creating quality products will enable them to remain a strong competitor in the furniture industry. The company also announced plans to expand their product line and continue to invest in digital marketing and customer service initiatives. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BSET. More…

| Total Revenues | Net Income | Net Margin |

| 485.6 | 65.34 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BSET. More…

| Operations | Investing | Financing |

| -2.97 | 65.84 | -35.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BSET. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 406.27 | 210.66 | 21.85 |

Key Ratios Snapshot

Some of the financial key ratios for BSET are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.4% | 66.1% | 6.2% |

| FCF Margin | ROE | ROA |

| -5.0% | 9.7% | 4.7% |

VI Analysis

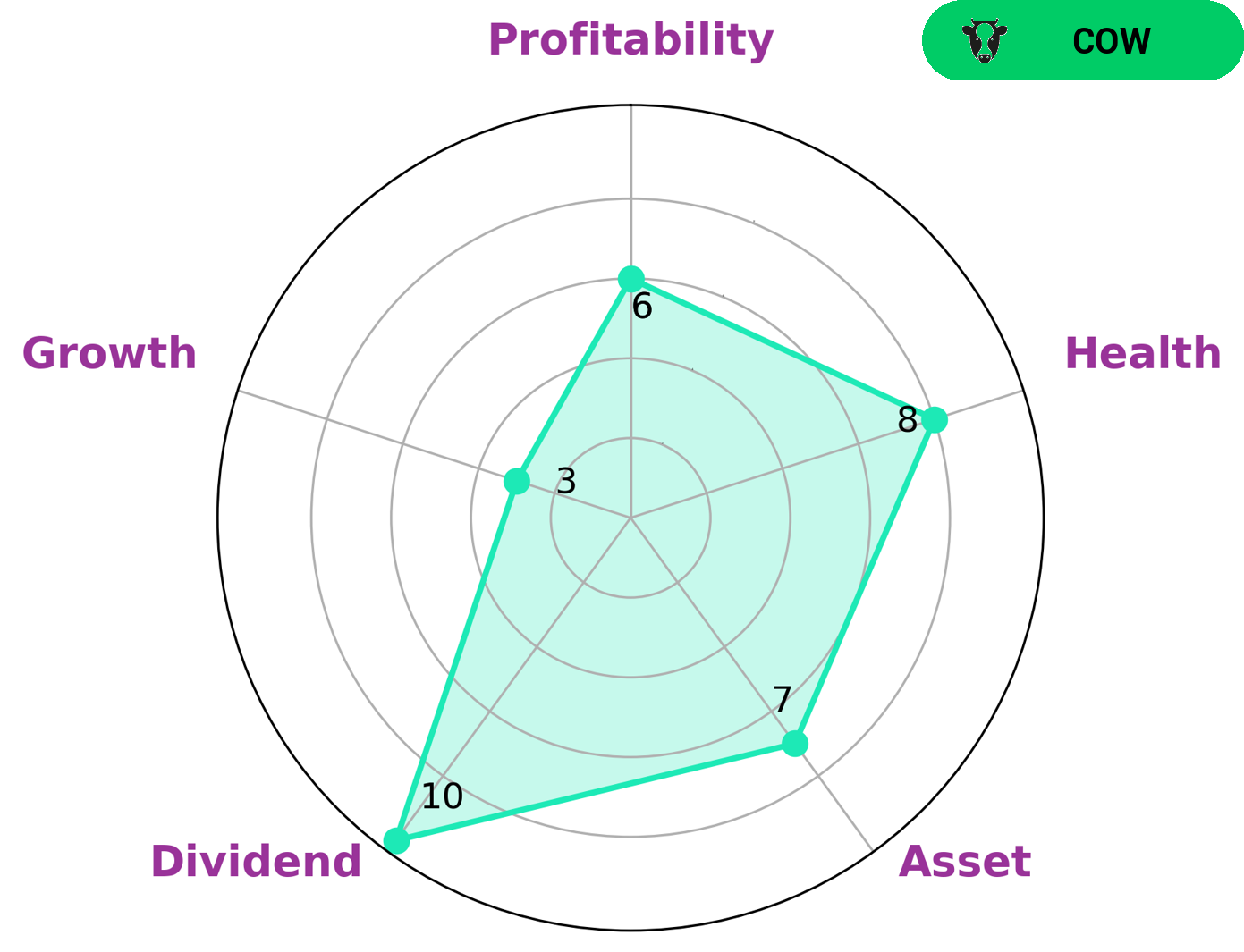

Analysis of BASSETT FURNITURE INDUSTRIES’ fundamentals is made easier through the use of the VI app. According to the VI Star Chart, BASSETT FURNITURE INDUSTRIES is classified as a ‘cow’, which is a type of company that has a track record of paying out consistent and sustainable dividends. Investors who are looking for a steady and reliable source of income may be interested in this type of company. The VI app also provides a comprehensive overview of BASSETT FURNITURE INDUSTRIES’s overall financial health. It is strong in asset, dividend, and medium in profitability, but weak in growth. The app also gives it a high health score of 8/10 with regards to its cash flows and debt, which suggests that it is capable of safely riding out any financial crisis without the risk of bankruptcy. In conclusion, the VI app makes it easier to analyze BASSETT FURNITURE INDUSTRIES’s long-term potential. Investors looking for a reliable source of income can consider this company, given its strong financial health and track record of paying out consistent dividends. More…

VI Peers

Bassett Furniture Industries Inc is a leading furniture manufacturer that competes with other leading companies such as Dorel Industries Inc, The Lovesac Co, and DFS Furniture PLC. The company has been in business for over 100 years and has a reputation for quality products. Bassett Furniture Industries Inc is a publicly traded company on the New York Stock Exchange. The company’s headquarters is located in Bassett, Virginia.

– Dorel Industries Inc ($TSX:DII.B)

Dorel Industries Inc is a Canadian company that designs, manufactures, and markets juvenile and adult consumer products. The company has a market cap of 166.2M as of 2022 and a Return on Equity of -9.02%.

