Arcos Dorados Stock Intrinsic Value – ARCOS DORADOS Reports 19.6% Increase in Total Revenue for Fourth Quarter of FY2022, Reaching USD 54.5 Million

March 31, 2023

Earnings Overview

On December 31, 2022, ARCOS DORADOS ($NYSE:ARCO) reported that their fourth quarter FY2022 earnings results showed total revenue of USD 54.5 million, which was a 19.6% increase from the same quarter in the prior year. Net income for the quarter increased 30.5% year-over-year to amount to USD 1018.6 million.

Transcripts Simplified

Doug Johnson, Chief Executive Officer: Thank you all for joining us. We are committed to keeping our leverage in this healthy range while executing our growth plans and investing in new initiatives. Our goal is to continue building an agile, digital and profitable business. We are focused on strengthening our digital capabilities, driving efficiency gains and cost savings, and improving our customer experience in all our markets.

We also remain committed to enhancing shareholder value through share repurchases and dividend payments. Looking ahead, we are excited about our future growth prospects and remain confident that we can emerge from this crisis stronger than ever before. Thank you for your time today.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arcos Dorados. More…

| Total Revenues | Net Income | Net Margin |

| 3.38k | 45.49 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arcos Dorados. More…

| Operations | Investing | Financing |

| 345.44 | -259.65 | -59.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arcos Dorados. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.64k | 2.31k | 1.54 |

Key Ratios Snapshot

Some of the financial key ratios for Arcos Dorados are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.5% | 17.7% | 4.8% |

| FCF Margin | ROE | ROA |

| 3.8% | 38.1% | 3.4% |

Share Price

Despite the positive news, shares of ARCOS DORADOS saw a mild sell-off. The stock opened at $8.2 and closed at $7.8, down by 2.5% from its previous closing price of 8.0. Overall, while ARCOS DORADOS reported a strong financial performance for the fourth quarter of FY2022, investors remain cautious about the stock’s future prospects due to the anticipated slowdown in consumer demand for fast food due to the pandemic. Live Quote…

