ASE TECHNOLOGY HOLDING Reports Fourth Quarter FY2022 Financial Results, Total Revenue Down 49.1% Year-on-Year.

April 9, 2023

Earnings Overview

On December 31, 2022, ASE TECHNOLOGY HOLDING ($TWSE:3711) released their financial report for the fourth quarter of FY2022, showing total revenue of TWD 15.7 billion, a year-on-year decrease of 49.1%.

Share Price

ASE TECHNOLOGY HOLDING recently reported its fourth quarter FY2022 financial results, which showed that total revenue for the quarter was down by a staggering 49.1% year-on-year. This is likely due to investors’ optimism over the company’s solid fourth quarter performance, despite the headwinds posed by the pandemic. This is indicative of ASE’s commitment to rewarding its shareholders for their loyalty and support throughout the pandemic. Overall, ASE TECHNOLOGY HOLDING’s fourth quarter financial results show that it has done well in one of the toughest years in recent memory.

The company was able to remain profitable despite the pandemic, and its stock price has held up well in the face of economic uncertainty. Investors should be encouraged by ASE’s long-term outlook and will be watching closely to see how the company fares in FY2023. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ase Technology Holding. More…

| Total Revenues | Net Income | Net Margin |

| 670.87k | 62.09k | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ase Technology Holding. More…

| Operations | Investing | Financing |

| 110.98k | -73.95k | -62.4k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ase Technology Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 707.07k | 387.14k | 70.22 |

Key Ratios Snapshot

Some of the financial key ratios for Ase Technology Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.5% | 48.3% | 12.7% |