Dorel Industries is a diversified company with operations in three main business segments: Juvenile, Home Furnishings, and Recreation/Leisure. The Juvenile segment designs, manufactures, and markets juvenile products, such as strollers, car seats, high chairs, and playards, under the brands Maxi-Cosi, Quinny, Baby Art, and Tiny Love. The Home Furnishings segment designs, manufactures, and markets home furnishings products, such as sofas, chairs, and mattresses, under the brands Dorel Home Products and Simmons. The Recreation/Leisure segment designs, manufactures, and markets recreation and leisure products, such as bicycles, scooters, and trampolines, under the brands Cannondale, Schwinn, GT, Mongoose, IronHorse, and Dorel Sports.

Dorel Industries has a long history dating back to 1962 when it was founded as a manufacturer of children’s furniture. Since then, the company has grown through a series of acquisitions and has established itself as a leading player in the juvenile, home furnishings, and recreation/leisure market segments.

– The Lovesac Co ($NASDAQ:LOVE)

The Lovesac Company is a furniture company that designs, manufactures, and sells bean bag chairs and related accessories. The company has a market cap of $343.47 million and a return on equity of 15.26%. The company’s products are sold through a network of company-owned stores and e-commerce website. Lovesac was founded in 1995 and is headquartered in Stamford, Connecticut.

– DFS Furniture PLC ($LSE:DFS)

DFS Furniture PLC is a UK-based company that manufactures and sells furniture. The company has a market cap of 271.97M as of 2022 and a Return on Equity of 19.51%. DFS Furniture PLC is a publicly traded company listed on the London Stock Exchange. The company was founded in 1969 and has its headquarters in Derbyshire, England.

Summary

Bassett Furniture Industries recently reported their earnings results for the fourth quarter of fiscal year 2022, which ended on November 30, 2022. Total revenue decreased slightly by 0.2% compared to the same quarter a year prior, and net income decreased 6.8% year over year. Despite this, the stock price moved up on the same day. Investors may want to consider investing in Bassett Furniture Industries due to the company’s strong financial performance in the fourth quarter despite the slight decrease in revenue and net income. It is also worth noting that the company has a strong balance sheet, with no long-term debt and a healthy cash position, making it a potentially attractive investment opportunity.

Furthermore, the company has a wide range of furniture products available and has established itself as a leader in the industry. It also has a growing presence in the e-commerce sector, which could help drive future growth. Bassett Furniture Industries is also focused on increasing its sustainability initiatives, which is likely to be attractive to many investors. In conclusion, Bassett Furniture Industries may be an attractive option for investors looking for a solid company with a history of strong performance, a healthy balance sheet, and potential for future growth.

Recent Posts