AVANTOR Reports 8.7% Drop in Q2 FY2023 Revenue, Totaling USD 1743.9 Million

August 3, 2023

🌧️Earnings Overview

AVANTOR ($NYSE:AVTR) announced their second quarter FY2023 earnings on June 30th, 2023, with total revenue of USD 1743.9 million, 8.7% lower than Q2 FY2022. Net income for the quarter was USD -7.3 million, down a staggering USD 187.4 million compared to the same period of the prior year.

Analysis

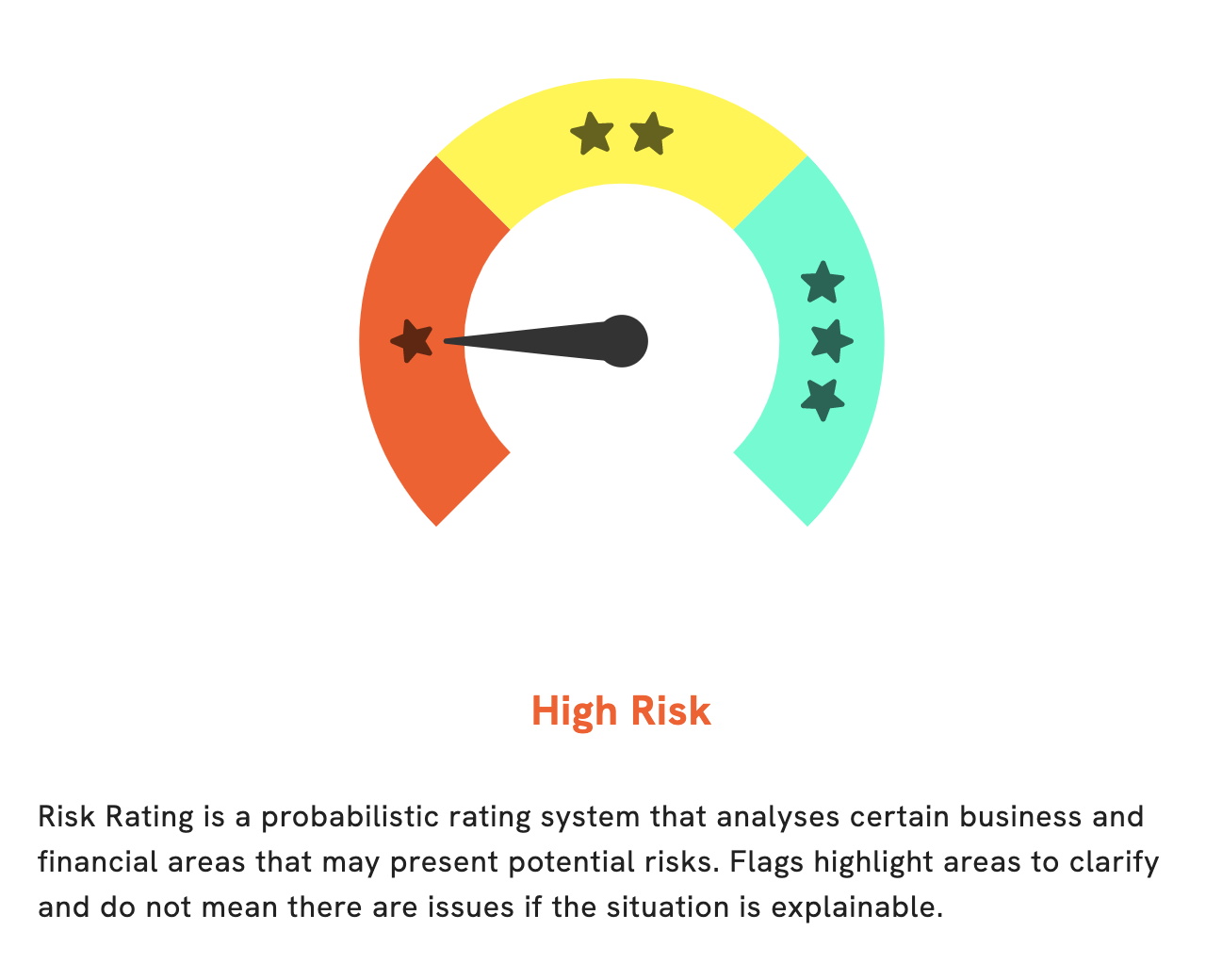

GoodWhale has conducted an analysis of AVANTOR‘s financials and found that it is a high risk investment in terms of financial and business aspects. According to the Risk Rating, AVANTOR scored lower than the average score for all companies, which makes it a higher risk investment. Further, GoodWhale flagged 1 risk warnings in the balance sheet, which can only be seen by registered users. Therefore, GoodWhale recommends that potential investors become registered users to understand the potential threats and risks associated with investing in AVANTOR. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avantor. More…

| Total Revenues | Net Income | Net Margin |

| 7.18k | 422.9 | 7.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avantor. More…

| Operations | Investing | Financing |

| 851.6 | -85.7 | -772.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avantor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.06k | 8.05k | 7.42 |

Key Ratios Snapshot

Some of the financial key ratios for Avantor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.0% | 16.9% | 11.5% |

| FCF Margin | ROE | ROA |

| 10.0% | 10.3% | 3.9% |

Peers

It has a wide range of products that it offers to its customers. The company has a strong market presence and is known for its quality products. It has a number of competitors, such as 5N Plus Inc, Swancor Advanced Materials Co Ltd, and Mitsui Chemicals Inc.

– 5N Plus Inc ($TSX:VNP)

Samsung Electronics Co., Ltd. engages in the manufacturing and selling of electronics and computer peripherals. The company offers digital TVs, monitors, printers, refrigerators, washing machines, and air conditioners. It also provides semiconductor and telecommunication products, and operates foundries that manufacture integrated circuits, including processors, memory chips, and image sensors. The company was founded on January 13, 1969 and is headquartered in Suwon, South Korea.

– Swancor Advanced Materials Co Ltd ($SHSE:688585)

Swancor Advanced Materials Co Ltd is a Taiwanese company that manufactures and sells advanced materials. The company has a market cap of 3.59B as of 2022 and a Return on Equity of 4.37%. Swancor Advanced Materials Co Ltd’s products are used in a variety of industries, including the automotive, aerospace, and electronics industries. The company’s products are known for their quality and durability.

– Mitsui Chemicals Inc ($TSE:4183)

Mitsui Chemicals is a Japanese company that produces and sells a wide variety of chemicals. It has a market capitalization of 536.92 billion as of 2022 and a return on equity of 12.55%. The company has a wide variety of products and services, including plastics, synthetic fibers, resins, adhesives, and electronic materials. It also has a wide variety of end markets, including automotive, construction, electronics, and healthcare. The company has a strong presence in Asia, particularly in China and Japan.

Summary

AVANTOR‘s second quarter of FY2023 earnings report showed total revenue at USD 1743.9 million, 8.7% lower than the same quarter from the previous year. Net income was reported at USD -7.3 million, a decrease of USD 187.4 million year over year. The stock price dropped on the same day in response to this news. Investors are likely to take a cautious approach to AVANTOR in light of these results, with analysts recommending a wait-and-see approach until more information is available to better assess the company’s performance.

Recent Posts