WALMART INC Reports 76.4% Year-Over-Year Revenue Increase and 7.3% Year-Over-Year Net Income Increase for Fourth Quarter of Fiscal Year 2023

March 3, 2023

Earnings report

On February 21, 2023, WALMART INC ($NYSE:WMT) reported a financial update for their fourth quarter of fiscal year 2023 (ending January 31, 2023), featuring a year-over-year increase of 76.4% in total revenue and 7.3% in net income. Total revenue for the quarter reached USD 6.3 billion, while net income was USD 164.1 billion. Walmart also opened new stores, contributing to revenue growth and leveraging their physical stores for eCommerce fulfillment.

Additionally, the company’s investments in operational efficiency have led to improvements in operating margin, helping to strengthen its bottom line. The impressive sales figures highlight WALMART INC’s success in adapting to the changing retail landscape and investing in strategic initiatives that are driving growth. The company looks to capitalize on this momentum moving forward and continue creating value for shareholders.

Stock Price

The news pushed WALMART INC stock to open on Tuesday at $142.9 and close at $147.3, representing a 0.6% improvement from the previous closing price of $146.4. The company attributed the success to its focus on digitizing operations and expanding e-commerce capabilities in order to meet increasing customer demand during the pandemic. WALMART INC also saw strong sales growth in its core retail business, driven by new initiatives such as the launch of WALMART+ subscription program and the expansion of various store formats.

WALMART INC is now looking to build upon its strong year-over-year performance in fiscal 2023 and is also taking steps to ensure it can continue to meet future demands. With the launch of new products, new services, and further expansion of its e-commerce capabilities, WALMART INC is well-positioned to capitalize on the continued growth of retail sales and maintain its leadership in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walmart Inc. More…

| Total Revenues | Net Income | Net Margin |

| 611.29k | 11.68k | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walmart Inc. More…

| Operations | Investing | Financing |

| 29.1k | -17.72k | -17.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walmart Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 243.46k | 159.47k | 26.75 |

Key Ratios Snapshot

Some of the financial key ratios for Walmart Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.3% | -0.2% | 3.1% |

