Avadel Pharmaceuticals plc Anticipates Record Profits in Third Quarter of 2023

April 7, 2023

Trending News ☀️

Avadel Pharmaceuticals ($NASDAQ:AVDL) plc is a multinational healthcare company based in Dublin, Ireland that specializes in developing specialty biopharmaceuticals to treat rare and serious conditions. The company is expected to report record profits for the third quarter of 2023, with its per-share earnings projected to be higher than any other period in the company’s history. Avadel Pharmaceuticals plc has been actively expanding its product portfolio and entering new markets to drive growth. In recent years, the company has acquired several smaller companies and launched new products in various therapeutic areas. This aggressive approach to business has resulted in the company’s exceptional performance, and the positive financial results of the third quarter of 2023 are a testament to this success.

The company is also investing heavily in research and development to further enhance its product offerings. Avadel Pharmaceuticals plc is committed to developing therapies that improve the quality of life for patients living with rare and serious conditions, and its investments in innovation are a reflection of this dedication. The projected financial performance for the third quarter of 2023 is an exciting milestone for Avadel Pharmaceuticals plc and its shareholders. The company is well-positioned to continue its growth trajectory, and investors can look forward to future success as the company continues to execute its strategic plans.

Price History

AVADEL PHARMACEUTICALS plc recently announced that it expects to report record third-quarter profits for the year 2023. This news saw their stock open up to $9.0 at the start of the trading day on Monday, and close at an impressive $9.6, which marks a 5.2% increase from last week’s closing price of $9.2. The soaring stock prices are a reflection of the robust financial performance of the company, which is poised to achieve record profits in a highly competitive market. The company’s success is indicative of the trust that the public has placed in Avadel Pharmaceuticals for producing dependable and reliable products.

Investors can take solace in knowing that the company is well-positioned to reach its third-quarter profit targets and maintain its strong financial footing. The effects of this news is expected to be felt throughout the markets, as investors flock to take advantage of the opportunity to invest in a growing and successful enterprise. Avadel Pharmaceuticals plc is well positioned to continue its impressive growth trajectory in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avadel Pharmaceuticals. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -137.46 | -103.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avadel Pharmaceuticals. More…

| Operations | Investing | Financing |

| -70.3 | 79.7 | 14.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avadel Pharmaceuticals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 132.78 | 153.93 | -0.2 |

Key Ratios Snapshot

Some of the financial key ratios for Avadel Pharmaceuticals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -49.5% | – | 35.4% |

