Target Corporation Stock Intrinsic Value – Target’s Inventory Solutions Unlock New Opportunities for Growth

April 20, 2023

Trending News ☀️

Target Corporation ($NYSE:TGT) is an American retail corporation that operates in the United States and Canada. Over the years, Target has grown and expanded its business operations to include a variety of different products and services. In recent years, Target has been able to resolve its inventory issues, allowing it to unlock new opportunities for growth. What are the next steps now that Target has resolved its inventory issues? Target has now turned its focus to optimizing its inventory management system to increase efficiency and reduce costs. This will allow Target to provide customers with quicker access to products and reduce the amount of time it takes for them to be delivered.

Additionally, Target is actively exploring new technologies that can help improve the customer experience, such as artificial intelligence and advanced data analytics. By leveraging these technologies, Target can better understand customer demand, order fulfillment, and supply chain management. Furthermore, Target is looking at ways to streamline their supply chain operations and create more efficient processes. Target’s efforts to resolve its inventory issues have enabled it to unlock new opportunities for growth and expansion. With the right approach and strategy, Target could potentially become an even greater success than it already is. By creating a more efficient inventory management system, investing in technology, and streamlining the supply chain process, Target could continue to increase its market share and profitability in the years to come.

Price History

Target Corporation has been on the forefront of innovation with their inventory solutions. On Tuesday, the company’s stock opened at $163.0 and closed at $162.4, a decrease of 0.2% from the previous closing price of 162.7. This slight drop in stock price has not deterred them from their goal of unlocking new opportunities for growth through their inventory solutions. The inventory solutions implemented by Target Corporation involve the use of predictive analytics, automation, and artificial intelligence. This combination of technology allows the company to accurately predict customer demand and optimize supply chain processes in order to maximize efficiency. Target has also invested in using robotics to automate the stocking and replenishment of shelves in their stores for an improved shopping experience. These innovative solutions have enabled Target to significantly reduce costs and increase profits. The implementation of these inventory solutions have allowed Target to be more competitive in the retail industry. They are now able to provide customers with more accurate inventory data and efficient delivery times, resulting in greater customer satisfaction and loyalty.

Additionally, the use of advanced analytics-based insights has enabled Target to improve their marketing strategies and develop new product offerings that cater to their customers’ needs and preferences. With this technology in place, they are set to become an even more successful business in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Target Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 109.12k | 2.78k | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Target Corporation. More…

| Operations | Investing | Financing |

| 4.02k | -5.5k | -2.2k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Target Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 53.34k | 42.1k | 23.94 |

Key Ratios Snapshot

Some of the financial key ratios for Target Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | -6.2% | 3.6% |