| FCF Margin | ROE | ROA |

| 2.0% | 16.1% | 4.9% |

Analysis

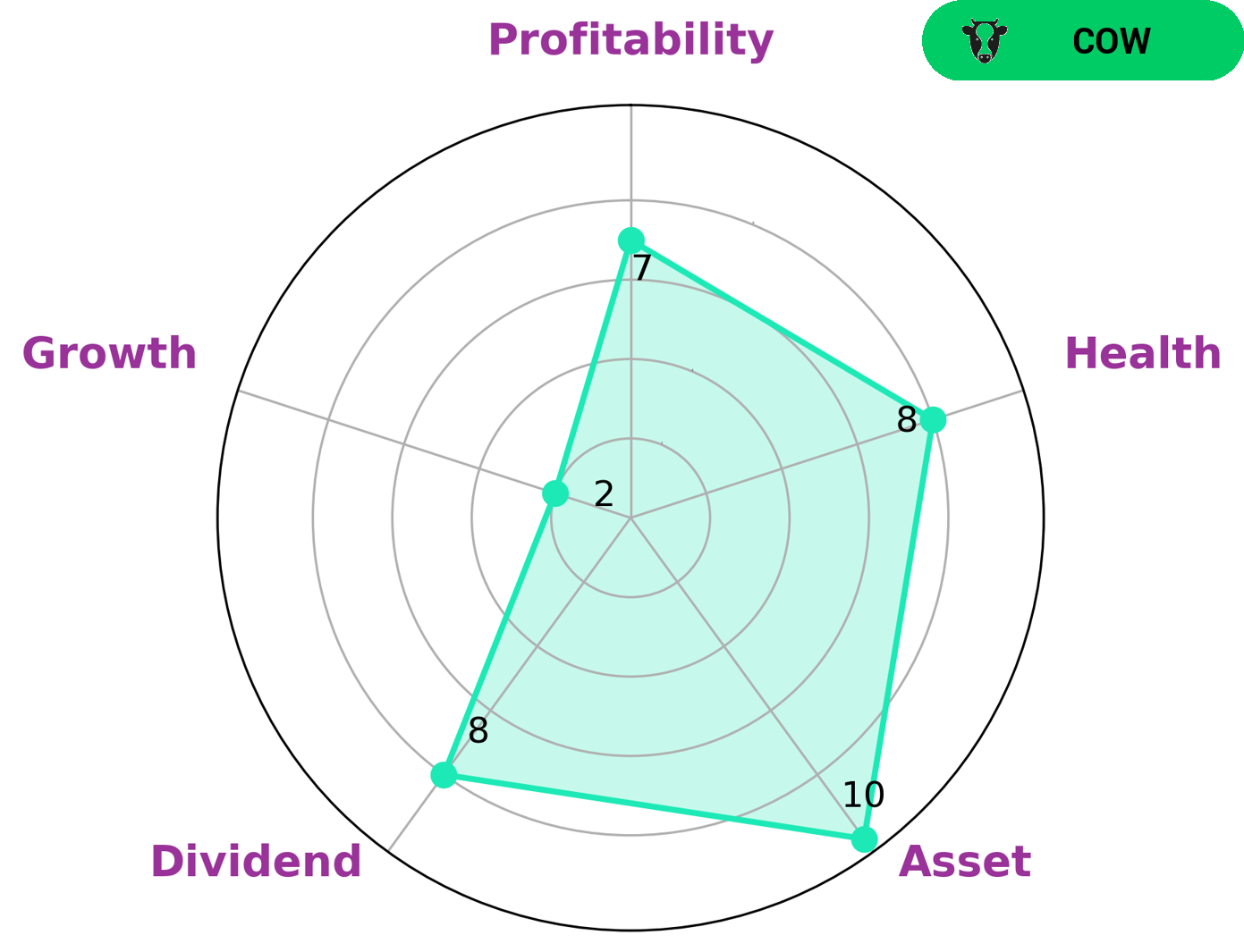

At GoodWhale, we recently conducted an analysis of WALMART INC‘s financials. According to our Star Chart, WALMART INC is strong in terms of assets, dividend, and profitability, but weak in terms of growth. We have classified WALMART INC as ‘cow’, a type of company that has a strong track record of paying out consistent and sustainable dividends. As a result, this company is ideal for investors looking for steady, reliable returns. Additionally, WALMART INC has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of sustaining future operations during times of crisis. All of these factors make WALMART INC an attractive option for investors seeking consistent and steady returns. More…

Peers

The retail industry is highly competitive, with Walmart Inc competing against Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are vying for market share in the retail sector. Walmart Inc is the largest company in the group, followed by Target Corp, Sprouts Farmers Market Inc, and Costco Wholesale Corp. All four companies are publicly traded on the stock exchange.

– Target Corp ($NYSE:TGT)

Target Corp is an American retail corporation. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target operates 1,851 stores across the United States. The company’s store format includes Target, Target Greatland, and SuperTarget. Target is the second-largest discount retailer in the United States, behind Walmart. The company’s revenue for 2018 was $75.4 billion, and its operating income was $5.9 billion. Target’s net income for 2018 was $3.6 billion, and its total assets were $42.5 billion as of December 31, 2018.

– Sprouts Farmers Market Inc ($NASDAQ:SFM)

Sprouts Farmers Market Inc is a grocery store chain that specializes in selling fresh, natural, and organic food. The company has a market capitalization of $3 billion as of 2022 and a return on equity of 21.14%. Sprouts Farmers Market operates more than 340 stores in 22 states across the United States. The company was founded in 2002 and is headquartered in Phoenix, Arizona.

– Costco Wholesale Corp ($NASDAQ:COST)

Costco Wholesale Corporation is the largest membership warehouse club in the United States. As of 2022, it had a market capitalization of 209.47 billion and a return on equity of 24.62%. Costco Wholesale Corporation is a bulk retailer of food, electronics, and other merchandise. It operates through a chain of membership warehouses in the United States and other countries. Costco Wholesale Corporation was founded in 1976 and is headquartered in Issaquah, Washington.

Summary

Walmart Inc. (WMT) is a leading global retailer providing customers with a broad range of products at everyday low prices. Investing analysis of Walmart involves examining the company’s financials, management, competitive position and industry environment. Wal-Mart has a strong balance sheet with substantial cash reserves, strong financial ratios and a consistent dividend policy. Management has a well-known track record for driving cost savings, driving growth and creating efficiencies.

Competitively, Walmart is the clear market leader in many areas and is well-positioned to capitalize on its size and scale advantages. The company has successfully leveraged its omnichannel capabilities to drive sales and expand into new markets. Finally, the retail industry is currently undergoing numerous changes from tech-driven disruption, shifting consumer preferences and more agile competitors; however, Walmart has managed to stay ahead of the curve.

Recent Posts