Analysis – Arcos Dorados Stock Intrinsic Value

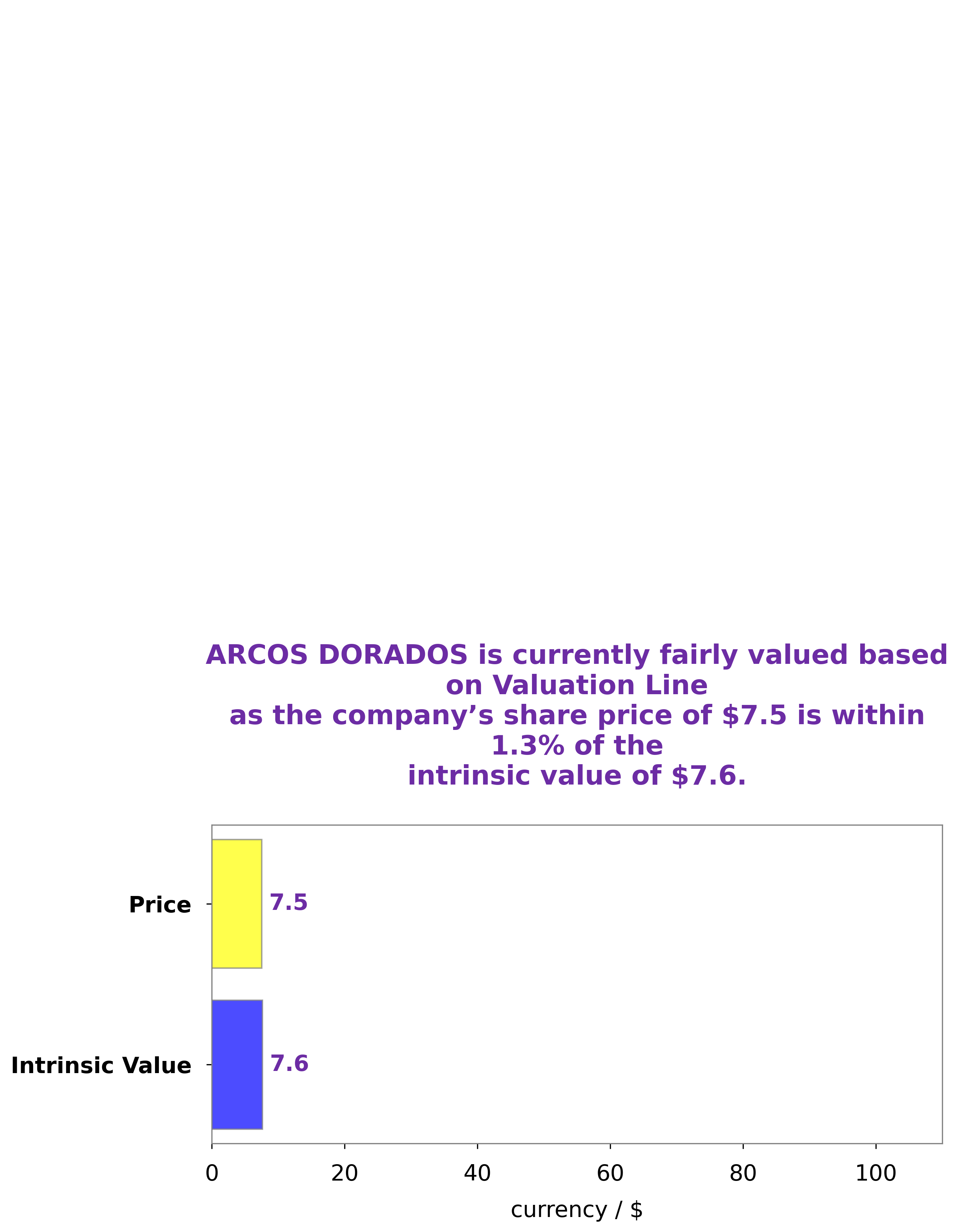

At GoodWhale, we have conducted a thorough analysis of ARCOS DORADOS’s financials. After careful consideration, our proprietary Valuation Line has determined that the fair value of ARCOS DORADOS’s shares is approximately $7.6. However, the current market price for the stock is $7.8, which indicates that it is overvalued by 2.7%. This could be a great opportunity for investors to buy and benefit from the potential upside in the future. More…

Peers

Arcos Dorados Holdings Inc is the world’s largest franchisor of McDonald’s restaurants. The company operates or franchises over 1,700 McDonald’s restaurants in 20 countries and territories in Latin America and the Caribbean. Arcos Dorados is headquartered in Buenos Aires, Argentina. The company’s primary competitors are Del Taco Restaurants Inc, Amrest Holdings SE, and Alsea SAB de CV.

– Del Taco Restaurants Inc ($LTS:0OGQ)

Amrest Holdings SE is a holding company that operates in the restaurant and retail industry. It has a market cap of 4B as of 2022 and a return on equity of 14.44%. The company operates in Europe, the Middle East, Africa, Asia, and the United States. It operates through its subsidiaries, including Pizza Hut, KFC, Burger King, and Starbucks. The company was founded in 1993 and is headquartered in Warsaw, Poland.

– Amrest Holdings SE ($OTCPK:ALSSF)

Alsea SAB de CV is a Mexican holding company that operates in the food and beverage industry. Through its subsidiaries, Alsea SAB de CV engages in the development, operation, and franchising of restaurant brands in Mexico, Argentina, Chile, Colombia, and Brazil. As of 2022, Alsea SAB de CV had a market capitalization of 1.59 billion and a return on equity of 52.23%. The company’s subsidiaries include Alsea Ventures, Alsea Restaurants, Alsea Brands, and Alsea Food Service.

Summary

ARCOS DORADOS reported strong fourth quarter financial results for FY2022, with total revenue increasing 19.6% year-over-year to USD 54.5 million and net income increasing 30.5% to USD 1018.6 million. This is indicative of the company’s ability to capitalize on market opportunities and continue to grow its business despite challenging market conditions. With a solid financial foundation and continued growth potential, ARCOS DORADOS remains an attractive investment opportunity for long-term investors looking for a stable, high-growth stock.

Recent Posts