COSTCO WHOLESALE Reports 13.1% Increase in Total Revenue for Quarter Ending January 31, 2023

March 27, 2023

Earnings Overview

COSTCO WHOLESALE ($NASDAQ:COST) reported total revenue of USD 1.5 billion for the quarter ending January 31 2023, a 13.1% increase from the same period in FY2022. Net income also rose 6.5% year over year, to USD 55.3 billion, with the earnings results released on March 3 2023 for the second quarter of FY2023.

Market Price

Despite this impressive surge, the company’s stock opened at $474.8 and closed at $475.3, down 2.1% from the prior closing price of 485.7. This indicates a slight lack of investor confidence in the company’s ability to continue the momentum of its previous quarter’s growth. Despite this, the company still reported a 4th consecutive quarterly increase in revenue, which is likely to be seen as a positive for the company’s future prospects. These figures are indicative of the company’s commitment to providing quality products and services to its customers both domestically and abroad.

In light of these results, analysts are optimistic that COSTCO WHOLESALE will continue to experience strong revenue growth over the coming quarters and beyond. The company has seen tremendous gains in recent years, and the management team appears devoted to continuing to capitalize on these trends for continued success. Overall, investors and analysts can be encouraged by the strong performance of COSTCO WHOLESALE for quarter ending January 31, 2023, and should seek to monitor any changes in the company’s performance over the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Costco Wholesale. More…

| Total Revenues | Net Income | Net Margin |

| 234.39k | 6.05k | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Costco Wholesale. More…

| Operations | Investing | Financing |

| 9.54k | -4.39k | -3.83k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Costco Wholesale. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.85k | 44.05k | 51.39 |

Key Ratios Snapshot

Some of the financial key ratios for Costco Wholesale are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 17.4% | 3.5% |