| FCF Margin | ROE | ROA |

| -1.4% | 21.9% | 4.6% |

Analysis – Target Corporation Stock Intrinsic Value

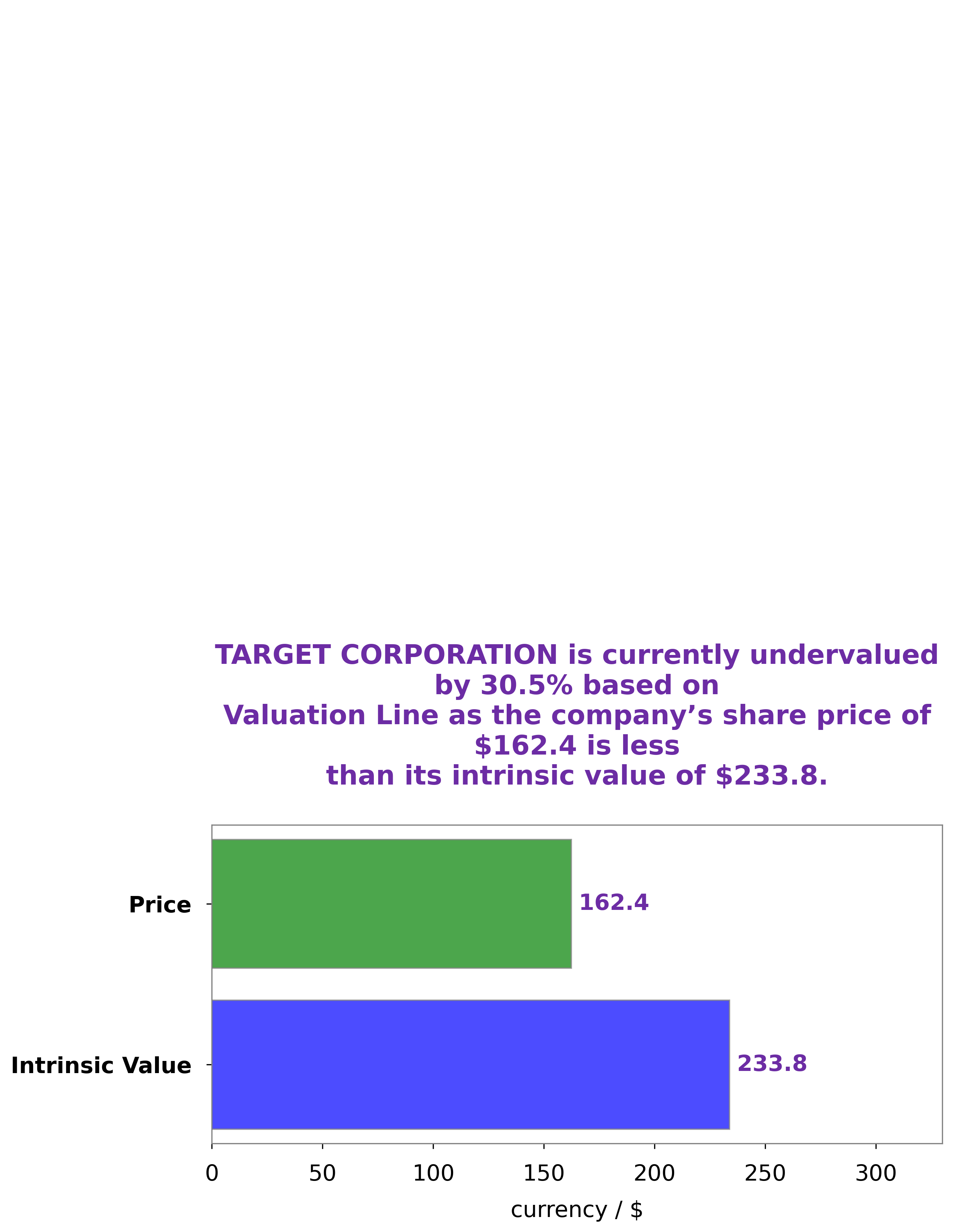

At GoodWhale, we recently conducted an analysis of TARGET CORPORATION‘s financials. After taking into account the company’s financial metrics, our proprietary Valuation Line suggested that the fair value of TARGET CORPORATION stock is around $233.8. Currently, TARGET CORPORATION stock is trading at $162.4, which is undervalued by 30.5%. This presents a great opportunity for investors to buy into this promising corporation at a discounted price. More…

Peers

Its competitors are Walmart Inc, Costco Wholesale Corp, and Dollar Tree Inc. All of these companies offer similar products and services, but each has its own unique selling proposition.

– Walmart Inc ($NYSE:WMT)

Walmart Inc is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores. Headquartered in Bentonville, Arkansas, the company was founded by Sam Walton in 1962 and incorporated on October 31, 1969. As of January 31, 2020, Walmart has 11,484 stores and clubs in 27 countries, operating under 55 different names. The company operates under the name Walmart in the United States and Canada, as Walmart de México y Centroamérica in Mexico and Central America, as Asda in the United Kingdom, as the Seiyu Group in Japan, and as Best Price in India. It has wholly owned operations in Argentina, Chile, Canada, and South Africa. Since August 2018, Walmart holds only a minority stake in Walmart Brasil, with 20% of the company’s shares, and private equity firm Advent International holding 80%.

– Costco Wholesale Corp ($NASDAQ:COST)

Costco Wholesale Corporation is a membership-only warehouse club that provides a wide selection of merchandise. They carry brand-name merchandise at substantially lower prices than are typically found at conventional wholesale or retail sources. Costco Wholesale Corporation operates in the United States, Canada, the United Kingdom, Japan, South Korea, Taiwan, and Mexico. As of 2022, the company had a market cap of 211.64B and a return on equity of 24.62%. Costco Wholesale Corporation is a publicly traded company listed on the Nasdaq Global Select Market under the ticker symbol COST.

– Dollar Tree Inc ($NASDAQ:DLTR)

Dollar Tree Inc is a retail company that operates dollar stores across the United States. The company has a market cap of $32.16 billion as of 2022 and a return on equity of 15.97%. Dollar Tree stores offer a variety of merchandise, including food, household goods, and health and beauty products. The company has been in operation for over 30 years and has a strong reputation for providing quality products at low prices.

Summary

Target Corporation is an American retail company that operates stores in the United States, Canada, and India. The company has seen a recent increase in financial performance due to initiatives to resolve inventory issues. Investing in TARGET CORPORATION can provide potential returns through its status as a major retailer with a strong presence in the US and abroad. Analysts suggest that the company’s focus on improving inventory efficiency, accelerating digital capabilities, and expanding omnichannel offerings will be key drivers of growth.

In addition, the company has a strong balance sheet with a net cash position, which provides potential for dividends or stock buybacks in the future.

Recent Posts