AZZ INC Reports 24.3% Revenue Increase and 18.4% Net Income Increase for FY2024 Q1

July 9, 2023

☀️Earnings Overview

On July 7 2023, AZZ INC ($NYSE:AZZ) announced their earnings results for the first quarter of 2024, which ended on May 31 2023. The company reported total revenue of USD 390.9 million, representing a 24.3% increase from the same period in the previous year, as well as net income of USD 28.5 million, a growth of 18.4% year over year.

Analysis

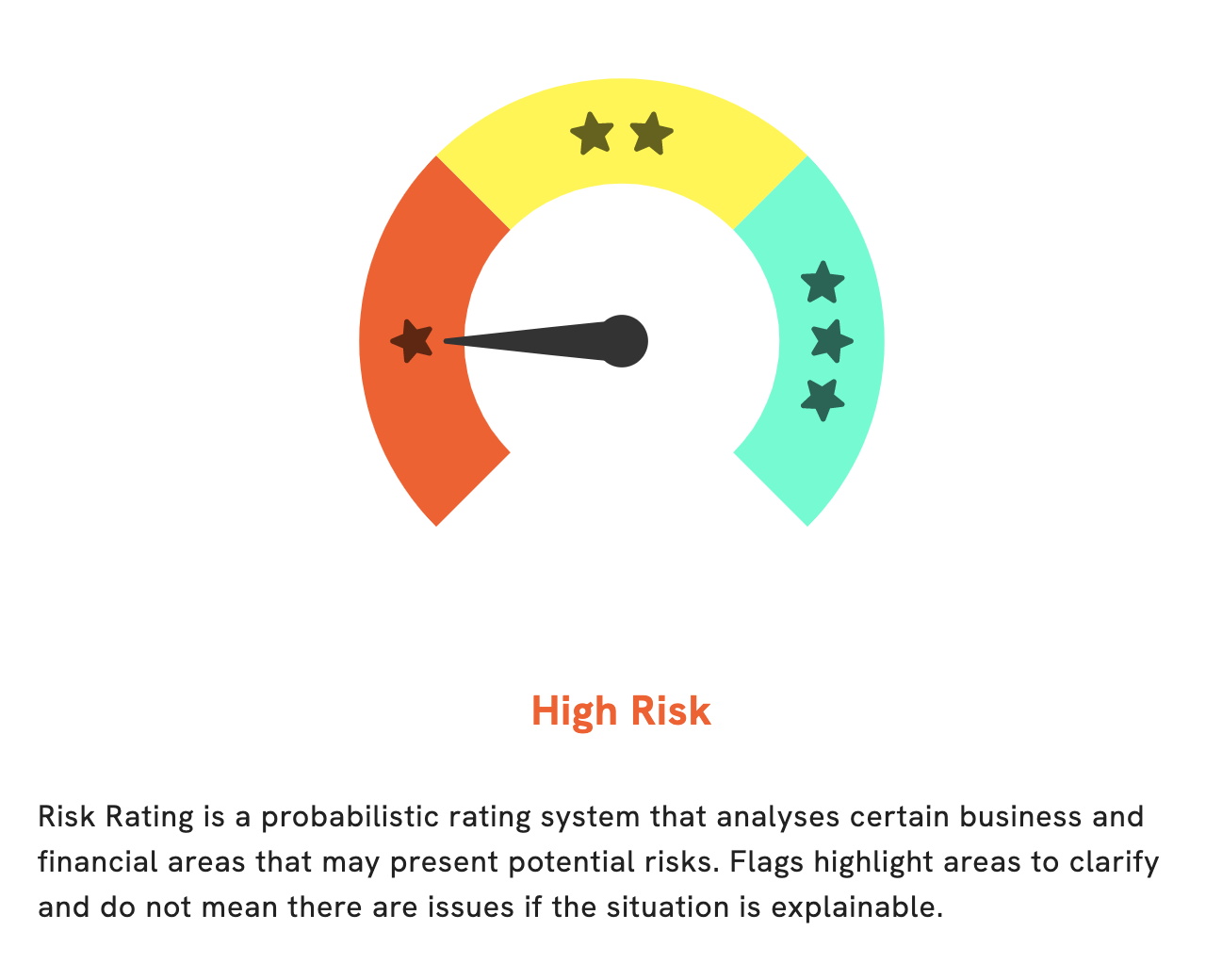

When looking to invest in AZZ INC, it is important to examine the financials with GoodWhale in order to make a well-informed decision. After analyzing the financials of AZZ INC, GoodWhale has determined it to be a high risk investment when considering both the financial and business aspects. GoodWhale has also detected two risk warnings in the balance sheet and financial journal, which should be taken into account when making an investment decision. To get a better understanding of these warnings, be sure to register on goodwhale.com for further information. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Azz Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.51k | -60.37 | 5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Azz Inc. More…

| Operations | Investing | Financing |

| 95.37 | 57.67 | -251.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Azz Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.21k | 1.33k | 34.84 |

Key Ratios Snapshot

Some of the financial key ratios for Azz Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | 37.5% | 14.4% |

| FCF Margin | ROE | ROA |

| 1.8% | 15.7% | 6.1% |

Peers

Their main competitors in the field are Manaksia Coated Metals & Industries Ltd, KFM Kingdom Holdings Ltd, and Vinacomin – Minerals Holding Corp. All four companies provide unique services that offer solutions to their customers’ needs. By delivering quality products and services, they strive to meet the ever-changing demands of the global market.

– Manaksia Coated Metals & Industries Ltd ($BSE:539046)

Manaksia Coated Metals & Industries Ltd is an Indian industrial goods manufacturer and distributor. Founded in 1975, the company produces a range of products including packaging materials, insulation boards, and other industrial goods. With a market cap of 1.24B as of 2022, Manaksia Coated Metals & Industries Ltd is one of the leading industrial goods companies in India. The company has also achieved a Return on Equity (ROE) of 15.03%, which is a testament to the company’s financial strength and performance. The company’s strong performance has enabled it to consistently create value for its shareholders.

– KFM Kingdom Holdings Ltd ($SEHK:03816)

KFM Kingdom Holdings Ltd is a Hong Kong-based investment holding company established in 2006. The company specializes in property and infrastructure development, construction, property management, hotel operations and property investments. As of 2022, KFM Kingdom Holdings Ltd has a market cap of 114.6M, which indicates that the company is well-positioned to generate returns for its shareholders. Furthermore, the company boasts a Return on Equity of 6.87%, indicating a strong financial performance and healthy profitability.

Summary

AZZ INC reported strong financial results for the first quarter of FY2024, with total revenue of USD 390.9 million and net income of USD 28.5 million, both figures representing significant growth year over year. These results are likely to be encouraging for investors, given the current challenging economic climate. The company has demonstrated its ability to increase sales and profits, a positive trend that is expected to continue in the coming quarters.

Furthermore, the company remains well-positioned for future growth, with a strong balance sheet and financial position. Overall, AZZ INC is a compelling investment opportunity, with the potential to deliver substantial returns over the medium to long term.

Recent Posts