| FCF Margin | ROE | ROA |

| 5.8% | 18.0% | 7.5% |

Analysis

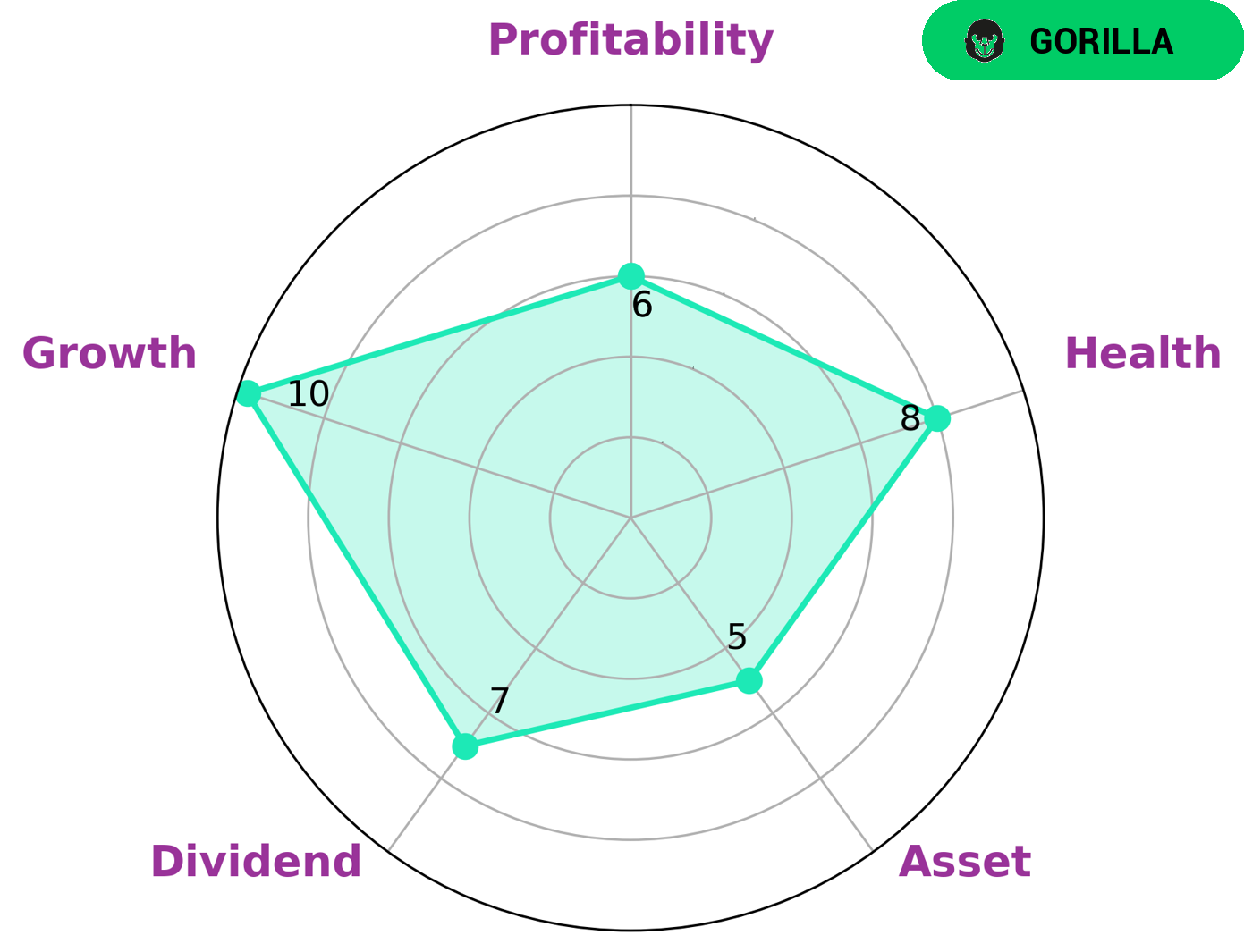

GoodWhale conducted an analysis of ASE TECHNOLOGY HOLDING fundamentals and found that the company has a high health score of 8/10. This score is based on the company’s cashflows and debt, meaning that it is capable of safely riding out any crisis without the risk of bankruptcy. ASE TECHNOLOGY HOLDING is also strong in both dividend and growth, and medium in asset and profitability. From this analysis, GoodWhale has classified ASE TECHNOLOGY HOLDING as a ‘gorilla’ company, one that has achieved stable and high revenue or earning growth due to its strong competitive advantage. These results make ASE TECHNOLOGY HOLDING an attractive option for a variety of investors, including those looking for consistent dividend income or growth opportunities. It is also a good choice for those looking for companies with strong competitive advantages that are capable of surviving economic downturns. More…

Peers

Its major competitors include Forehope Electronic (Ningbo) Co Ltd, Micro Silicon Electronics Co Ltd, and Amkor Technology Inc. All four companies specialize in providing sophisticated semiconductor assembly and test services to the semiconductor industry, making them formidable competitors in the market.

– Forehope Electronic (Ningbo) Co Ltd ($SHSE:688362)

Forehope Electronic (Ningbo) Co Ltd is a Chinese electronics manufacturer that produces and sells products such as printed circuit boards, connectors, antennas, and more. The company has a market cap of 10.23B as of 2023, making it one of the larger players in its industry. Additionally, the company’s return on equity (ROE) of 17.74% indicates that it is able to generate a healthy return from its investments. This is an indication of the company’s financial health and its ability to generate value for its shareholders.

– Micro Silicon Electronics Co Ltd ($TPEX:8162)

Micro Silicon Electronics Co Ltd is a technology company that specializes in semiconductor and integrated circuit (IC) production. As of 2023, the company has a market capitalization of 2.3 billion and a Return on Equity of 18.35%, indicating that it has a strong financial performance. The company’s market capitalization is a measure of its overall value and can be used to compare it to other companies in the industry. The high ROE shows that the company is able to generate more profits from its shareholders’ invested capital. This suggests that the company has good management and a strong competitive advantage.

– Amkor Technology Inc ($NASDAQ:AMKR)

Amkor Technology Inc is a leading global provider of advanced semiconductor packaging and test services. The company has a market capitalization of 6.76 billion dollars as of 2023 and a Return on Equity of 17.69%. This indicates that the company has been doing well and has been able to increase its shareholders’ equity over time. Amkor is known for its advanced packaging solutions, which help its customers develop and produce high-performance, cost-effective semiconductor solutions. The company also offers various testing solutions and services to help ensure the quality and reliability of its customers’ products.

Summary

ASE Technology Holding reported total revenue of TWD 15.7 billion for the fourth quarter of FY2022, a decrease of 49.1% compared to the previous year.

However, net income increased by 2.6%, indicating that the company was still profitable. Investors should keep an eye on ASE Technology Holding as the company continues to develop and grow. The company is well-positioned to take advantage of industry trends and capitalize on new opportunities. Long-term investors should remain positive on the stock, as it has consistently outperformed the market over the last few years.

Recent Posts