| FCF Margin | ROE | ROA |

| 2.3% | 23.3% | 7.7% |

Analysis

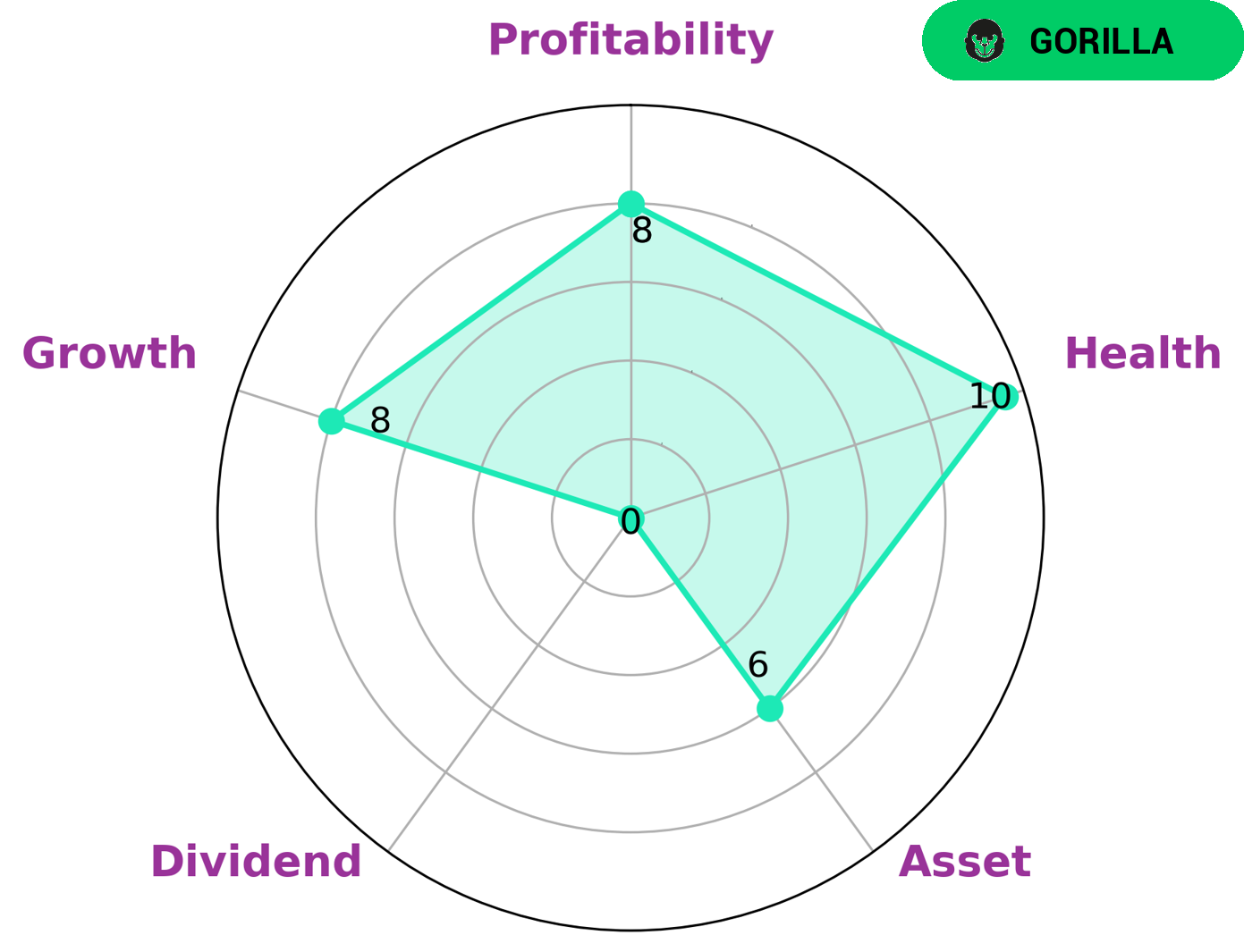

At GoodWhale, we analyzed the financials of COSTCO WHOLESALE, and our Star Chart gave this company strong ratings in growth and profitability, medium ratings in asset, and a weak rating in dividend. With a high health score of 10/10 with regard to its cashflows and debt, COSTCO WHOLESALE is certainly capable to sustain future operations in times of crisis. Furthermore, our classification of COSTCO WHOLESALE as a ‘gorilla’ – a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage – indicates that this company could be a great investment option for many investors. Gorillas are particularly attractive for value, growth, and income investors due to their stability and consistent earnings. Therefore, investors who are looking for a reliable and safe long-term investment may want to consider COSTCO WHOLESALE for their portfolio. More…

Peers

The retail industry is highly competitive, with companies constantly vying for market share. Costco Wholesale Corp is no exception, and it competes directly with the likes of Target Corp, Takayoshi Inc, and Walmart Inc. All four companies are leaders in the retail space, and each has its own strengths and weaknesses.

– Target Corp ($NYSE:TGT)

Target Corporation is an American retail company that operates in the discount retailing industry. The company was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target Corporation operates 1,851 stores in the United States and Canada, and has a market cap of 71.52B as of 2022. The company’s return on equity is 34.09%. Target Corporation’s main competitors are Walmart and Amazon.

– Takayoshi Inc ($TSE:9259)

Takayoshi Inc is a Japanese company that manufactures and sells electronic products. It has a market cap of 8.99B as of 2022 and a ROE of -45.41%. The company’s products include computers, mobile phones, digital cameras, and other electronic devices. Takayoshi Inc has been in business for over 50 years and is a well-known brand in Japan.

– Walmart Inc ($NYSE:WMT)

With a market cap of 363.06B as of 2022, Walmart Inc. is a retail giant with a 16.44% return on equity. The company operates a chain of hypermarkets, discount department stores, and grocery stores. Walmart is the world’s largest company by revenue, with US$514.405 billion in 2020.

Summary

COSTCO WHOLESALE‘s financial performance in the quarter ending January 31 2023 was impressive, with total revenue rising 13.1% year-over-year and net income increasing 6.5%. This indicates that the company has maintained a healthy and steady growth rate despite the ongoing pandemic and economic uncertainty. Investors should pay close attention to COSTCO WHOLESALE’s financials and consider the strength of its balance sheet and potential for future growth when evaluating its stock. Furthermore, careful analysis of the company’s recent quarterly earnings results should be considered in making investment decisions.

Recent Posts