| FCF Margin | ROE | ROA |

| -218.6% | 368.8% | -46.6% |

Analysis

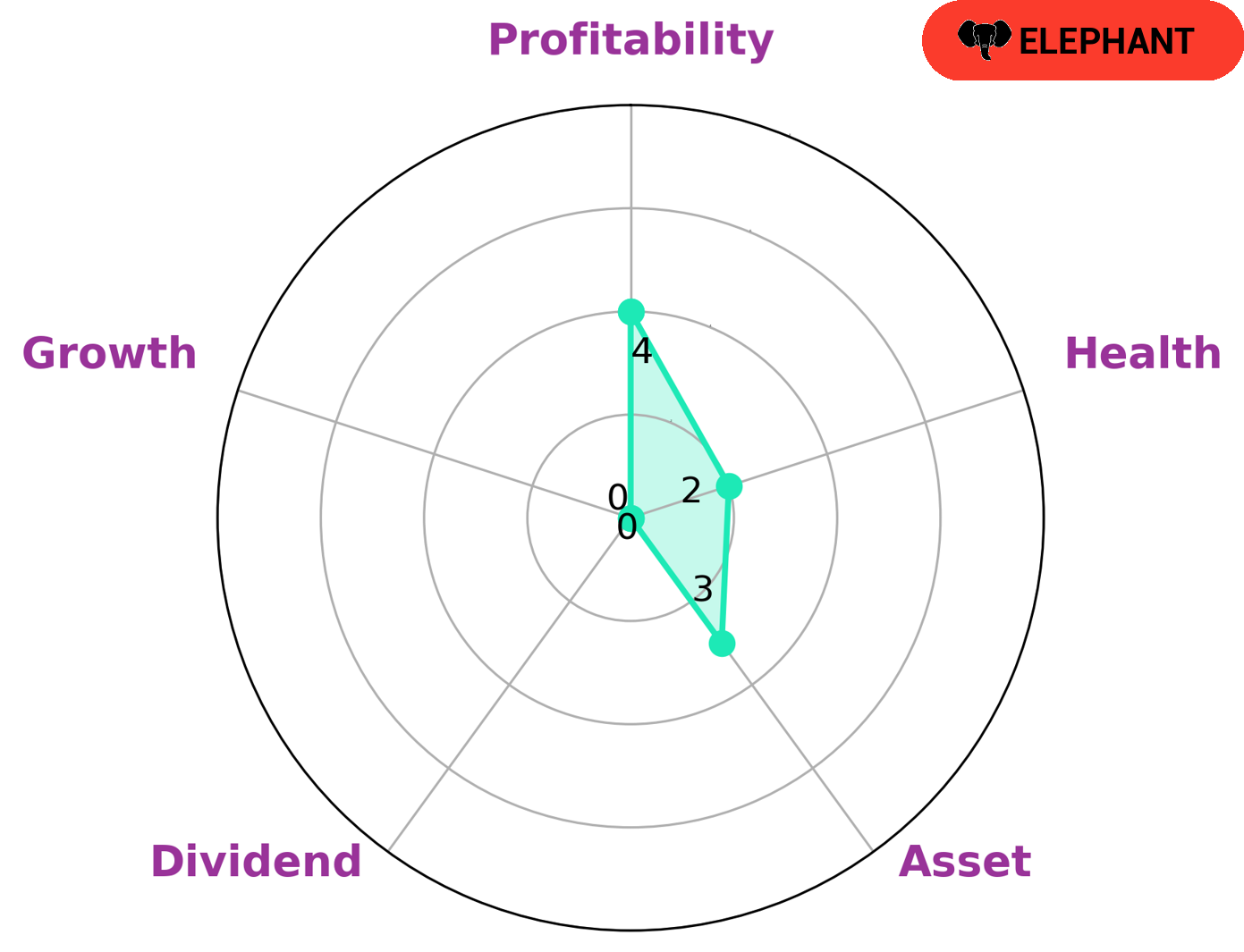

At GoodWhale, we recently performed an analysis of AVADEL PHARMACEUTICALS‘s wellbeing. We looked specifically at their Star Chart, which gave us insight into their overall financial health. We found that AVADEL PHARMACEUTICALS was strong in profitability, medium in asset, weak in dividend and growth. More importantly, our health score for AVADEL PHARMACEUTICALS was only 2 out of 10, indicating that they are less likely to safely ride out any crisis without the risk of bankruptcy. After further analysis, we classified AVADEL PHARMACEUTICALS as an ‘elephant’, meaning they are rich in assets after liabilities are taken into account. Investors looking to invest in AVADEL PHARMACEUTICALS should be aware of their weak financial health and the risk associated with such a venture. However, those looking for long-term investments may be attracted to the company’s asset-rich profile. More…

Peers

The company’s primary competitors are Mallinckrodt PLC, AcelRx Pharmaceuticals Inc, and Taro Pharmaceutical Industries Ltd.

– Mallinckrodt PLC ($NASDAQ:ACRX)

AcelRx Pharmaceuticals Inc is a pharmaceutical company that focuses on the development and commercialization of innovative therapies for the treatment of acute pain. The company’s lead product candidate, Dsuvia, is a 30 microgram sufentanil sublingual tablet for the treatment of moderate-to-severe acute pain in medically supervised settings. AcelRx Pharmaceuticals Inc has a market cap of 20.41M as of 2022, a Return on Equity of -1155.51%. The company’s focus on developing innovative therapies for the treatment of acute pain makes it a promising investment for those looking to gain exposure to the healthcare sector.

– AcelRx Pharmaceuticals Inc ($NYSE:TARO)

Taro Pharmaceutical Industries Ltd is a pharmaceutical company with a market cap of 1.21B as of 2022. The company’s ROE is 1.92%. Taro Pharmaceutical Industries Ltd is engaged in the development, manufacture and marketing of generic pharmaceutical products. The company’s product portfolio includes finished dosage forms and active pharmaceutical ingredients. Taro Pharmaceutical Industries Ltd operates in two segments: Finished Dosage Forms and Active Pharmaceutical Ingredients. The Finished Dosage Forms segment includes oral solutions, ointments, creams, lotions, gels, capsules, tablets, powders and injectables. The Active Pharmaceutical Ingredients segment includes intermediates, bulk actives and formulations.

Summary

Avadel Pharmaceuticals plc is a pharmaceutical company focused on developing treatments for sleep disorders. The company is expected to report its third quarter earnings for 2023 in the near future. Analysts predict that the company will report earnings per share of a certain value. On the day that the forecasted earnings were announced, the company’s stock price moved up.

This suggests that investors anticipate positive performance from Avadel Pharmaceuticals and are willing to invest in the company. Despite some short-term volatility, the long-term outlook for Avadel remains positive and investors are likely to see returns on their investments in the future.

Recent Posts